METAL FABRICATOR Suzhou Boamax Technologies Group Co Ltd (SZA: 002514) says it expects a bright future ahead in the solar power sector.

The A share-listed firm which makes ATMs for NCR, power supply equipment and a whole host of other metal wares, guided investors through its Jiangsu factory Thursday before its annual results briefing.

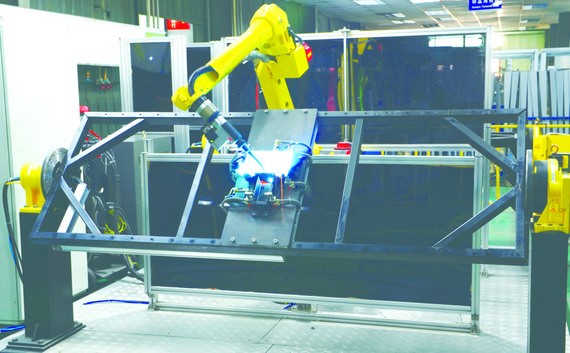

Photo: Tina Ye, Financial PR

The 11-year old firm has strong manufacturing ties with foreign powerhouses like Tyco Electronics, Schneider Electric, Alcatel-Lucent, Teradyne and NCR as well as a growing list of major plays in the US electronics, medical, telecom and new energy sectors.

And it is this latter industry, particularly solar power plays, that has Boamax executives especially intrigued.

“We anticipate strong growth potential from the new energy sector. There’s a growing appreciation of all things green around the globe and this enduring movement will continue to provide support for the solar sector in particular,” said Boamax General Manager Zhu Yongfu.

Boamax, which listed in Shenzhen in December 2010, fabricates products primarily from steel to very exacting client specifications in five major industry categories: financial (ATM machines), electric (power box housings), telecommunications (data and equipment storage units), medical (stainless steel operating tables) and new energy (private use solar power apparatus).

Although the electric segment currently is the largest contributor to Boamax’s top line, Mr. Zhu said that the sky’s the limit for solar power potential.

“For all of these segments, we expect new energy products to have the fastest growth going forward.

“One of our main drivers for this sector is the growing demand from overseas for private use solar power apparatus, especially from North America and Europe.

"Therefore, we are more market and demand driven than being overly exposed to government policy,” he said.

He also added that the trend toward renewable energies and conservation helps maintain steady demand for Boamax’s steel fabricated solar power apparatus.

“Therefore, there is an element of counter-cyclicality or recession-proof stability, if you will, to our order growth in this segment.”

He also pointed to growing potential in the hybrid and fully-electric vehicle industry in Mainland China, and Boamax’s increasing exposure to this lucrative segment.

High-mix/Low-volume

In addition to the company’s growing exposure to the promising solar industry growth being seen around the world.

Mr. Zhu said the core strength of Boamax so far has been its “high-mix/low-volume” business model.

By this, he means the company excels in producing a wide range of highly specialized and customized products for a growing list of clients across a broad spectrum of industries.

“We are highly specialized and focused on high-end, high-quality production.

"This gives us better margins and allows us to operate as a high-mix/low-volume enterprise,” he said.

The strategy is paying off in spades for Boamax.

Mr. Zhu told the investors assembled at the company’s production base city of Suzhou in the eastern Chinese province of Jiangsu that for 2011, the company was able to command enviable profit margins of around 30% for its electric sector clients, with approximately 20% margins for all other product categories.

“As a high-mix/low-volume competitor, we must be extremely flexible with rapid turnover. As our products are custom made for each client, we must not only be quick to complete orders but also highly positioned up on the technological totem pole. Without cutting-edge technology, we would quickly fall behind so we put great emphasis on using the best machinery available.”

However, he said this came at a price – literally – as most of the machines we investors observed on the factory floor were imported from Italy, Germany, Japan, Taiwan and elsewhere.

“Because capital expenditure for production machinery takes up such a large portion of our budget, we help to make up for this by running our factories 24 hours a day, seven days a week, with the only real lull coming once a year when we shut down for a week during the Chinese New Year,” Mr. Zhu said.

Not only did this help to get a true return on investment from the equipment purchases, but it was necessary from a market point of view due to the robust orders Boamax boasted.

“Our downstream orders from clients are very strong, and we expect that to continue. And fortunately for us, we have a broad list of clients, therefore avoiding any overreliance on any one customer or sector.

“But at the end of the day, we have to be very fast and highly maneuverable in order to satisfy all our clients. In this sector, economy of scale is highly important because cost controls can make or break you.”

This is why Boamax practiced a delicate balance between contract and spot sales for its main raw material – steel – as well as for copper and aluminum.

As for finding customers, it wasn't a problem for Boamax.

“We’ve been seeing huge market demand, especially for our finished products like ATMs, medical equipment and solar assemblies. We’ve gotten there reputation wise. If you have a good enough reputation, customers will come knocking on your door so we don’t have the need to spend much at all on any A&P campaign,” Mr. Zhu added.

But being too popular can bring pressures of a different kind.

“Our biggest headache right now is limited production capacity. Sudden major orders can cause us some difficulty because of this. Although we realize that a well-run, limited-scale plant is more efficient and easier to manage, if you want to expand your order and customer base, you have to grow. Therefore, we expect land purchases to be one of our biggest expenses this year.

“This will allow us to grow our sales by at least 20% in 2012.”

The General Manager added that the company was also keen on moving even further up the technology chain with more automation, and this meant less reliance on good old-fashioned human labor.

“However, as most of our products are custom-made, characterized by order-based specifications in small quantities, we will always have a need for manpower.”

See also:

SUZHOU BOAMAX: Touched By Billions Worldwide

Any key advantages that the Company has?