Photo: Aries Consulting

VST HOLDINGS, one of the top three IT product distributors in the region, saw its 2011 revenue surge by nearly a quarter to 32.6 billion hkd, producing a bottom line increase of 20% to 488 million hkd.

This resulted in a 26% surge in its share price Friday.

And despite the slowdowns overseas, the twin calamities last year afflicting both Japan and Thailand, and the strong likelihood of slower GDP growth in Mainland China down the road, VST Holdings still managed to push up its gross margins to 4.6% last year from 4.4% in 2010.

“The year 2011 has been challenging. We had the earthquake and tsunami in Japan and the floods in Thailand resulting in supply chain disruptions to the electronics industry. We also have had uncertainty surrounding the Eurozone debt crisis.

“Despite these challenges, the Group has continued to grow its business and strengthen its relationships with vendors, customers and bankers. We have continued to widen our product range, enlarge our distribution network and improve our operational efficiency,” said VST Chairman and CEO Li Jialin.

The Hong Kong-listed firm says its broad product diversification and client spread has ‘IT’ very optimistic going forward.

Last year, distribution commission from HP products constituted 28% of VST’s revenue, with Apple and its hot selling iPad 2 leading the charge to take second place for VST at 13% of top line contribution.

“The iPad 3 has already been released in Hong Kong and Singapore and later this year we expect its much-anticipated market introduction in the PRC. The iPads are far and away the main driver of our Apple family sales. However, iPad sales come with a twist, as while per-unit margins are not so high, but return on assets for this product category is very lucrative,” said VST CFO William Ong.

Founded in 1991 and listed in Hong Kong in 2002, Hong Kong-based VST counts among its major clients globally recognizable names in the IT field as HP, Apple, Seagate, AMD, Intel, Western Digital, Lenovo, Dell, IBM, Acer, Microsoft, Oracle, Cisco and a host of other providers of desktops, laptops, tablets, hard drives, CPUs, storage devices, printers, scanners and the whole IT gamut.

VST has over 25,000 active channel partners serving a wide regional customer base and has 53 offices in six countries: Mainland China, Singapore, Indonesia, Thailand, Malaysia and The Philippines.

“We have the product range and experienced staff to meet any and all challenges or market transformations,” Mr. Ong added.

The robust 2011 performance was spurred on by increased sales of tablets, desktops, notebooks, CPUs and hard disks, the company said.

Chairman Li said that despite VST’s recent successes, there was still plenty of room for improvement.

“There is huge existing market potential for new, innovative products and we already have our growth drivers in place.

"As our current product distribution lineup has a relatively small market share overall, there is huge upside growth potential.”

Mr. Li said that 2011 was all about finding the products that would meet with enthusiastic customer response and hitching the company’s wagon to them during their wave of popularity.

“We achieved another set of excellent results last year mainly due to leveraging on a diversified product range and a strong distribution network.

"In the end, we further improved our product range and expanded our distribution channels in the Asia Pacifiic.”

Photo: Aries Consulting

He added that the group businesses have also extended from distribution of IT products for the commercial and consumer markets to the provision of system tools for IT infrastructure, training, maintenance and support services.”

Looking ahead, Mr. Li said: “The economic uncertainty and supply chain disruptions will continue to impact spending on technology products in the coming months.

"However, we expect the usage of IT products will continue to penetrate all the markets in which we have operations, resulting in steady continuous growth over the long run.”

Photo: Aries Consulting

Despite being the world’s most populous country, the globe’s biggest online population at over 500 million souls, and owner of one of the fastest recent economic growth records worldwide, Mainland China still had a largely untapped IT products landscape.

“”Market penetration of computers in Mainland China is still low with tremendous potential for growth. VST plans to continue to strengthen its foothold in the Mainland China market, capitalizing on our expanding product mix, our comprehensive sales network and our dynamic marketing strategy.”

Pursuant to this expansion strategy, he said VST was currently in talks with Mainland China’s largest electronics retailer – Hong Kong-listed Gome Electronics – on possible cooperation going forward.

“With good growth in 2011, we have also consolidated our foundation in our Southeast Asian markets. And with our experienced management team, we will continue to look for opportunities to work with world famous IT suppliers and continue to expand our product mix and sales channels so as to achieve excellent results.

“We are confident in overcoming the challenges ahead and will strive to extend our best efforts to maximize returns for our shareholders,” Mr. Li added.

But for those expecting VST to blindly expand for the sake of expansion alone will be somewhat disappointed, as the firm was committed to conducting due diligence and market research before throwing its hat into a new ring.

“We won’t rush into any new markets, The six countries we operate in now are doing well and are quite lucrative. That being said, if we do discover any promising new opportunities elsewhere, we will explore them fully yet judiciously,” said CFO Mr. Ong.

See also:

VST Holdings: IPads, China Market Propel 1H Sales

MING FAI Gets ‘Buy’ On Retail; TIANYI ‘Positive’ On Strong Earnings

JUICED UP: CHINA TIANYI Crushing Peers In PRC Orange Juice Market

DUKANG: 2Q2012 Net Profit Up A Whopping 55% At Rmb 94.4m

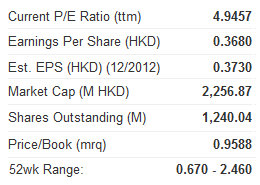

Compared to most stocks, this stock has outperformed the market.

Worth a second look.