Photo: dushi.org

Bocom: Pork Bellies a Bourse Beacon

Bocom International said it has discovered a way to gauge the performance and perhaps predict trends on China’s stock market.

“Ever since the ‘Great Recession’ in 2008, Keynesian advocates have been growing louder on the so-called ‘China-Model’. The central premise of such a belief is that the state is better at running the economy than private enterprises,” Bocom said in the note to investors.

The research house said this theme echoes the period after the Great Depression in the 1930s, when we witnessed rising intensity of government intervention.

“Yet history is rife with unintended consequences. In the years after the US Federal Reserve was assigned the responsibility of monetary policy, instability in the US economy was actually greater than before the Fed was founded – even after considering the two wars.

“Indeed, during the peace time between 1920 and 1939 the US underwent more banking crises than in previous years. One could even argue that the 1929 Crash was ushered in by the Fed’s action to stem market speculation, as it started to tighten in mid-1928 and overplayed its hand.”

Bocom said this is a striking example of failed government intervention.

“Now in China we have excess capacity, an even bigger property bubble and an ailing stock market. But many are still crying out for more government intervention."

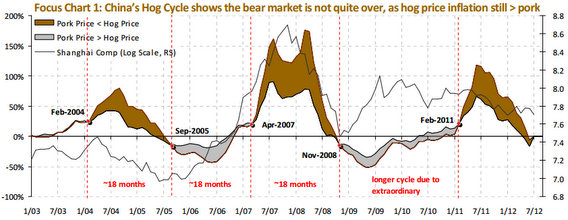

The ‘Hog Cycle’

The fact that companies can now obtain money more easily through bond offerings rather than bank loans also lessens the need for another cut in the reserve requirement ratio (RRR).

“If credit demand is indeed weak because of scarce investment opportunities, then lowering interest rates will not help. Further, we would argue that in an economy that is growing at 7.6%, with inflation at around 2% and broad money supply increasing at around 14%, the economy appears to have sufficient liquidity for now,” Bocom said.

And here is where the “Hog Cycle” comes into play.

“Meanwhile, we note that the pork and hog price deflation has largely stabilized, and the gap between pork price deflation and that of hogs is narrowing. Or that pork price is rising faster than hog price, signaling a normalization of the pig-farming industry.

“Such inflection points, or the ‘Hog Cycle’ as we term it, have in the past augured the onsets of bull and bear markets in Chinese stocks,” Bocom said.

If food and housing inflation pressure is to rise in the coming months, monetary policy should not be altered, the research house argues.

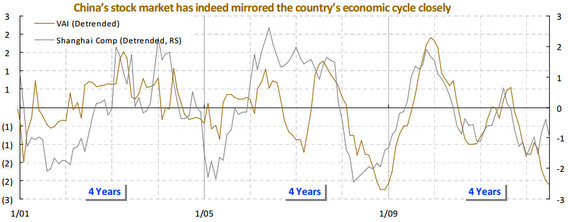

“And contrary to popular belief, the Chinese stock market has been closely mirroring the fundamentals of the underlying economy -- after filtering out the monetary and fiscal noise. Policy makers should leave the market alone.”

China’s market cycle is a struggle between “investor activism and liquidity extraction,” the note added, saying the PRC bourse has been more of a financing vehicle than an investment instrument.

“It is a delicate balance: when financing is a primary function, it is difficult to make money; but then investors will complain in an attempt to temporarily restore the balance -- as now.”

As such, China’s stock market cycle has always been a struggle between investor activism and companies’ ability to extract liquidity from the system.

“But with the gradual opening of the country’s capital account, liquidity leakage is harder to stem. Recent expectations of RMB appreciation have weakened -- a consequence of capital flight and falling investment returns.

“It will be a headwind for any oversold rebounds to evolve into a genuine market reversal.”

This all comes at a time when provincial and municipal governments are announcing multi-trillion yuan investment programs one after another.

“But we ask: How can these programs be financed? If the government borrows, be mindful of the crowding out effect, both on rising market interest rates and on declining incentives for private investment.

“We need less government intervention, not more,” Bocom concludes.

