“I’ve always said the easiest way to become a millionaire is to start out as a billionaire and then go into the airline business”. – Richard Branson

Tay Jun Hao (left) oversees over S$3.95 million in investments in a private family office. The annualized returns of the partnership's US portfolio of which he had exclusive purview of has returned in excess of 25% since inception. He also runs The Asia Report, a site dedicated to providing timely investing wisdom to investors around Asia.

Tay Jun Hao (left) oversees over S$3.95 million in investments in a private family office. The annualized returns of the partnership's US portfolio of which he had exclusive purview of has returned in excess of 25% since inception. He also runs The Asia Report, a site dedicated to providing timely investing wisdom to investors around Asia.

I REMEMBER looking at Tiger Airways about 2 years back when the news was roundly more optimistic.

It had all the hallmarks of a great stock story: exciting industry, growing customer base and good PR. I daresay many an investor had thought about investing in it after taking a budget airline flight.

Alas, a great story does not make a great investment. Traditionally, airlines are just not great businesses to invest in. This has got nothing to do with how competent the management is but the very nature of the industry itself.

In January 2010, Tigerair sold its IPO shares at $1.50. In that year, the stock soared to above $2 but has since descended. It recently traded at 43 cents. Photo: http://singapore-ipos.blogspot.sg/The aviation industry has been brutal to all entrants. Even established players like Singapore Airlines have struggled to make money consistently.

In January 2010, Tigerair sold its IPO shares at $1.50. In that year, the stock soared to above $2 but has since descended. It recently traded at 43 cents. Photo: http://singapore-ipos.blogspot.sg/The aviation industry has been brutal to all entrants. Even established players like Singapore Airlines have struggled to make money consistently. Budget airlines are worse off, constantly competing based on price to attract customers.

On top of that, they face the onslaught of ever increasing costs, and the need to replace their airplanes. No airline which keeps its planes for years will be around for very long.

Upgrading an airline fleet is very costly, and therein lies the next problem: There’s no market for selling 20 – 30 planes at once.

No airline can afford to buy its fleet based on cash entirely, hence the presence of massive airline leasing arms that provide financing.

To top that off, national carriers are often a source of national pride, providing a somewhat implicit guarantee for the financing of these costly investments.

However, even if they are market leaders, airlines discover that making money is very tough.

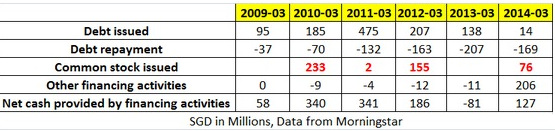

Consider this: For the past 6 years, Tiger Airways has burnt through $2.1 billion in cash… and it is still not done upgrading its fleet. Tigerair has just announced an additional $3.8 billion in capex plans!

Singapore’s Tigerair orders Airbus jets worth $3.8 billion – Reuters

The only way that Tigerair has been able to keep expanding was to tap the debt market, raising cash from loans. More tellingly, Tigerair has raised a significant amount of money through shares issue.

As a rule, I avoid industries that are (1) reliant on debt (2) has a business model that cannot sustain itself without massive infusions of cash.

By simply following this rule, investors can sleep easier at night.  Tigerair's stock clearly has been anything but a roaring success. Chart: FT.com

Tigerair's stock clearly has been anything but a roaring success. Chart: FT.com

Recent story: Chan Kit Whye: TIGER AIR Shares Could Be "Technically Worthless"