INVESTOR ATTENTION has increasingly been drawn by online articles and forum postings to the dramatic changes in the rubber accelerator industry in China and its positive impact on Singapore-listed China Sunsine Chemical.

In the forums of NextInsight and Valuebuddies, posts by forumers indicate rising expectation of a significant jump in earnings in 2Q and beyond for China Sunsine. 1-year performance: Shenzhen-listed Shandong Yanggu is up 80% while Singapore-listed China Sunsine is up 33% only, largely due to a lack of Singapore investor awareness of the fundamental changes in the industry.

1-year performance: Shenzhen-listed Shandong Yanggu is up 80% while Singapore-listed China Sunsine is up 33% only, largely due to a lack of Singapore investor awareness of the fundamental changes in the industry.

Charts: www.marketwatch.comThis is well supported by a just-released profit guidance issued by a peer, Shandong Yanggu Huatai ( 山东阳谷华泰), which is listed on the Shenzhen Exchange.

The company guided on July 14 that its Jan-June 2014 net profit would come in at between RMB 19.74m and RMB 22.71m, representing a year-on-year increase of between 100% and 130%, respectively.

It attributed the profit surge largely to escalating rubber accelerator prices of around 20%, which is caused by a supply shortage since May 2014 following a government clampdown on businesses that do not meet environmental regulations in producing an intermediate product called MBT.

Commenting on the Shandong Yanggu Huatai announcement, brokerage 中信建投证券 highlighted that its 2Q profit forecast of between RMB 14.64m and RMB 17.60m formed the bulk of the expected half-yearly profit, and it is impressive as it is more than thrice the corresponding period's profit in 2013.

The brokerage cited two main developments that led to tight rubber accelerator supply within China and the consequent product price surge.

>> First, China lost around one-third of MBT capacity (or 100,000 tonnes) following the suspension and closure of MBT factories which have been polluting the environment.

>> Second, China exported 51,700 tonnes of rubber accelerators in the first five months of 2014, or 76.8% higher year-on-year, which reduced inventory levels in China.

Another brokerage, 安信证券, stated that as 80% of rubber accelerators produced in China originate from the northern region, government enforcement on accelerator producers is mounting ahead of the November APEC meeting in Beijing.

A recent article on rubber accelerators asserted that although MBT price is high, an increase in MBT production capacity is unlikely to materialise in the near term, as many players in the industry need to switch to clean production techniques.

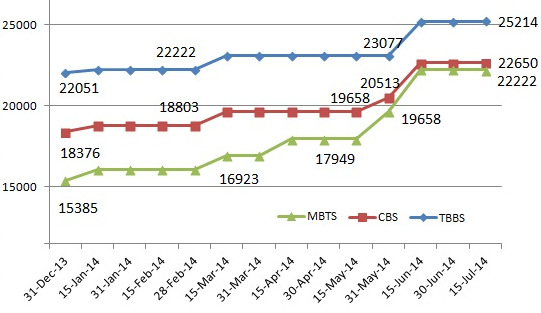

Attempts to switch will meet with hurdles in the form of capital and know-how, which is why the MBT shortage is likely to persist for a long period.  The price trends (in RMB per tonne) for MBT-based accelerators, especially the strong price spike in June, augur well for Sunsine's profit in 2Q2014 and beyond. Data source: http://zgxcl.oilchem.net/x/p_281_110_553_0_1.html

The price trends (in RMB per tonne) for MBT-based accelerators, especially the strong price spike in June, augur well for Sunsine's profit in 2Q2014 and beyond. Data source: http://zgxcl.oilchem.net/x/p_281_110_553_0_1.html

|

But it is important to note that Sunsine's new insoluble sulphur factory has commenced production and might have incurred start-up costs. An earlier article asserting tight MBT supply has also indicated that existing accelerator companies are stepping up production or acquiring suitable MBT factories. A NextInsight article (CHINA SUNSINE: Will 2Q Profit Soar More Than 100%?) on July 3 noted the possibility of one-off costs eroding profits even though benefits would materialise later. |

That should limit how high the price share can go.