AFTER AN EXCEPTIONAL 1Q growth boosted by the success of its M&A strategy, Changjiang Fertilizer posted top line growth of 25.0% year-on-year to Rmb 143.1 million in 2Q2011.

Revenues grew due to the following reasons:

1.) Additional contribution from the two plants in Xiangyin County and Hanshou County acquired last year

2.) Increase in average selling prices (ASP) on the back of inflation in China

3.) Higher sales volume for all products except ammonia solution

Ammonia demand was affected by a severe drought in Hunan province in May 2011 followed by flash floods in June 2011. The natural disasters destroyed farmland and caused a slowdown in fertilizer demand in May and Jun.

"The extreme weather conditions have impacted on the demand of our products especially our nitrogenous fertilizers and ammonia solution which are used by the farmers.

”Also, our expansion plan may be delayed because of the current tight financing environment,” cautioned CFO Joel Leong during an investor briefing yesterday.

Finance expenses increased by 20.1% to Rmb 1.5 million due to higher levels of borrowings but gearing remains low at 15.6%.

Net earnings rose 16.7% to Rmb 29.5 million.

Power shortage and inflation

As the dam water is insufficient to generate electricity, Joel is expecting a power shortage in the coming months, which will affect capacity utilization in 3Q.

To address this, Changjiang intends to time its regular shut down of plant maintenance works with the halt in electrical supply.

He also expects coal prices to increase in the near term, but margins will be sustainable as price increases can be passed on the customers.

Below is a summary of questions raised by investors at the briefing and Joel’s replies.

Q: How did your ASPs do for Jul and Aug?

Prices are sustaining.

Q: What was the average cost of coal during the quarter?

About Rmb 750 per ton.

Q: Is methanol segment making gross profits?

We are making a little money but the drop in oil price may affect methanol prices negatively.

Q: Why did accounts receivables go up more than proportionately to sales?

Trade receivables are comparable to last year’s levels. Advances to suppliers more than doubled, however, because we wanted to secure coal supplies. We are foreseeing a significant increase in coal prices. Secondly, electricity supply consumes coal, so we are also competing with power plants for coal. Even though power plants do not use the coal dust that we use, coal prices move in tandem to each other. Q: Is there a sufficient market in Hunan for supply of coal dust?

Q: Is there a sufficient market in Hunan for supply of coal dust?

Yes, there is an abundance of coal dust in Hunan. Even XLX is converting to the use of coal dust as it is the cheapest form of coal [for our purposes].

Q: Why did electricity costs go up?

Now we have 3 plants fully operational. Last year, we only had our original plant plus a second plant that had been in operation for one and a half months.

Q: What was utilization rate in 2Q?

About 60% to 70%. Production decreased because of the flood.

Q: If utilization went down, why did ASP go up given the spare capacity?

Fertilizer is a commodity product. Rises in coal prices can be passed on to customers, but methanol prices are very closely related to oil price.

Q: When you have a 5% coal price increase, what will be the product price increase?

Coal comprises about two-thirds of our cost of sales. The corresponding increase in product prices will be less than 5%, maybe around 3%.

Q: Can you shut down the methanol facility or consume it as an energy source?

No

Q: How extensive was the electricity rationing?

The whole province was affected.

Q: What is your dividend policy?

There will be no dividend payout this year and the next as we need funds for expansion and tax planning.

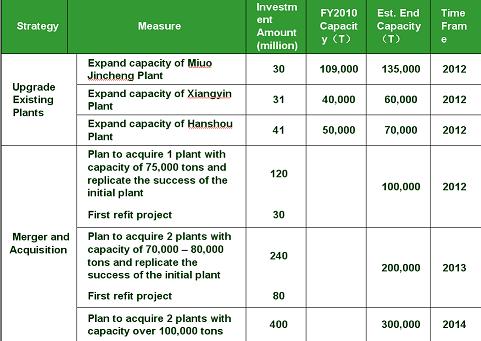

Related story: CJ FERTILIZER Visit: Aggressive Expansion, Strong 1Q, Weak P/E... What Gives?