Roxy-Pacific has a market cap of S$692 m, PE of 7X and dividend yield of 3.3%.

Roxy-Pacific has a market cap of S$692 m, PE of 7X and dividend yield of 3.3%.Chart: FT.com

A SUBSTANTIAL SHAREHOLDER, Kian Lam Investment, bought 288,000 shares of Roxy-Pacific Holdings at 58 cents apiece on Tuesday (2 Sept).

L-R: Teo Hong Lim (Executive Chairman & CEO) and Koh Seng Geok (CFO & Executive Director). NextInsight file photos.On the same day, Roxy-Pacific executive chairman Teo Hong Lim scooped up 440,000 shares at about 58.1 cents on average.

L-R: Teo Hong Lim (Executive Chairman & CEO) and Koh Seng Geok (CFO & Executive Director). NextInsight file photos.On the same day, Roxy-Pacific executive chairman Teo Hong Lim scooped up 440,000 shares at about 58.1 cents on average. Kian Lam Investment is the investment vehicle of the controlling Teo family, including Teo Hong Lim, who is also CEO of Roxy-Pacific.

Kian Lam Investment now has a direct interest in 444,261,750 shares, or 37.22% stake in Roxy-Pacific.

Kian Lam Investment owns an indirect interest in another 132,993,750 shares, or 11.14% stake.

Kian Lam Investment owns an indirect interest in another 132,993,750 shares, or 11.14% stake.Mr Teo directly owns 109,770,625 shares, or a 9.2% interest.

The purchases this week follow on previous regular purchases by Kian Lam Investment, Mr Teo and the company's CFO, Koh Seng Geok. (See: AUSGROUP gets new big shareholders, ROXY-PACIFIC insiders buy more).

All this reflects the company's strong earnings visibility for the next two years, as Roxy-Pacific has nearly S$1 billion of property development revenue to book from 3Q this year till 2017.

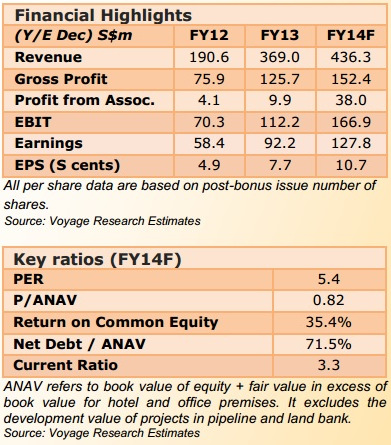

(See FY14 forecast of Voyage Research in the table on the right).

The company is on track for its 10th consecutive year of record profits.