Excerpts of latest analyst reports…..

DMG & Partners maintains ‘buy’ call on Thomson Medical, and 88-cent target price

Analysts: Lynette Tan and Terence Wong, CFA.

Thomson Medical’s 3QFY10 earnings rose 38.7% YoY to S$4.8m, even as revenue grew 25.4% YoY to S$21.8m. The increased number of baby deliveries and better operating efficiencies boosted earnings growth.

Growth is continually expected to be supported by its clinics and specialised centres, as the Group continues to expand the scope of its services for women and children. It remainson the lookout for strategic partnerships in the region, particularly Malaysia, to grow its business. We roll forward our earnings valuation and our TP of S$0.88 (previously S$0.78) is based on 16x FY11 (previously FY10) earnings. While other healthcare peers (ex-Parkway) are trading ~21x forward P/E, Thomson Medical is trading at 15x. Maintain BUY.

Expect patient load and utilisation to continue to rise, as two senior O&G consultants recently commenced clinic operations at Thomson Medical. Management is also planning to expand its network of Thomson Women’s Clinic (TWC), which would be a growth driver for the Group. The TWC would support patient referrals to the hospital, which would in turn contribute to growth.Similarly, its Thomson Paediatric Centre and its Thomson Women’s Cancer Centre would also help drive patient referrals to its hospital. Management remains committed to expanding its network of specialised centres to grow.

Focus is not just on Singapore. Besides its two Vietnam hospital projects,Thomson Medical is also currently looking to expand into Malaysia.Management’s strategy for overseas growth has always been to start off with strategic partnerships with overseas healthcare partners.

Maintain BUY. Thomson Medical is currently trading at 15x forward P/E, whichis ~30% lower than its peers (~21x P/E). While some may view Thomson Medical’s operations as smaller and more focused compared to peers, we are of the view that the niche operations makes it more stable. We believe it should trade at a smaller discount to peers. Hence, our TP of S$0.88 is based on 16x FY11 earnings.

Recent story: THOMSON MEDICAL: Lively Q&A with investors

OSK-DMG initiates coverage of China Minzhong with a $1.68 target price

Analysts: Tan Han Meng, CFA, CPA, and Terence Wong, CFA

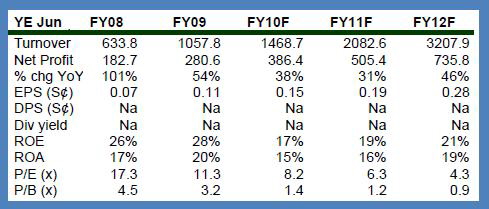

38% CAGR over 2009-12F; Initiate with BUY. Originated as a state-owned enterprise in 1971, China Minzhong (MINZ) is a “National Leading Dragon Head Enterprise”, a status for top 500 PRC agriculture leaders selected to spearhead the modernisation of China agriculture system. MINZ is an integrated vegetable processor with >40% market share for China export of champignon mushroom, capsicums and German chives.

Strong overseas demand has helped to lift net profit by an average of 80% over the past two years. We project 38% net profit CAGR from 2009-12F on cultivation area increase, higher value product mix shift and general food inflation.

Trading at an undemanding 6.3x P/E for financial year ending Jun 11, we believe valuation will improve as an increasingly attractive agriculture thesis precedes concerns over post-moratorium share overhang. Initiate with BUY, at TP of S$1.68, representing 40% upside potential.

Agriculture – an increasingly attractive thesis. Recent investments by global private equity funds into China agriculture sector highlight what we believe is the start of the next global investment theme that will be positive for MINZ. China is the world's top producer of vegetable with 575m tonnes, or 55% of global output in 2008. It is also the world's 4th largest vegetable exporter with 7% market share. Export grew at 14% CAGR from 2005-08 and is expected to continue its growth momentum on the back of increasing global vegetable consumption.

Sustainable growth with new cultivation area. Access to new farmland is important to MINZ‟s business model. We estimate that MINZ‟s revenue increase is largely driven by cultivation area expansion and yield improvement. Annual addition of 30,000 mu in cultivation area and new contribution from organic farming by FY12 will help to sustain revenue growth over the next three years.

Key risks. Cultivation area acquisition delays, talent and management resources constraints, natural disasters, international trade barriers and land rights disputes.