May 25-31 edition.

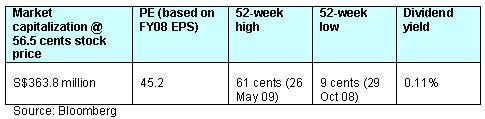

THE COVER STORY of this week’s edition of The Edge focused on Ezion, a company whose stock has zoomed up from 11 cents in March (yes, two months ago) to 56.5 cents yesterday.

That's one sizzling move, which has lifted its PE to 45X!

The market is rekindling its hot affair with the stock which was a darling in 2007 before things cooled off as oil prices plunged.

In The Edge's article, veteran writer Goola Warden highlighted a recent Ezion joint venture as a breakthrough for the company.

The joint venture has secured an A$350 million ($392 million) contract to supply marine vessels for at least three years to Chevron Corp, which is involved in the development of Australia’s Gorgon gas fields.

“That’s a big deal for Ezion, which reported revenue of only $14.6 million in 1Q2009,” according to The Edge.

Located off the northwest coast of Australia, Gorgon is said to be the world’s single-largest known gas resource, holding as much as US$165 billion ($241 billion) worth of natural gas at current prices.

Chevron owns a 50% stake in the concession and is managing its development. Its partners are ExxonMobil and Royal Dutch Shell.

Ezion is partnering Australia-listed Skilled Group and Hong Kong-listed Pacific Basin Shipping on the project.

The A$350 million contract should commence in 4Q, Ezion says in a statement, and it should have “a positive material impact” on its earnings next year.

The Edge's article, giving the history of the company, said Ezion was a failing electrical wire maker called Nylect Technology a little more than two years ago.

Ezion CEO Chew Thiam Keng was MD of KS Energy Services, a company in the offshore services business that had been sold to Indonesian tycoon Kris Wiluan.

In November 2006, Chew bought a controlling interest in Nylect for $8 million. Among those who invested in Chew’s dream was his ex-boss Tan Kim Seng, the former chairman and controlling shareholder of KS Energy.

Then there was Ezra Holdings, whose founder Lee Kian Soo is now chairman of Ezion.

Others: Roland Ng, managing director of crane owner and operator Tat Hong Holdings; and Tan Boy Tee, the then-controlling shareholder and chairman of shipbuilder Labroy Marine.

Today, Ezion’s largest shareholders are Chew (27.7%) and Ezra (15.5%). Others include several funds such as Legg Mason (8%); Stichting Pensioenfonds (6.5%); and Colonial First State (6.1%).

Last year, Ezion reported a 130% rise in revenue to $31.1 million, and a 100% rise in earnings to $8 million. The PE ratio of Ezion is a whopping 45X and dividend yield a virtually non-existent 0.11% (see table below).

In 1Q2009, revenue was up 211% to $14.6 million, while net earnings climbed 182% to $3.3 million.

There's much more meat in The Edge's article which you can find out from the newsstands or online.