Translated by Andrew Vanburen from: 現金為王也需止蝕機制 (中文翻譯, 請閱讀下面)

NO ONE would deny that having a few extra twenties in one’s wallet is a comforting feeling.

However, the notion that ‘cash is king’ can sometimes backfire for equity investors if they don’t have a build in stop mechanism, ie: spend like drunken sailors.

Someone with a lot to say on this is Mr. Isaac Sofaer, one of the best eyes in the business on spotting suspicious financial statements and accounting irregularities.

Mr. Sofaer himself has been a weekly contributor to online financial news portal Quamnet for over two years now, and he has recently been holding well-attended investment seminars to which I have been party at times.

His stock picks, from top to bottom, all have one thing in common: they are recommended ‘buys’ for their own intrinsic value and do not fall prey to macroeconomic conditions or negative trends overhanging a particular sector.

In other words, if a particular lender has a stellar balance sheet, strong earnings history and rosy outlook, what the People’s Bank of China decides to do Fridays after markets close does not affect how Mr. Sofaer feels about that particular bank pick.

He put forth an instructive snippet by way of explanation, citing a recent attendee's question.

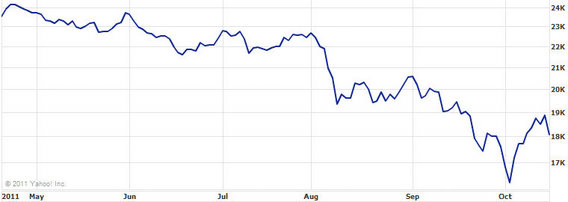

“It is very hard to swim against the current in any facet of life. The background chatter can sometimes be deafening and often drowns out the truth of the object under scrutiny. With the downward spiral in valuations in Europe and the US and the growing clamor for those allegedly responsible for the failures to serve time, does this also mean cash should be shackled as well? Are not plummeting share prices a good time to jump into the market?”

Sofaer replied: “Opportunities come and go, often in the blink of an eye. Cash is indeed king, and I would never stand in the way of someone’s freedom to do with what is rightfully theirs as they deem fit. But before committing, you should ask yourself: ‘Is the crisis at its logical end? And is the price at its natural nadir?'

“Many investors will wait on the sidelines for ages after pulling out, always believing that their patience will pay off as the true bottom is only a trading day away. However, after sitting near the water’s edge watching the daily ebb and flow of the waves, before they know it the high tide is in and they are underwater with no chance to ride out the latest rise safely."

I believe one of the most salient points Sofaer makes is this:

“When a stock is reaching its perceived peak, most people bail out prematurely. So why does this same majority make the same mistake by latching onto a counter before it hits the floor? In fact, there is no such thing as the perfect buy-in time. It is all illusory and situated upon a shifting foundation.”

He adds that there are also no universally applicable litmus tests for determining when is the most ideal buying and selling opportunities, with conditions varying by sector, scale and individual investor characteristics.

And how does this all help investors in the Hong Kong stock market (or any other market, for that matter)?

Perhaps it does less to point to particular picks than it does to help instill discipline in our investing behavior.

Given the financial and budgetary crises enveloping major economies of the world and the subsequent heightened expectations we have for Wall Street, Fleet Street and financial institutions everywhere to show more accurate accounting and market discipline, it is not therefore reasonable to expect individual investors to display more discipline as well?

See also:

Current Bear Market A 'Playground' For Institutional Investors

RIGHT TIME FOR REITS? Hong Kong Beckons...

現金為王也需止蝕機制

(文: 黃國英, 豐盛融資資產管理部董事)

去年本欄寫過,接替東尼的艾薩(Isaac Sofaer),與自己有一面之緣。

近日他舉辦投資課程,同事去了旁聽。艾薩選股,從下而上,主張擇優而買,不必過分被宏觀因素牽引。有一男士,股齡應已不淺,隨即問曰:「不理外圍,恕難苟同。歐洲、美國如此,勢似續跌,豈非應抱牢現金,靜候良機?股價再瀉,估值更低,豈非更加抵買?」

艾薩回答,不失睿智:「再跌機會,不可排除。閣下現金為王,不便阻擋。敢問一句:幾時係底╲抵?邊刻入番市?很多人離場後,一路等等等,到真係見底,仍然不敢出手;之後升番,又嫌唔夠抵,最後都無入番,錯失後續升浪。」艾薩最有point的,是指出:當日見頂,多數人未能抓着;來日見底,為何又有信心捉正?完美捕捉時機,多是虛幻,不若分段買入。

前輩教誨,所言甚是。自己一向認為,所謂「現金為王」,短線有理,長期有害。股市續瀉,連破數關,後美元走強,貴金屬各有死傷,連人仔都瓜埋。此時此刻,難免想全倉盡斬,轉揸港紙,歸家瞓覺。然後每日睇睇大市,跌五百?「!話咗啦!又慳番兩、三巴仙嘞!」升五百?「唓!跌咗咁多,升番少少!咪話我話,轉頭咪又跌過!」如是者,可以hea足一年半載,甚至更久,身家並無寸進,購買力按年遞減,但因數字上無輸,尚可若無其事。

現金非王,卻也不是打鑼打鼓,叫大家現價狂買。市況轉差、方向未明,提升現金水平,保存戰鬥力,算是操作守則。但不等於一有風吹草動,就全線清倉套現。不妨換個角度思考:揸現金,就等於沽空緊閣下想買的股票、想進入的資產類別。很簡單,當你有十盎司黃金,千六蚊盡沽,揸住美金。跌到千四,就可以買十一盎,仲有錢剩;升到千九,想買番十盎,唔該補多三千蚊盎。效果與沽空無異,只是在帳戶中顯示不到,難以感受,而且沽空一定要平倉,揸現金唔買嘢,最多輸通脹,無人會強迫重投市場。

如果認為瞓身沽空,尤其是心儀的資產,是甚為戇居之舉,滿倉現金,亦不遑多讓。一時減低持倉,增加現金,不是問題,但一如沽空,要有「止蝕機制」:幾時「投降」,買回想揸的資產?最好白紙黑字,清楚寫低條件,例如:「中電(0002)、電能(0006),跌到四厘就買」、「黃金,千六蚊樓下,每五十蚊一注」。注意所設目標,不應虛無飄緲:「外圍無事就買」世界咁大,總有某地有壞消息,執意追求絕對安全,即是永不入市。

跌市期間,堅守部分資產,還要逐步買回,捱價在所難免。但將時框拉長,大部分資產類別,包括金股債樓,回報都比現金為佳。追捧港紙,代價不輕。要克服心理障礙,大可將身家用不同的單位計價,例如澳元,自能量化問題何在。

請閱讀:

CHOW SANG SANG, FOCUS MEDIA: Jewelry, Ads Show Recession-Resistant Results