NITROGENOUS FERTILIZER manufacturer, Changjiang Fertilizer has posted strong 1Q2011 earnings growth, thanks to the success of its M&A strategy.

1Q11 revenues grew 112.5% year-on-year to Rmb 168.0 million. Net profit grew 158.5% to Rmb 46.3 million.

Gross margins improved 4.4 percentage points to 33.3%, and net margins were 27.5%, an improvement of 4.9 percentage points.

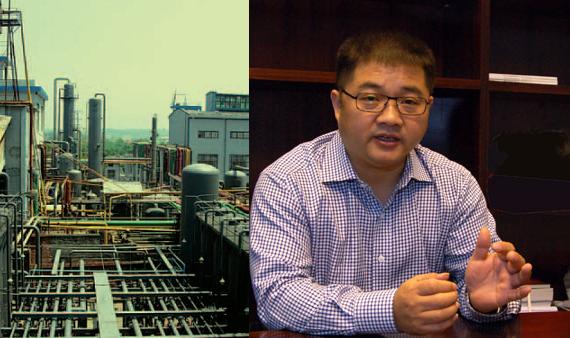

”We are very happy with the two fertilizer factories we acquired last year,” said executive chairman Zhu Chengbao in an exclusive interview with NextInsight.

He also noted that Changjiang, which is in the southern Chinese province of Hunan, was not affected by the recent severe drought in North China.

Economies of scale are very important for fertilizer manufacturers, and can make a few percentage points of difference in margins.

Margins started improving during 3Q2010, about half a year after it acquired its second plant in Xiangyin county and increased capacity by close to 40%.

Economies of scale kick in when a fertilizer manufacturer uses close to 300,000 tons of coal a year.

Changjiang Fertilizer used 101,532 tons of coal during 1Q2011, up 120.8% from 45,990 tons in 1Q2010.

At this scale, the cost of coal can be cheaper for Changjiang than for the smaller players by Rmb 10 to Rmb 20 per ton.

Coal makes up about 60% of cost of goods sold for Changjiang. However, inflation has resulted in the company’s average purchase price for this feedstock rising by 24.3% year-on-year to Rmb 685 per ton.

Mr Zhu hopes to acquire another one or two more plants this year, but will only embark on this after ensuring that its latest acquisitions are fully integrated.

|

|||||||||||||

Acquisitions cost only 40% of what it would take to build a new facility of similar capacity and take no more than half a year to complete, compared to up to 2 years for a new-build, he said.

His plan for the next 3 years is to have about 10 operating plants or a total annual capacity for 1.5 million tons of ammonia.

At such a scale, Changjiang Fertilizer will be able to capture the entire Hunan market, compared to only 20% currently.

”M&A is a low-risk strategy for rapid expansion. We are acquiring technology and customers, not debt,” said Mr Zhu.

Related story: CHANGJIANG FERTILIZER: 138% Leap In 4Q Profit On Capacity Expansion