Prior to his retirement, Chan Kit Whye (left) worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.

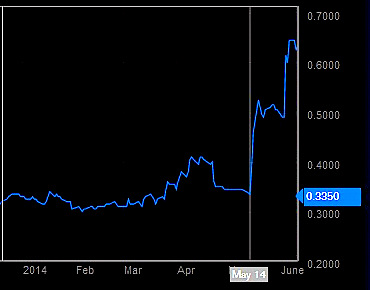

Prior to his retirement, Chan Kit Whye (left) worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School. Stats ChipPac stock closed at 65 cents yesterday, double what it was in mid-May. Chart: BloombergSTATS CHIPPAC's share price has doubled since mid-May. Technically it is bullish, purely based on rumour of privatisation.

Stats ChipPac stock closed at 65 cents yesterday, double what it was in mid-May. Chart: BloombergSTATS CHIPPAC's share price has doubled since mid-May. Technically it is bullish, purely based on rumour of privatisation.Currently, Stats ChipPac's NAV is about 41 US cents. When it was 77 cents, the offer to delist was at 1.75.

Simple calculation shows that if the company is to delist now, the offer price should be around 0.93 to 1.00 based on its past offer vs NAV.

Temasek has close to 84% stake in the company. It means that about 360 million shares are held by institutions and minority shareholders.

There are about 10,700 shareholders holding between 1,000 and 10,000 shares representing 37 million shares or 1.6% of the total outstanding shares.

Declining profits over the years had a knock-on effect on its share price, and as the semiconductor industry has fully recovered, the company should see a turnaround to profitability, but only if it is able to contain costs and improve productivity.

If its plant still has the capacity to produce more wafer chips and able to modify to produce in line with advanced wafer technology, then third party competitors like Taiwan Semiconductor Mfg may be interested to take over the control from Temasek, in which case, a general offer must be made to the rest of the shareholders.

I don't think Temasek is likely to make the offer, but that is my opinion.

Recent story: Chan Kit Whye, DBS Vickers on... YANGZIJIANG SHIPBUILDING

Worlds no 1 in semi-con tech....