Photo of Mr Yeo by Leong Chan Teik

THOMSON MEDICAL’S FY2010 results briefing this afternoon was attended by about 40 analysts, fund managers and institutional traders after the leading private healthcare provider for women and children posted a 27.8% surge in net profit to S$16.3 million for its financial year to 31 Aug.

Revenues grew 21.2% to S$81.7 million, while gross margins improved by 0.5 of a percentage point to 43.7%. Net margins improved by one percentage point to 19.9%.

A final tax-exempt cash dividend of 2.0 cents per share was proposed. Adding this to the 1.2-cent interim dividend, 57.8% of FY2010 earnings will be paid out. There will also be a 1-for-10 bonus issue.

"We are excited over the number of deliveries," said CEO Allan Yeo as he explained how bed utilization was increased.

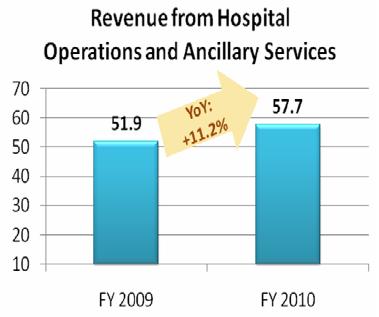

A rise in number of patient referrals (up 4.2%), increase in deliveries to 9,268 babies (up 4.1%) and strong growth in diagnostic imaging services, parent craft services and other ancillary services helped its Hospital Operations and Ancillary Services segment to grow 11.2% to S$57.7 million (70.6% of Group revenue).

Revenue from Specialised and Other Services surged 54.7% to S$24.0 million, thanks to 8 months of contribution from Thomson Paediatric Centre, full year contribution from Thomson Women Cancer Centre (TWCC) and continued growth in patient load and revenue from our network of clinics under Thomson Women Clinics (TWC).

Cash reserves were up 48% at S$30.5 million. Bank borrowings were halved (down 48%) to S$1.4 million, bringing gearing ratio to less than 1%.

The group maintained its net cash position and generated S$22.2 million of operating cash flow, up 15.7%.

Total equity rose to S$142.1 million from S$111.3 million. Net asset value per share rose 27.2% to 48.48 cents per share.

Expansion in Vietnam

Thomson’s Hanh Phuc International Women and Children Hospital at the Binh Duong province in Vietnam will have its soft opening next month, when it receives the hospital license in mid Nov.

It will also commence operations for a satellite clinic at Saigon Trade Centre on 1 Nov to build a network for referral of medical cases to the Hanh Phuc hospital.

”We are evaluating potential sites for 2nd hospital in Hanoi and also at opening a pediatric eye center and childcare center,” said Mr Yeo.

Below is a summary of questions raised by investors at the briefing and Mr Yeo’s replies.

Q: What is your current stake in the Vietnam hospital?

We don’t have a stake in the Vietnam hospital currently. We are booking consultancy fees as soon as the operations begin. For the first year, it will be a retainer plus a percentage of gross profit.

We have an option buy up to 25% in the Han Phuc hospital within the first 3 years of its operations at founders’ price.

Q: Will you transfer the option?

No. Our agreement with the owner requires him to buy stake at market value if he wants us to exit.

Q: When do you expect the Hanh Phuc hospital to break-even?

About 2 to 3 years.

Q: Please elaborate on your regional expansion plans

We signed an exclusive consultancy deal with Hanh Phuc for 3 hospitals in Vietnam. I think India has good potential; people have approached us. We want to ensure the consultancy agreement mirrors our Vietnam deal.

Q: Will you consider expanding to Johor?

We have also been approached to take stakes in other hospital groups, but we don’t want to take stakes in uncompleted hospitals because of uncertainty arising from political power changes. We will only consider completed hospitals.

Q: How do Parkway’s new hospitals at Novena and Farrer Park affect you?

Parkway's hospitals in Novena and Farrer will complement us. They are not doing obstetrics and gynecology and can refer customers to us.

Q: How do you see the growth in pediatric clinics and Thomson Women Cancer Centre specialized services in the next 2 to 3 years?

I saw a huge potential as our pediatric clinics are packed everyday. A competitor clinic nearby is relatively empty because their doctors are young and new. We only have senior consultants and above.

I'm looking for senior doctors, especially pediatricians, to come in. If I catch the patients at outpatient level, I will catch them at inpatient level.

Thirdly, most pediatric services are basically general medical practice. There is a huge market for behavioral medicine.

For Thomson Women Cancer Centre, our anchor tenant is Professor Tay (a renowned gynecologist). The other two doctors have full-time practices elsewhere. When we are able to have full-time breast cancer and colorectal tenant doctors, their referral to Thomson will also increase.

Q: What is your capex for coming year?

About S$5 million to S$6 million.

Recent story: THOMSON MEDICAL: Lively Q&A With Investors