Excerpts from S&P analyst report…

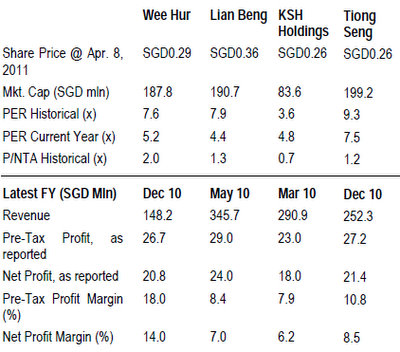

S&P initiates coverage of WEE HUR, expects 74% jump in net profit this year

Analyst: Seu Yee Lau

Looking ahead into 2011 and 2012, the recognition of strong sales take-up of the Harvest@Woodland industrial project is expected to be a major boost to the group’s earnings.

In addition, construction projects such as Trilight (SGD128.7 mln), JCube (SGD103.6 mln) and HDB lift upgrading (SGD47.9 mln) are expected to gain momentum and hit key billing milestones.

We have projected average gross margins to hover around 23% in 2011 and 2012 (FY10:23.1%). Although cost pressure from the foreign workers’ levy increase and higher material prices are expected to erode gross margins, larger contribution from the higher margin property division particularly the industrial segment will help cushion the impact.

With the above assumptions, we estimate net profit to increase by 74% to SGD36.2 mln in 2011 on the back of stronger property earnings particularly from its Harvest@Woodlands project (95% sold to-date).

The key construction projects which were still in their early stages of work in 2010 (and hence lower recognition of revenue) are expected to start contributing meaningfully in 2011 and 2012. Thereafter, we have projected net profit to increase by 2% to SGD36.8 mln in FY12.

Report on readers' visit: WEE HUR: 'We are riding on Singapore's construction boom'

Daiwa rates HYFLUX a 'buy' and raises target price to $2.40

Daiwa Capital Markets said it believed Hyflux’s share price reached an inflection point on 7 March 2011, when the company won an S$890m Tuaspring desalination contract from the Singapore Government.

“We expect its share price to continue to rise as sentiment improves with new contract wins,” wrote Daiwa analyst Chris Sanda.

Daiwa has revised up its 2011 and 2012 net profit forecasts by 30.8% and 61.8% respectively, and raised its six-month target price to S$2.40 from S$2.03 previously.

It is equivalent to PERs of 23.7x for 2011 and 17.5x for 2012 based on Dawai’s EPS forecasts.

Daiwa believes the key potential share price catalysts should be further contract wins. Its 2012 net-profit forecast is 9.2% higher than that of the Bloomberg consensus.

Excerpts from CIMB report...

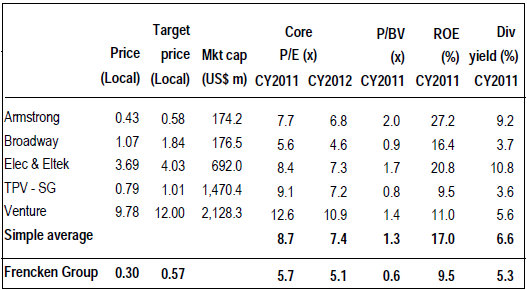

CIMB initiates coverage of FRENCKEN with 55-c target price

Global semiconductor industry expected to grow, albeit slower. Although 2011 will still exhibit growth, we will not see a repeat of the broad expansionary phase seen in 2010 which had been flattered by the low base in 2009. Chip sales have already been experiencing weakness since Oct and Nov marked the second straight month of a decline in chip sales.

With seasonal patterns now back in play, we do not anticipate a lift-off for chip sales until the seasonally stronger 3Q and 4Q. Most market researchers are also expecting a softer landing following a runaway 2010 and have forecast lower growth rates of 5-11% for 2011.

Riding the medical upswing. With more hospitals being built in Asia, there has been a surge in demand for sophisticated medical equipment and their compact versions for smaller outfits. Frencken has started commercial production of several new medical products.

Initiate coverage with BUY and target price of S$0.55. We have a target price of S$0.55 based on parity to CY11 NTA per share. Attractive dividend yields of 5.3% to 6.8% will limit share price downside.