Translated by Andrew Vanburen from: 單靠宏觀分析 隨時捉錯用神 (中文翻譯, 請閱讀下面)

KEYHOLE INVESTORS -- those with a single-minded focus on a particular economic indicator like exchange rates, inflation or GDP, or an ill-advised allegiance to a favorite analyst’s advice -- are usually left behind in the dust heap by more resourceful and dynamic-thinking market players.

One favored strategy is to attentively follow each and every quarterly, interim and annual report a target company issues – preferably by attending such events in the flesh, or to bet the farm on the rise of fall of a particular currency.

But in this day and age of diversified retail portfolios, it is virtually impossible to give adequate attention to the leading listcos under scrutiny or pay requisite heed to any given greensheet or its more seasoned equivalents.

Let me throw out an anecdote backed by recent reality.

A colleague of mine recently attended an economic brainstorming session whose sole topic was how to determine the true and fair exchange rate of the euro – made even more scintillating these days by the chronic falling from grace of several members of the European Union (EU).

Speakers prepared quantitative analysis from the standpoints of full, long, medium and short-term positions, as well as comprehensive analyses, further categorized by the purchasing power of assets, country-specific economic growth, domestic inflation, respective debt crises – and finally got around to debating what the actual fair-value of the euro should be today.

The meat of the matter was finally broached after around an hour: the consensus was that due to the on the ground situation in Europe with several EU members facing default, the euro should by all rights be around 30% weaker versus the greenback than it currently is.

After all, with the "PIGS" (Portugal, Ireland, Greece and Spain) already sending jitters throughout the EU with their sovereign debt crises, recent news that Italy is on the brink of bankruptcy not only ruins the neat acronym, but also brings the EUs third biggest economy onto the danger list and strengthens the argument for a weaker currency.

Eloquent Inaction

Although rare in practice, economists and analysts can be of one mind on any range of issues affecting markets or regional economies.

But even if there is 100% consensus on any given issue, that does not mean governments – or companies – will actually act in accordance with the educated counsel and advice of the financial experts.

At the end of the day, governments (at least the democratic ones) usually need to collective nod of the majority – and listed firms require the approval of key shareholders -- to implement far-reaching changes, even if economists and analysts all insist that such measures are necessary for the very survival of the country or company.

Oftentimes a key stumbling block to action on the ground is that economist and analysts are often full of ideas on what needs to be done, but at the same time they provide scant solutions on how things can be accomplished.

In other words, they can point to a destination and say: “That’s where this country/economy/sector/company needs to be”... but they fail to provide a roadmap on how one might get there.

However, the dynamic at play here serves as a built in regulator which prevents a form of insider trading on a large scale.

Think of it...

If countries/governments/sectors/enterprises immediately put into practice the resolutions and recommendations of economic powwows and academic conferences, what would be the most obvious result?

I can tell you that if the European Central Bank were to have immediately adopted our conclusion that the euro was 30% overvalued against the US dollar, then I would be the first to wager dollars to donuts that everyone in the conference hall would rush out to the nearest bank or ATM and immediately convert all their cash to greenbacks.

And then, the next day, they would be able to buy 30% more euros with their holdings.

This obviously cannot be tolerated and we economic conference junkies need to find a way to be satisfied with being beacons for financial progress rather than the actual levers that direct it.

For these very same reasons, investors should not put all their eggs in any one basket.

Shareholders who bet the family silver on the expected rise and fall of a particular currency against another are more than likely to be dining with plastic forks sooner than later.

Best to leave such speculation to the pros.

That’s what God made short-sellers for, right?

See also:

Counting The Costs Of Living In SHENZHEN

ALEX WONG: Don’t Blame The Shorts

單靠宏觀分析 隨時捉錯用神

搜集資訊,輔助操作,除了業績發布,還有同業論壇。同事去了一場經濟研究會,講題是歐元匯價。

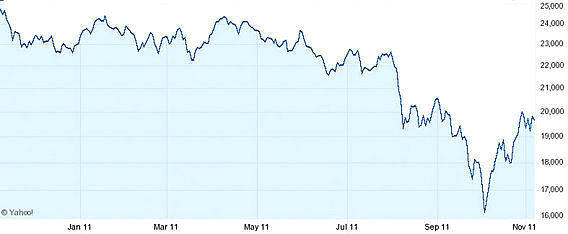

講者準備相當充分,將長、中、短線因素,全面分析,由購買力評價、經濟增長、通脹,一直講到歐豬債務危機。架構完整,推論也合理,一小時縱論全局,算係咁。結論是歐元兌美金,應該比現時貶值三成。

未抵終點已輸死

經濟學家的分析時框,動輒以年計,是否正確,有待時日驗證。但最大問題是,就算百分百肯定正確,都難以執行。因為分析不論幾準,最多只能告知目的地,卻沒提供路線圖。假如當天聽講後,急急下注沽歐元,結果會是極速被挾,期貨由1.39直殺至1.42,一張輸幾萬銀,即日被搞掂。即使目標正確,都抵受不了中途跌蕩,倉位捱不到終點。情況就像想行路去北歐,知道方向,帶齊禦寒裝備,卻不知中途原來要經戈壁沙漠,當然熱死渴死收場。

分析不能提供路線,主因是能影響一項資產的因素,實在太多,而且會不停推陳出新。至於各項因素反映的時序,沒有一定規律,數據甚至落後於資產價格走勢。財經專家費雪(Ken Fisher,股神二號師父Philip Fisher孻仔),在其著作《大揭穿》(Debunkery)中,就闡明以經濟數據,尤其是單一因素,對捕捉股市走勢,並無幫助。例如傳統智慧認為,失業率升不利股市,在二○○八年確是如此,但美國失業率升幅最勁的一年是二○○九,也是近年股市最亮麗一年。

據費雪研究,股市領先經濟、失業率落後經濟,是一直以來的常態,因為一般企業,非到萬不得已,不會裁人;一旦落手後,便盡量攤派工作,提升生產力,直至生意再破頂,先會考慮加回。更搞笑的一點,是失業率的分子,是待業人數,即有意搵工而未成功。當景氣恢復,肯重新上路的人數增加,反而會令失業率上升。所以如果要等失業率跌,先入市買股,要等到二○一○年次季,啱啱好撞正上一次歐債危機揭幕,一買即捱。若一心認定失業率續升,年內逆勢造淡,損傷更大。捉錯用神,比沒有分析,衰多二錢重。

使用刪除法投資

一個普及的經濟指標,已足以弄至雞毛鴨血;全盤宏觀分析,途中可能出現的變數、波動更多。那麼是否一切長線分析,都要棄而不用?也許不必,可以從下列方法着手:方法之一,是用很小的注碼,或用期權去執行,以保證可以抵受波動,及大幅出錯時限制損失。方法之二,是將這類宏觀分析,改為配合刪除法使用。一般人的直覺,是將分析結果,用最直接的方法執行,用回上例,看淡歐元便沽空歐元。但這種直線對撼,往往大生大死,極難駕馭。較溫和的做法,是刪除歐元相關資產,不予考慮。當集合不同觀點,刪刪減減,剩下的便是心水組合。如此一樣可受惠於正確分析,卻不用因槓桿對賭,日夜煎熬。

請閱讀: BAOFENG: Aiming To Crystallize New Orders With Swarovski