Translated by Andrew Vanburen from 地緣政治因素漸反映,港股短期波幅收窄

Recently, the Hang Seng Index has been captive to the flow of annual reports coming out of boardrooms. Other than that, the major drivers – up or down – have been the Japan earthquake, the ongoing recovery in the West, the political turmoil sweeping across North Africa and the Mideast and ongoing financial and monetary adjustments in the PRC.

We all see the daily, heart-wrenching images from Japan and wish the nation a speedy return to something resembling “normalcy.” As for the tragedy, it of course had an immediate impact on shares, with the Nikkei losing over 10% one day but recovering a huge chunk the next. In short, it is simply too soon to know the long-term effects of the calamity there on regional stock markets, including Hong Kong.

As for the “Western recovery,” every year brings a slightly brighter picture to the art show, and has helped the Hong Kong capital markets in measurable terms. And as for central bank action (or inaction) in mainland China, following the just-completed legislative session A shares have moved decidedly rangebound which has trickled across the de facto border and provide support to the Hang Seng.

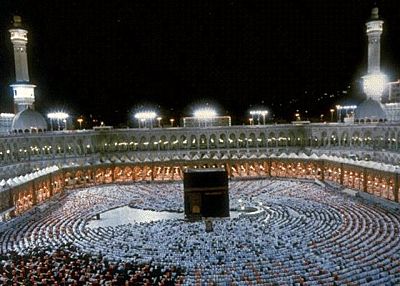

But more destabilizing is the turmoil embroiling formerly autocratic regimes in North Africa and the Mideast. But only time will tell if the most strategically-sound regime in the region in the eyes of Washington – Saudi Arabia – will withstand the regional pressure and hold fast to the sands of time by resisting the democratic (or populist) wave sweeping across the Muslim states and fiefdoms.

Anything other than the status quo would seriously disrupt the supply mill of the world’s biggest petroleum exporter and endanger the economic and strategic position of the US in the region. The CBOE Volatility Index is especially susceptible to instability in these resource-rich regions.

With global attention now shifted to the calamity in Japan, it seems Libya’s civil conflict is being put on the back page, which is just what the autocracy in Tripoli wants.

And of course, while all eyes may be on Japan, all ears are on any noise that may be coming out of Beijing in the form of more interest rate hikes or related credit controls.

As for Hong Kong’s capital markets, volatility has been more the name of the game, with 10% weekly moves in either direction for individual shares quite commonplace. But staking a position doesn’t necessarily mean even the so-called “experts” are on solid footing and know their next moves.

The Hang Seng jumped 300 points in a single week recently, but gave up all 300 the following Wednesday, much like a day on the rollercoaster.

But taking all of that week into account, the benchmark index didn’t fluctuate all that much when looking at the five-day trend. In fact, the 600-point movement either way didn’t equal recent fluctuations in their extremes, so “relative stability” was the name of the game.

One sector worth keeping an eye on is technology.

Recently, the tech sub-index hit a 12-month high.

Among the sub-index’s listcos, Tencent Holdings Ltd (HK: 700), China’s top social networking portal, had the most noteworthy performance, making this chat provider something to chitchat about.

See also: HONG KONG Stocks To Test 22,400 In Feb Amid Mideast Instability