Main source: Story in Workers Daily

READY FOR A no-holds barred assessment of the state of share prices in the China's capital markets, and opinions on why so many domestic investors are deciding to bolt the market for greener pastures?

Then keep reading...

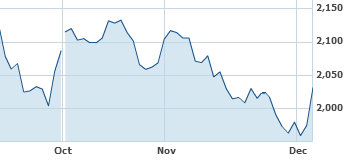

The protracted bear market is causing investors to not only voice their opinion on the bourse with their share trading activities, but also to make a point of voting on the market's recent performance with their feet – by leaving it altogether for better returns elsewhere.

All of this begs the bigger question: Where is the value these days in China’s A-share markets?

Or put more succinctly: Is "value investing" in China still a viable strategy or has it become too nightmarish an experience for even the dreamiest of investors?

Share value, and valuation for that matter, are in and of themselves rather abstract entities, and can vary drastically from one beholder’s eyes to the next.

However, perception is more important than reality for share prices, and when the common perception is that a particular listco deserves a basement-level share price, then said share will suffer from a basement-level share price.

Much the same could be said for market sentiment.

When investor sentiment is low, and remains as such session after session, then the benchmark index will tend to follow the gloomy sentiment to greater depths.

Any given stock index can be tracked throughout the entire trading session, with investors always aware of its exact location.

However, determining where investor sentiment is at any particular point in the trading day is an exercise in futility, and can vary greatly from investor to investor.

So when trust and confidence -- two key pillars of any healthy bourse -- are in short supply, capital outflow is usually the result.

And with the exit of each investor and her money, the market can either respond positively by rewarding newcomers with lower buy-in prices, or it can scare away said newcomers with the rumblings and grumblings of the departing shareholders.

Unfortunately for listed firms in Shanghai and Shenzhen, the latter is certainly the case these days in most instances.

Lest investors think all is lost, there are a few rays of hope trying to break through the cloudcover.

China’s PMI – chief barometer of the country’s manufacturing health – is trending into more positive territory of late.

Furthermore, other litmus tests of economic vitality are also improving, such as electricity output, real estate sales and other macroeconomic data points.

So if that elusive and arcane thing called investor sentiment is looking for a shot in the arm, perhaps it can look in these places.

China’s A-share markets need all the help they can get these days.

See also:

BIG BROTHER? China Firms Dominating Blockbuster HK IPOs

What The Big Boys Are Buying In China

PARTY TIME: Top Five PRC Earners

POINTING FINGERS: ‘Immature’ Investors At Fault In China?