This is Part 2. Part 1 >> Kyith Ng: "My Take On STRACO's Purchase Of Singapore Flyer"

|

Ways to boost profits I am not a retail savvy person. If we dare to put money into Straco, it is in the belief that the management are better managers than us in this area. Still we have to do our common sense checks to see if there are ways to boost the visitor numbers, rather than buy everything that the management says. London Eye was able to maintain and boost visitors by: · Ticket price reductions through online platform. · Establishing e-partnerships with museums, restaurants, theatres. · Setting up partnerships and tearing down partnerships. · Linking up with other attractions to create complementary packages. I do question why the Flyer's operating costs seem much higher than the London Eye's. It could be the cost of running it in Singapore. Then again, London isn’t cheap either. If there was no overestimation of costs, Straco may be able to improve on it.

WTS has 60 luxurious buses. Assume that half of them (30) ferry 30 people daily to the Flyer. In one year, that is 300k more people per year. At current ticket prices that is perhaps $6.3 mil revenue. There are rumors swirling around that Zouk is looking for new premises at the Flyer. Based on $7 psf/m rent, this could add a long term recurring operating cash flow stream. |

Profits and Cash flow for Flyer

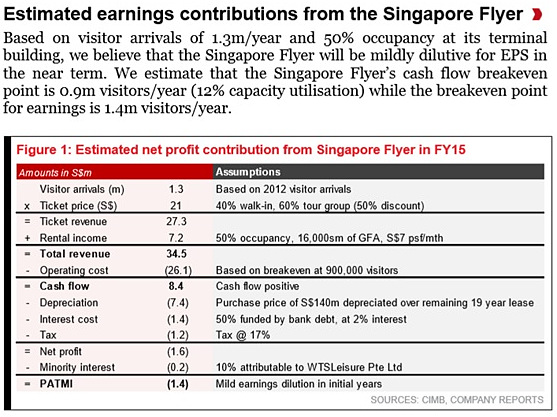

We really do not have much information to work with at this stage but kudos to CIMB analysts who came up with this estimation. The one thing I don’t get is how can it be possible that the operating cost of 26 mil is almost similar to the revenue of 27 mil. Even the London Flyer in 2000 made an operating profit of 6.5 mil pounds on 25 mil pounds in revenue. Even if you half the revenue of the Eye due to them receiving more visitors, it shouldn’t be this close.

The market is not very happy with Straco's acquisition because they expected it to be cash flow generating. It is. It’s just that with depreciation and interest cost, it is making a loss. Take out the depreciation, and the cash flow is positive.

Somehow I have a hunch that the Flyer's operating profit is much higher.

· The CIMB projected cash flow is 7 mil not inclusive of taxes

· The other interesting thing is that 50% of the terminal is still available for rental. If it is rented out to a big player for long lease (say, Zouk), the operator could probably get another S$7 mil

· If WTS manages to bring in 300k more people per year, and since fixed costs don’t increase and variable costs are low, this could bring in S$6.3 mil in revenue or S$ 5 mil in cash flow after cost

That adds up to 19 mil in operating cash flow or 11.5 mil in PBT. That is a 8.2% return on asset (ROA). Not astounding. But better than the 3.88% earned on cash now.

On the basis of Straco's 2013 FCF of 34 mil, that is a significant boost.

At this stage, it’s not going to be a good investment, in fact, it may leach more capex. Much will depend on what the management of Straco can do about this.

Entrance to the Underwater World Xiamen.

Entrance to the Underwater World Xiamen.

Photo: http://choodoris.blogspot.sg/The UWX case study

The only other purchase of significance carried out by Straco was in 2007 when it bought UWX from the three Tan brothers.

That acquisition cost $12 mil. The first year, the aquarium generated $2 mil in profit or 16% ROA.

In 2013, the net profit was $12 mil. That’s as much as the purchase price. It was a shrewd deal in hindsight.

Would the Flyer deal prove to be the same?

Owner Deploying $120 mil of cash

Straco is vomiting cash really. The historical cost of its assets is S$58 mil and they are generating S$34 mil last year. Mr Wu owns roughly 55% of Straco.

