Photo: Freepik

Photo: Freepik

There are times when you need credit facilities. You may want to apply for a home mortgage or take a loan for a car or home renovations. Or you are applying for a credit card to make full use of perks you’ve heard so much about.

You might not know it, but anytime you apply for credit facilities from banks in Singapore, they will look up your credit score, which gives a snapshot of your credit trustworthiness and risk of default. If you are deemed to be at higher risk, banks will charge you a higher interest rate, or they might choose not to lend you any money at all.

Knowing what is on your credit report will help you ensure you are in good standing so that you can continue to have access to credit. It is also helpful so you can report fraudulent or inaccurate entries on your credit report.

Who Maintains Records of Your Credit Report?

Credit Bureau (Singapore) Pte Ltd (CBS) is a joint venture between the Association of Banks in Singapore (ABS) and an information management firm. CBS has full-industry uploads from all retail banks and major financial institutions. It is a centralized repository of credit information that keeps their members informed in their credit risk assessment of potential borrowers to make more accurate lending decisions.

However, know that any decision to grant or deny credit is made by individual banks or credit card companies, and not CBS. The credit score provided by CBS is just one factor in the evaluation criteria that banks use. Other factors may include your annual salary, length of employment, and existing number of credit facilities.

Your credit information held by CBS can only be accessed by yourself and approved participating financial institutions for the purpose of evaluating credit-worthiness. They are prohibited by law to disclose this information or use it for other purposes like marketing.

|

|

What Is In Your Credit Report?

Your credit report primarily contains records of your credit payment history and other information relevant to assessing your creditworthiness, such as:

- Basic personal data (without contact addresses or phone numbers)

- Records of credit checks made

- Credit repayment trend for the past 12 month

- Default records, if any

- Litigation records, if any

- Bankruptcy records, going back 5 years from the date of discharge

- Closed or terminated credit accounts going back 3 years from the date the account was reported closed or terminated

- Aggregated outstanding balances

- Aggregated credit limits

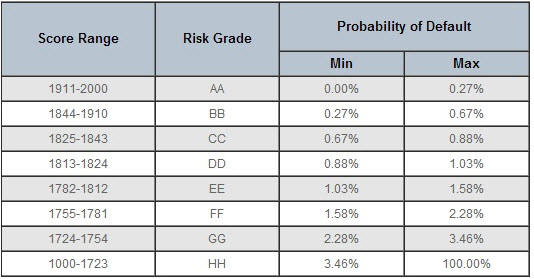

After taking the above factors of the credit history into account, your credit report also contains a credit score, which is a is a four-digit number. The score ranges from 1000 to 2000. Based on the score, you will be given a risk grade from “AA” to “HH”.

Range of Credit Scores (Source: Credit Bureau)

How To Get Your Credit Report

You can purchase a copy of your credit report online or head down to any of the following places:

Consumers who have applied for a new credit facility with any of CBS member banks or financial institutions are entitled to a free credit report.

Credit applicants will now receive a letter informing them of the credit application approval or rejection statuses. With this letter, you can obtain a free credit report from CBS within 30 calendar days from the date of the letter.

|

|

How To Improve Your Credit Risk Grade In Singapore

CBS does not provide an exact description of how the credit score is computed, but broad guidelines exist.

Non-repayment or late repayments are clear factors that negatively affect your credit score.

You should always strive to repay your credit card bills and loans installments on time.

For credit cards, the more recent the missed payments occurred, the greater that impact will be on your credit score. You can also use things like GIRO to help ensure you do not forget.

If you think you might miss your loan repayments, inform your bank early and work out an alternative repayment plan.

Suddenly applying for multiple lines of credit like credit cards in a short time is another red flag for your credit score. You should space them out as far as you can, which should be possible with better planning.

Not having a credit history is actually not a good thing. So if you see that not having recent credit history is mentioned in your credit report, you can remedy it by regularly using your credit card to pay for expenses you will already be incurring, and then build up a track record of timely payments.

| ♦ What To Do If You Spot An Error |

| Sometimes, there could be mistakes in your credit data which will affect your credit score. If you do spot a mistake, contact CBS and the bank or financial institution that originated the entry and get them to reverse or amend it. You should check your credit report periodically, or at least a few months before you anticipate you needing credit. This will give you time to remedy wrong records, or improve your credit score if you need to. Not knowing about the error and letting it sit in your credit report will impact your credit score unnecessarily. |

This article is republished with permission from Dollars and Sense.

Not having a credit history is actually not a good thing. So if you see that not having recent credit history is mentioned in your credit report, you can remedy it by regularly using your credit card to pay for expenses you will already be incurring, and then build up a track record of timely payments.

Not having a credit history is actually not a good thing. So if you see that not having recent credit history is mentioned in your credit report, you can remedy it by regularly using your credit card to pay for expenses you will already be incurring, and then build up a track record of timely payments.