Smaller government -- not bigger -- is the ideal, it added, saying this is an era for “radical new thinking” on China’s economic management.

See also:

CHINA’S LADY BUFFETT Struggling Like Rest Of Us

POOF! 1.7 Trillion Yuan Gone From China Mkt Since May

Bocom: HENDERSON LAND Kept ‘Neutral’

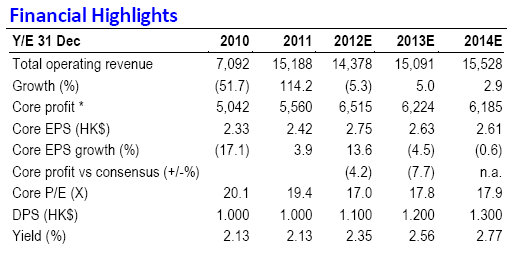

Bocom International said it is maintaining its “Neutral” recommendation on Henderson Land (HK: 12 HK) and 47.90 hkd target price.

“Henderson Land saw better-than-expected results with 1H12 core profit up 5% YoY to HK$3.6bn, or 28% ahead of our forecast as the company continued to roll out its China projects, with the mainland contribution surpassing that of Hong Kong for the first time during the period.”

In addition, Henderson also posted a HK$257m interest income from a land deposit refund.

“Otherwise, the results came in slightly below our forecasts with the improvement in net rental margin largely offset by the low property margin, which fell below the 20% mark as dragged by a gross margin of 10% achieved by China property sales. The company raised interim dividend for the first time in the past,” Bocom said.

During 1H12, the company sold HK$4.5bn worth of properties in Hong Kong, mainly from the sales of inventory and non-core investment properties.

“While FY12 property earnings should be largely secured by The Gloucester (90% sold), a high-margin project bookable in 2H12, asset turnover of its property business still lagged behind.

Apart from the long negotiation in farmland conversion and gloomy profitability of China property, new launches in Hong Kong have been slow with only High West launched so far, among the four “old deed” projects it plans to launch this year.”

The note to investors added that all eyes are now on Double Cove I (928 units, 59%-owned), for which the company expects to receive presale consent soon and official launch by September, with the high target ASP at HK$8k/sqft.

“Nevertheless, we only assume an ASP of HK$6k-6.5k/sqft, or a ticket size of HK$5m-6m, which should better tap the purchasing power from the secondary market and fetch faster sales momentum.”

Bocom said it is revising up its 2012E NAV forecast on Henderson by 1% to HK$87.13, on higher asset values from old building acquisition and farmland along with rising property prices.

“While the low net gearing of only 19% allows the company to sit on these quality assets, the slow turnover continues to hinder the share price performance, with the NAV discount wide at 46% (or 66% on an ex-Gas basis)."

See also:

PROSPERITY REIT: Seeking Right Stuff In Hong Kong

CHINA NEW TOWN Inks Landmark Beijing Fund Deal

SING HOLDINGS: Stock Price Is No Reason For Shareholders To Sing

Kingston: KERRY H1 Property Sales in HK Surge 8x

Kingston Securities said it is closely watching Kerry Property (HK: 683) after its Hong Kong-based unit sales soared eight-fold in the first half.

Photo: Andrew Vanburen

Its buy-in price for Kerry is HK$37, the target price is HK$41 and the stop loss is HK$35.5.

For the first six months, Kerry’s property sales in Hong Kong surged over eightfold, leading its turnover to jump 92.7% to HK$17.96bn.

Net profit increased 10% to HK$3.39bn, mainly derived from the recognized sales of Primrose Hill, Island Crest, The Altitude and Lions Rise.

Turnover of HK$7.84bn and an operating profit of HK$2.74bn were achieved from the sales of completed properties in Hong Kong.

“Hong Kong’s secondary property market reported increasing transactions recently and the prices kept reaching record highs. Mainland businesses were comparatively weak due to the micro-control policies with turnover from PRC properties plunging over 20%.”

See also:

HOUSE MONEY: Top 500 PRC Developers Assets Up 50% To 5 Trillion Yuan

PROPERTIES, PREMIUMS, PIERS: Three China Sectors Scrutinized