Given the choice, he can choose not to do this Flyer deal. He waited for sometime before he purchased UWX and has been waiting since.

By deploying $120 mil of the cash, he is forgoing the 3-4 mil in interest income (around 3.88%) for a higher risk adjusted return.

If this deal turns out bad, he could stand to see a large part of this $120 mil go down the drain.

$120 mil is a huge investment for him, considering the current assets were bought $58 mil at cost.He will not only incur losses but also lose out on the interest income.

At 60+ years old, he can take the safe route. If this is a bad deal, he doesn’t have to bite it. Pay out a special dividend and pocket $65 mil.

We won’t know if he chooses now to fail, but it is likely the decision to purchase was evaluated thoroughly and he was certain he can improve the Flyer's business performance.

The existing business

The market seem to be discounting the Flyer deal. They seem to like to underestimate Straco just like how I used to underestimate it.

The Flyer deal can be seen as deploying cash to generate a higher rate of return than 4%.

It does not affect its main business which is doing rather well.

The main business has reached a stage where a $1 increase in revenue per visitor does not increase the cost by the same proportionate amount. Since majority of the cost is fixed cost, then as visitorship grows, the revenue flows to operating profits.

The past years' growth in visitors in the 3rd quarter, which is the busiest quarter of the year. (See chart)

The past years' growth in visitors in the 3rd quarter, which is the busiest quarter of the year. (See chart)

When I first looked at Straco, my domain competency in this business was really bad. I had no idea that the growth rate can be so crazy.

If you are afraid that they are going to hit max capacity, the maximum capacity per day provided by management was: SOA 20,000 visitors/day and UWX 16,000/ day. That’s nearly 13.1 mil. a year.

Valuation

At S$0.78, the stock's PE is 18 times or an earnings yield of 5.5%. That looks rather rich to a lot of people. But for me it's the growth rate and the speed of growth that matters. If Straco grows at 3% per annum from here on, then of course this is an expensive proposition with little margin of safety.

If it grows 25% for the next 3 years, based on current share price, your forward PE becomes 8.71 times. That looks kind of a bargain.

Great companies are even better in that they tend to grow at above average rates.

But if you are valuing it to purchase, it is better to use a conservative estimate. Anything surprisingly good is a bonus.

We know that even Straco’s current assets are based on concession and the Flyer's lease ends in 2033 while the rest of the assets' concession ends in 2037.

Based on my cash flow project estimate, a 19 mil supplement to current cash flow is possible. Remember that existing assets are still growing.

I feel that it's not far fetched to see earnings rise from 34 mil to 34 + 8 mil (current assets at 8% growth) + 19 mil = 61 mil (EPS 7.2 cents). The forward PE then would be 10.8 times.

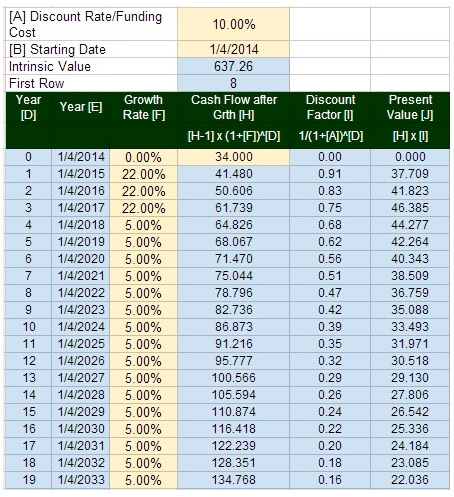

If we use DCF with 34 mil as current year cash flow to 2033, growing at 22% for the first 3 years followed by a stable 5% for the rest of the years. We use a 10% discount rate.

We arrive at $0.75. The assumptions that accompany this valuation is, a good business that doesn’t collapse, existing business growing at 8% for the first 3 years, 50% of Flyer unoccupied space rented out, WTC brings in 6.5 mil in additional revenue.

To have enough meat to buy Straco at current levels, we need to be pleasantly surprised. Pleasantly surprised that 5% growth is too conservative. Pleasantly surprised that Straco can turn around the Flyer in better ways than we conservatively think.