The writer is a full-time professional trader.

“To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude and pays the greatest ultimate rewards.” --- Sir John Templeton

THE RECENT crash in the share prices of Blumont, Asiasons and Liongold resulted in a loss of >S$10bln market cap in the local market. Waves of panic selling and forced liquidation in the 3 counters inevitably resulted in indiscriminate selling across other stocks, mainly smaller cap names and pennies.

In the course of my work, I observed that there were a few days of heavy selling of these 3 stocks almost without regard for price. Sources working at local brokerages also talked about forced selling of these positions due to insufficient top-ups in margin calls. News reports subsequently confirmed my observations.

At the same time, fears over US government debt repayment also shook out late "longs" and weaker hands in these stocks. The speculative fever in these stocks has subsided, to say the very least. Having been a professional trader for the past 5 years, I have formed the view that the current backdrop presents buying opportunities for market participants who have an intermediate term horizon.

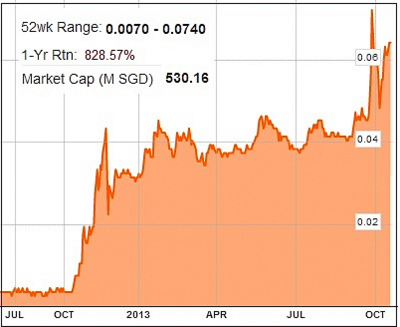

I have increased my exposure to two stocks, YHM and Sino Grandness. Chart: Bloomberg1) YHM – It is backed by an experienced and financially prudent management team in Ezion who have established a stellar execution track record in developing and chartering offshore vessels. In a stubbornly high oil price environment, enquiries for offshore drilling vessels will continue to flow and Ezion’s execution ability and existing working relationship with international oil majors will certainly be the key differentiating factor for YHM.

Chart: Bloomberg1) YHM – It is backed by an experienced and financially prudent management team in Ezion who have established a stellar execution track record in developing and chartering offshore vessels. In a stubbornly high oil price environment, enquiries for offshore drilling vessels will continue to flow and Ezion’s execution ability and existing working relationship with international oil majors will certainly be the key differentiating factor for YHM.

I belive YHM’s recently announced US$183mln semi-sub rig contract may be the first of several to come. YHM fell near 40% from its high of 7.4c to 4.8c last week. I bought the stock at 5c during the recent decline and will continue to monitor the company’s execution ability. However, having a market capitalisation of nearly S$550mln without earnings to prove yet, investors should also keep an eye on overvaluation concerns if overly optimistic expectations start building in. Loquat juice has been a big winner for Sino Grandness. Photo: Company2) Sino Grandness – With recurring earnings growth of >30% and trading at 4-5x earnings multiple, the stock still looks cheap to me despite having year-to-date returns of 110%.

Loquat juice has been a big winner for Sino Grandness. Photo: Company2) Sino Grandness – With recurring earnings growth of >30% and trading at 4-5x earnings multiple, the stock still looks cheap to me despite having year-to-date returns of 110%.

Although it is operating in the highly competitive beverages industry in China, the company management has been steadfast in its advertising and promotion efforts to drive its Garden Fresh’s brand awareness and thus earnings growth.

With all eyes on Garden Fresh’s IPO spinoff in Hong Kong in 2014, I believe management (Chairman having a sizeable 40% stake in the company) has a strong self-interest in delivering on its promises and seeking to achieve an attractive IPO valuation for its shareholders.

Through leveraging on its existing distribution channels, Sino Grandnes also recently started to sell food and snacks products under its Garden Fresh brand. If its execution goes well, this will allay concerns that Sino Grandness is overly reliant on a single segment for earnings growth. I bought the stock at 66c during the recent decline and will look to buy more on worthy corrections.

Investing in small caps

Short-term fears more often than not create inefficiencies in pricing. The smaller the market cap, the more extreme the market reaction gets. Boom-bust cycles happen more frequently in smaller cap names. As many deep-pocketed people and fund managers are looking at big caps, any cheapness in these names tends to be corrected rather quickly.

Hence I believe in investing during times of market weakness, and it's best to look at where the overreaction on the downside is the biggest -- the smaller cap names. However, I recognise that negative market sentiments and undervaluation may persist longer than most people expect.

Still, it is my pleasure to pick companies that are fundamentally sound and ride through the volatile period. Doing this, I am confident I have a good chance to realise value appreciation when market sentiment inevitably normalises. I have devised a buying approach during a market/stock bottom, and will explain this in a future article.

Entering a seasonally stronger 6 months period

We are now entering a seasonally stronger 6-month period. Since 1950, the average return of S&P 500 was only 0.5% during the May-October period, compared with an average gain of 7.1% during the November-April period. This market anomaly is widely cited as the Halloween effect which describes the outperformance of returns observed in the latter 6 months period compared to the former.

Low trading volumes during summer and an increase in investment inflows towards the start of a year are two commonly cited reasons for the outperformance. As a student of financial history and believer in seasonality, I have been buying, and will continue to buy, some of the fundamentally strong small-caps amid the current market weakness. It gives me a statistical advantage. (Caveat: This market timing strategy is well known and practised hence may render any outperformance invalid.)

Conclusion: The ability to buy based on underlying value, low price relative to value and depressed general psychology is more often than not the safest approach towards investment.

“Buying from a forced seller is the best thing in our world, being a forced seller is the worst. That means it is essential to arrange your affairs so you will be able to hold on - and not sell - at the worst of times. This requires both long term capital and strong psychological resources.” --- Howards Marks, Oaktree Capital.

Recent story: SINO GRANDNESS: Will its Garden Fresh IPO be boosted by rival's rising valuation?

Maybank's 2 Jul 2103 report suggests a target price of $1.89 or 94c (after the share split) for Sino Grandness.

If a 20% discount is applied to this target price to provide a sufficient buffer, the adjusted target price of 75c is not far off the current share price of 72c.

Maybank's target price of 94c is made up of the intrinsic values of the beverage business (70c) and canned product business (24c).

What is your target price for Sino Grandness?

Very valuable insight ! Do you have your own blog ? Wish to read more