Excerpts from Credit Suisse reportAnalyst: Iris Wang

Biosensor's drug-eluting stent is used by surgeons to treat diseased coronary arteries. Image: company

Biosensor's drug-eluting stent is used by surgeons to treat diseased coronary arteries. Image: company3Q FY14 core earnings declined 44.7% YoY. China revenue was flat as the volume growth was offset by the ASP cut of 15-20%.

● R&D and SG&A expenses rose sharply due to consolidated expenses from SpectrumDynamics and ongoing clinical trials including those for Excel 2 in China, the global study of BioFreedom and the new protocol studies of SpectrumDynamics.

● We believe going private and IPO in Hong Kong or China domestic exchange is a viable option for Biosensors to unlock its value, given:

(1) it has ~US$500 mn cash (and equivalents) with a 37.5% share held by two of the largest PE firms in China and ~52% free float;

(2) it recently appointed the industry veteran Mr. JIANG Qiang (the ex-CFO of Shandong Weigao) as COO; and

(3) Citic PE's recent share acquisition price of $1.05 (purchased from Shandong Weigao).

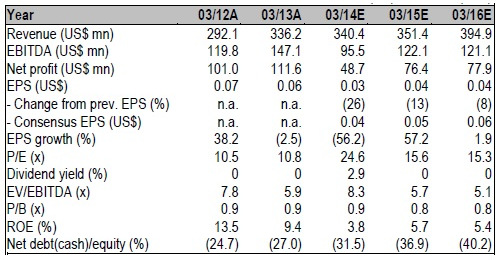

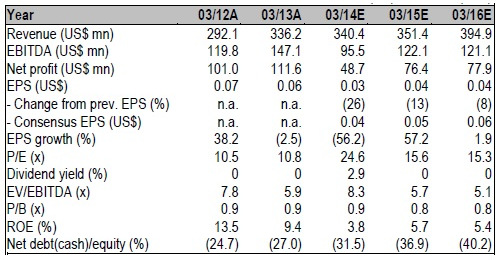

● We cut our FY14E earnings and maintain NEUTRAL rating for the short-term earnings weakness, but we believe the stock is currently undervalued for its long-term growth potential.

Credit Suisse has a 'neutral' rating on Biosensors (87 cents) and an unchanged target price of $1.00.

Credit Suisse has a 'neutral' rating on Biosensors (87 cents) and an unchanged target price of $1.00.

Qiang Jiang obtained a Masters degree in Accounting from Northeast University of Finance and Economics in China. Qiang Jiang obtained a Masters degree in Accounting from Northeast University of Finance and Economics in China.

Privatisation and re-IPO in Hong Kong may happen

Biosensors appointed Mr. JIANG Qiang as the COO on 29 January 2014. Mr. Jiang is the former CFO of Shandong Weigao and has extensive experience in accounting and financial management.

He will take full responsibilities of business development in his new position.

Given that Biosensors has US$689 mn cash with a 37.5% share held by two of the largest PE firms in China (Hony Capital and Citic PE), and recently appointed the industry veteran Mr. Jiang as COO, we believe going private and relisting in Hong Kong could be a viable option.

Our studies of Sihuan Pharma and China Animal Healthcare, both got de-listed from Singapore Exchange and re-listed in Hong Kong, show that re-listing in Hong Kong is likely to lead to higher valuation and better liquidity.

We maintain a NEUTRAL rating for the short-term earnings weakness but remain positive on its long-term growth potential.

Plus the repurchase programme started in November 2012 is going to provide downside protection.

Recent story: BIOSENSORS to privatise? VICOM target $6.28

|

Biosensor's drug-eluting stent is used by surgeons to treat diseased coronary arteries. Image: company3Q FY14 core earnings declined 44.7% YoY. China revenue was flat as the volume growth was offset by the ASP cut of 15-20%.

Biosensor's drug-eluting stent is used by surgeons to treat diseased coronary arteries. Image: company3Q FY14 core earnings declined 44.7% YoY. China revenue was flat as the volume growth was offset by the ASP cut of 15-20%. Credit Suisse has a 'neutral' rating on Biosensors (87 cents) and an unchanged target price of $1.00.

Credit Suisse has a 'neutral' rating on Biosensors (87 cents) and an unchanged target price of $1.00. Qiang Jiang obtained a Masters degree in Accounting from Northeast University of Finance and Economics in China.

Qiang Jiang obtained a Masters degree in Accounting from Northeast University of Finance and Economics in China.