Excerpts from latest analyst reports….

CIMB sets 74-cent target for HU AN CABLE stock

Copper demand in China to double in 10 years? In an interview with Bloomberg, Chairman of Hu An Cable, Mr Dai Zhixiang, said that he expects copper demand from China’s cable makers, the biggest user in the world’s largest market, to more than double over the next 10 years as people move into cities and as power grids expand.

Mr Dai forecasts that the industry’s demand may increase by 10-15% per year over the next 10 years.

BUY Hu An Cable as an inexpensive proxy to ride on China’s booming copper demand: We see at least three good reasons to own the stock:

(i) its cables and wires, and copper businesses provide exposure to rising copper demand in China,

(ii) company has a strong earnings growth history (FY07-FY10: 3-yrs CAGR of 41%), which we expect will continue over our forecasted period (forecasted FY10-FY13: 3-yrs CAGR of 34%),

(iii) last but not least, its valuation is undemanding at 4.5x CY11 P/E (2.9x CY12 P/E). Our target price of S$0.74 implies a further upside of 106%.

Company recently proposed a 3-for-10 bonus share issue to encouraging better trading liquidity which is pending approval. Suppose the bonus issue goes ahead, our target price would be adjusted to S$0.57.

Recent story: HU AN CABLE: Rides on booming power sector and grows 1Q2011 revenues 71% to Rmb 607.9 million

CIMB raises MENCAST target price to 70 cents

Analyst: Gary Ng

What happened? Mencast has entered into a sale and purchase agreement to acquire a local marine maintenance, repair and overhaul (Marine MRO) company, Top Great group.

What we think. We see this acquisition (1) complimentary to Mencast’s business with added global exposure. Top Great Group serves a large group of customers in the environment, marine and oil & gas sectors from many countries, some of which include Singapore, Malaysia, Indonesia and the Middle East.

(2) This is also an accretive acquisition and will quantum-leap the usual profit Mencast used to see. The unaudited profit before income tax of the Top Great Group was S$4.7m in FY2010 with S$10.6m net asset value.

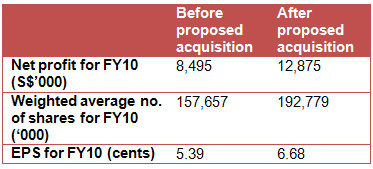

The positive EPS impact on Mencast is clear to see (table on the right).

What you should do. This stock is only at the growth stage, and has not scaled the high wall of valuation (peers trading at in excess of 10x CY12 P/E). It will climb, and a further re-rating will propel the multiples further with an upgrade to mainboard from its current board (Mencast has been listed on Catalist for almost three years now).

Earnings and target price upgrade; Maintain BUY. Taking into consideration of the new shares dilution, FY11-13 EPS are adjusted down by between - 3.6% to -9.6%.

Target price, however, got lifted to S$0.70 (from S$0.66), pegged at 9x CY12 (from 8x previously), or around 15% discount to bigger peers, as we deem fit to review the multiple with such accretive M&A. Target price offers a 60% upside from current level.

Recent story: MENCAST: After record 2010 profit, will there be encore in 2011?

DnB Nor reiterates its ‘buy’ call on JAYA HOLDINGS

DnB Nor has reacted positively to Jaya Holdings’ Q3 FY 2011 results as its net earnings came in at SGD44m versus its forecast of SGD3m, largely driven by gains on the disposal of vessels of SGD31.6m.

Given Jaya's yard business model of building vessels for sale (instead of building on third party contracts), the pricing trend of vessels is an important assessment of its fundamentals, wrote analysts Kay Lim and Thor Andre Lunder.

The selling price of vessels forms the key valuation driver of Jaya.

“Jaya is priced at an attractive discount to NAV on its vessels, offering high margin of safety for investors. In our view, it is the yard to own in an investment cycle that is trending up, as the yard can enjoy the upside potential from higher vessel prices,” wrote the analysts.

Recent story: KEVIN SCULLY: 'Hold on to Jaya shares as they are undervalued....."

UOB Kay Hian unfazed by insider selling of EPICENTRE

Analyst: Tan Jun Da

We reiterate our BUY recommendation and target price of S$1.01 (unchanged), representing a whopping 75.7% upside from the current price.

Our valuation is based on a target PEG of 0.55x, and we derive our target price by applying a 11.8x PE multiple to FY12F EPS of 8.6 cents, using our projected 2-year EPS CAGR (FY11F-13F) of 21.5%.

Epicentre is currently trading at FY11F and FY12F PE of 5.7x and 6.7x respectively, a steep discount to its peer average trailing PE of 11.0x.

We see deep value at current price levels, which may be unlocked through two potential share price catalysts: a) strong 2H11 earnings and b) progress on Chinese expansion.

Recent story: EPICENTRE: Stock price has doubled year-to-date

Comments

Resilient but not cheongsters.

The stock price will have a hard time shooting up in the near term as the SS still holds a big chunk.