MING FUNG JEWELLERY Group Ltd (HK: 860) “sells dreams, not just products,” and therefore customer service is paramount to wearer satisfaction, and more importantly – repeat visits – an executive told investors in Hong Kong.

“Ming Fung enjoys very balanced growth with three key drivers: retail business, jewelry and our mid- to high-end market focus. We also believe in promoting a lot of repeat customers, so customer service is extremely important to us,” said Ming Fung Vice President Werner Schuppisser.

Ming Fung is a growing presence Greater China, with 14 retail outlets across the PRC, five in Hong Kong and one in Taiwan.

The company took cheer from an 18.2% jump in Mainland China sales to 304.2 mln hkd in the six-months to March.

Speaking at an investor luncheon high above Hong Kong’s iconic Victoria Harbor, Mr. Schuppisser said that customers entering Ming Fung's watch and jewelry shops across Greater China are treated in much the same meticulous way as patrons at a high-end health and fitness spa might be.

“When clients enter a spa of health resort for the first time, they are immediately studied by the attentive and well-trained staff to determine which exercise, workout, massage and dietary regimens are best suited to the needs of the individual.

“In many ways, we perform a similar service at Ming Fung.”

He said staff at the jeweller are highly trained in the finer points of customer service, and perform similar “analysis” on first-time customers as might happen at health resorts.

“As for sales commission, we typically don’t provide much during an employees first six months, as this allows the newcomer to prove and improve his or her skills and customer service talents. After that initial period, we will begin paying more attention to commissions."

Founded by Jeffry Wong in Hong Kong in 1989, Ming Fung listed on the city’s mainboard in 2002 and has its main production facilities located a short distance away in Shunde, Guangdong Province.

Mr. Wong's rich background as a diamond trader provided him with the knowledge to source top quality polished diamonds which he combined with the low cost manufacturing environment in China to bring a compelling range of options to buyers in the US and Europe.

Through national distributors, Ming Fung's products can be found in renowned retailers across the US and Europe.

However, it is Greater China – and particularly Mainland China itself – which offers the most promising growth potential for Ming Fung.

As China's demand for luxury items began to grow over the past few years, Ming Fung formulated a strategy to target this market through its own brand name and stores including SAVANTI.

The first SAVANTI store was opened in 2005 in Shanghai.

The company has built a comprehensive retail store chain reaching Eastern, Northern, Northeastern and Southwestern regions of China.

Going forward, Ming Fung’s overall business will be driven by its wholly-owned and rapidly growing jewelry retail stores-chain in China under the group's own brand name, SAVANTI.

Consequently, Ming Fung's net margins should drastically improve as the number of SAVANTI stores increase and retail sales become a much more significant contributor to the group's overall sales.

Total retail purchase of jewelry in China have shown staggering growth of late, rising 25% in 2011 to reach 300 billion yuan.

With a market like this, it is no wonder Ming Fung is focusing on Greater China.

“The current retail jewelry market is China is very fragmented and there are no major national jewelry brands other than a few in the low-end gold segment.

"The top international segment is still underdeveloped and the focus on China will increase. Therefore there is a strong opportunity for Ming Fung to reshape China’s jewelry retail market,” said Mr. Schuppisser.

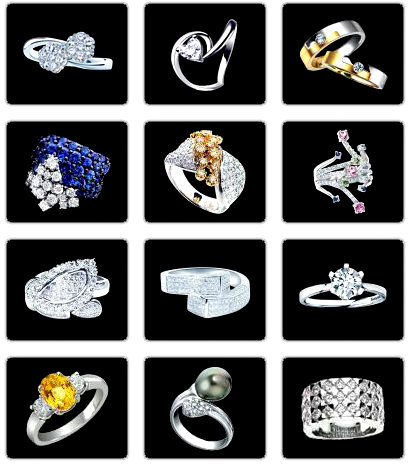

He said that Ming Fung “sells dreams, not just products” and therefore customers ultimately want a unique product in their jewelry.

“Uniqueness is one of the highest priorities for high-end jewelry buyers around the world, and China is no exception,” he said, displaying to the roomful of investors a 1.7 million yuan necklace.

“Take for example these colored stones, all cut from the same original. This is what we mean by unique.”

He said the prices in Ming Fung stores could range from around 3,000-4,000 yuan for a Gucci watch (for which Ming Fung enjoys exclusive distribution rights in Mainland China and Hong Kong) to nearly 13 million yuan for the top-end piece.

Photo: Company

“Average prices in our shops are around 40,000 to 50,000 yuan,” he said, adding that margins and selling prices for jewelry were much higher than for timepieces, and once necklace could equal “several Gucci watch sales” in terms of revenue.

Gucci was not simply a watch company, but was a growing name in the jewelry business as well.

“As Gucci’s exclusive distributor, we see fantastic opportunities for growth in Gucci’s jewelry business. That being said, our Gucci watch business is growing at around 100% per year,” Mr. Schuppisser said.

He reemphasized that setting and service were of paramount importance.

“Because of the luxury, high-end nature of our products, a store’s setting is extremely important, as is ensuring a premium level of customer service.

“For example, we have already hired 17 ‘jewelry advisors’ for our new flagship store in the Hangzhou Tower luxury shopping mall.”

Most of Ming Fung’s new stores will be opened in shopping malls and high-end department stores.

“We are also considering opening in hotels,” Mr. Schuppisser added.

He said Ming Fung took a long-term positive outlook on the growth potential in China’s retail jewelry market, and also adopted the same attitude toward customer service.

“When a client purchases a ring, for example, we consider it not the end of the business relationship but just the beginning. Through product quality and top-notch customer service, we hope to build up customer loyalty so that hopefully the client will return again to buy a whole set of rings,” Mr. Schuppisser added.

He said that Ming Fung also avoided directly competing with established peers like Chow Tai Fook, Luk Fook and Chow Sang Sang.

“We focus more on the branded and high-end market so we don’t compete head to head with these three names that are more concentrated on the commodity and gold-based side of the business.”

Ming Fung must be onto something good, because the Hong Kong-listed firm has seen a CAGR growth over the past decade of nearly 17%, and recently grew its interim net profit by nearly 14% to 48.6 million hkd.

“Our goal is to become the undisputed leader in the jewelry retail and distribution market in Greater China, and a leading player in the world,” Mr. Schuppisser said.

See also:

MING FUNG JEWELLERY: Domestic Sales Surge On China Gold Rush

HK Tycoon's Chow Tai Fook Jewellery IPO May Top 30x P/E

CHOW SANG SANG: Jewelry Shows Recession-Resistant Results

HK JEWELERS CHOW SANG SANG, LUK FOOK: What Analysts Now Say...