AS THE Greek debt crisis faded from the headlines last week, stocks made gains - tentative - in many global markets and Singapore.

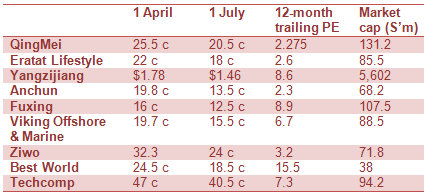

Still, there are many stocks which are currently way below the levels they were at just three months ago, as the table above indicates.

Are these bargains worth picking up now? You decide.

A spate of accounting scandals at S-chips (such as China Gaoxian and China Milk) has seriously undermined investor confidence in China companies.

And there are still significant risks to global stock markets arising from the eurozone debt crisis and America's own humongous debt.

Progressive steps to resolving such matters could send stocks flying -- but then again, there could be other crisis yet to erupt, such as the Middle East.

And there are market-damaging events that truly cannot be foretold until they break out (think the triple Japanese disasters of tsunami, earthquake and nuclear radiation leaks)

Anyway, for what it is worth, the stocks in the table are among those that have been the subjects of discussion in the NextInsight forum, so this compilation should be of particular interest to NextInsight readers.

Please trawl through our forum for the postings on these stocks by investors such as MacGyver, greenrookie, observer2, yeh, Joes and ethan999.

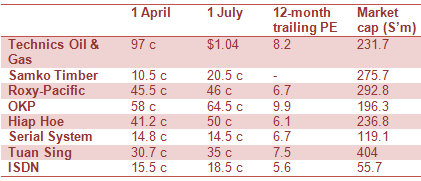

On the other hand, some stocks have demonstrated resilience and even strength in the face of the recent market downturn that was triggered by the Greek debt crisis, as the table above shows.

Again, these stocks are among those that have been the subject of discussion in the NextInsight forum.

Interestingly, note that these are non-S-chips.

They have not been associated with the S-chip sector where investors have lost confidence in their financial statements.

In recent months, the key culprits among S-chips whose accounts have been determined to be in grave shape were China Gaoxian and China Milk Products.

So, indeed, there are great S-chips with lots of market potential that other players are eyeing... and there are rotten apples like Gaoxian.