DBS Vickers has 25-c target for SIIC Environment

Analyst: Tan Ai Teng (left)

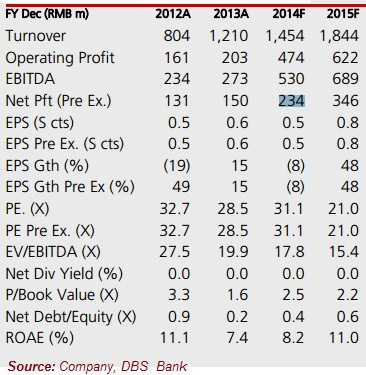

Analyst: Tan Ai Teng (left)• Core PATMI of S$48m beat our S$37m forecast as EPC revenue was front-loaded

• Growth outlook intact, underpinned by rising capacity utilisation and potentially more acquisitions

• Maintain BUY and S$0.25 TP

We believe the outperformance at this juncture is mainly due to front-loaded EPC revenue. 1Q profit typically accounts for 16-17% of FY forecast.

But 1Q14 has already met 27% of our FY14F earnings. Core net margins improved to 16.2% from 15.1% in 1Q13 and 13.6% in 4Q13.

This can be partly attributed to rising contributions from the higher margin Treatment business.

This can be partly attributed to rising contributions from the higher margin Treatment business.

Our View

Future growth supported by higher capacity utilisation and expansion.

Apart from organic Treatment growth in the form of higher capacity utilisation and upgrades, FY14 will be partly boosted by higher operating capacity of 2.92m tons due to acquisition of Qingpu wastewater treatment plant and the acquisition of Pucheng waste-to-energy plant early this year.

SIIC is expected to continue on its aggressive growth plan via acquisitions.

SIIC is expected to continue on its aggressive growth plan via acquisitions.

Although net debt to equity ratio has risen to 0.59 from <0.30 previously, there remains some debt headroom for acquisitions, which could give rise to upside risks to our earnings forecast.

In view of on track expansion, we maintain our Buy rating on SIIC with a 12month TP of S$0.25.

|

DBS Vickers says no respite from losses in the near term for Tiger Airways Analysts: Suvro SARKAR and Paul YONG, CFA • Core net loss of c.S$45m, plus impairments and provisions totaling c.S$51m in 4QFY14

• Decline in both load factors and yields amid industry overcapacity deals double whammy; desperate measures to manage capacity growth in place now

• Further losses loom in FY2015 with no significant turnaround in sight

• Maintain FULLY VALUED with lower TP of S$0.35

Tiger Airways: @Further losses loom in FY2015 with no significant turnaround in sight," says DBS Vickers. NextInsight file photo Tiger Airways: @Further losses loom in FY2015 with no significant turnaround in sight," says DBS Vickers. NextInsight file photo Our View

Attempts to rationalise capacity ongoing. To recap, Tigerair had earlier cancelled the remaining 9 aircraft scheduled to be delivered from its 2007 orderbook, which means it will not be receiving any new aircraft till 2018.

The orders for 37 A320 new aircraft to be delivered over 2018-2015 will largely replace the existing 27 older generation A320 aircraft, as leases expire during that period. Thus, management hopes demand will be better matched to supply going forward, leading to improvement in load factors and yields. With other budget airline competitors also looking to rationalise capacity ex-Singapore, further downside may be limited, though any significant improvement in yields looks far-fetched. In terms of associates’ outlook, we expect losses to decline as Tigerair has exited its Philippines investment and is scaling down Indonesian operations as well. As a result, it will be grounding 8 aircraft next year (3 from Philippines and 5 from Indonesia) and has already taken a sizeable hit in terms of estimated grounding costs. Recommendation No respite from losses in the near term. We expect the Singapore operations to remain in the red in the near term unless yields jump significantly, which seems unlikely given slowing passenger traffic growth at Singapore Changi Airport. With no catalysts in the offing, we maintain our FULLY VALUED call at a lower TP of S$0.35 (pegged to 7x FY15 EV/EBITDAR).

|

this amazing site needs far more attention. I'll probably be back again to read through

more, thanks for the advice!