Excerpts from latest analyst reports...

BOCI starts CHOW SANG SANG (HK: 116), "China’s Tiffany in the making”, at ‘BUY’

With more than 70 years of operational history, Chow Sang Sang (CSS) has 187 jewelry outlets in the PRC and 53 stores in Hong Kong/Macau.

The major difference between Chow Sang Sang and local rival Luk Fook is that Chow Sang Sang self-operates all its stores while Luk Fook runs more than 90% of its outlets through licensing in the PRC, implying Chow Sang Sang has higher revenue, profit and jewelry inventory levels.

Additionally, the company is targeting mid to high-end customers in the PRC and focuses on expansion quality.

The group distinguishes itself from Hong Kong and mainland competitors by targeting mid to high‐end PRC customers with greater spending power.

100 outlets are to be opened in the PRC over the next two years, representing a 54% increase in outlets.

Same-store-sales growth (SSSG) exceeded 28% in 1Q11 and is expected to be strong for the rest of 2011.

Operating and net margin to improve from 8.3% and 6.5% in 2010 to 9.8% and 7.6% in 2013.

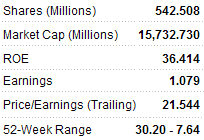

We expect Chow Sang Sang’s revenue and net profit CAGRs of 20% and 26% during 2010-13. We initiate coverage with a BUY rating and a target price of HK$27.60, or 19x FY11 December P/E.

See also: CHOW SANG SANG: Double Digit Growth Seen For 3Q

BOCI initiates LUK FOOK (HK: 590) ‘BUY’ on rapid PRC expansion

Luk Fook is principally engaged in the sourcing, designing, retailing and wholesaling of gold, platinum and gem-set jewelry in Hong Kong and the PRC. Its manufacturing facility is in Panyu, Guangdong Province.

The group is rapidly establishing a presence in mainland China through licensing and is expected to supply 85% of its self-managed gem-set jewelry to licensees by March 2013.

Given the strong demand for jewelry from Chinese customers coupled with the surging prices of gold and platinum, we expect revenue and net profit to register respective CAGRs of 27% and 32% during FY10-13.

Retail outlets in the PRC should increase from 519 in March 2010 to 920 in March 2013E.

We expect same-store-sales growth (SSSG) of 27.6% from March 2010 to March 2011 (50% y-o-y SSSG for the month of March 2011).

Operating margin should improve from 11.8% to 13.5% by March 2013E.

We initiate coverage with a BUY rating and a target price HK$34.00, or 19x FY12 P/E.

See also: PRECIOUS METALS: On Cusp Of Global Gold Rush?