- Posts: 6

- Thank you received: 0

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

GOLDEN AGRI-RESOURCES LTD IS DEEP LY UNDERVALUED AT SGD 0.37 !!!!

- financialanalyst18

- Topic Author

- Offline

- New Member

-

Less

More

10 years 7 months ago #22347

by financialanalyst18

GOLDEN AGRI-RESOURCES LTD IS DEEP LY UNDERVALUED AT SGD 0.37 !!!!

FROM THE WALL STREET JOURNAL:

TOTAL SHARES OUSTANDING AS 22/7/2015 12.84B

FROM BLOOMBERG BUSINESS:

TOTAL SHARES OUSTANDING AS 22/7/2015 12.735B

TOTAL TANGIBLE ASSETS **: USD $ 8,967,276,000

NTA = USD $ 8,967,276,000 /12.84B= USD 0.698 = SGD 0.95 (WSJ)

OR

NTA = USD $ 8,967,276,000 /12.735B= USD 0.704 = SGD 0.96 (BLOOMBERG)

Current stock price as 22/7/2015: SGD 0.370 (61% huge discount compare to NTA)

**NTA (net tangible assets) is described as the total assets of a company, excluding intangible assets (such as goodwill, trademarks and patents) minus total liabilities. NTA/share is relevant because it helps you judge whether a share price is over or under valued.

Formula: NTA = total assets - total liabilities - intangible assets

Formula: NTA/share = net tangible assets ÷ number of shares on issue

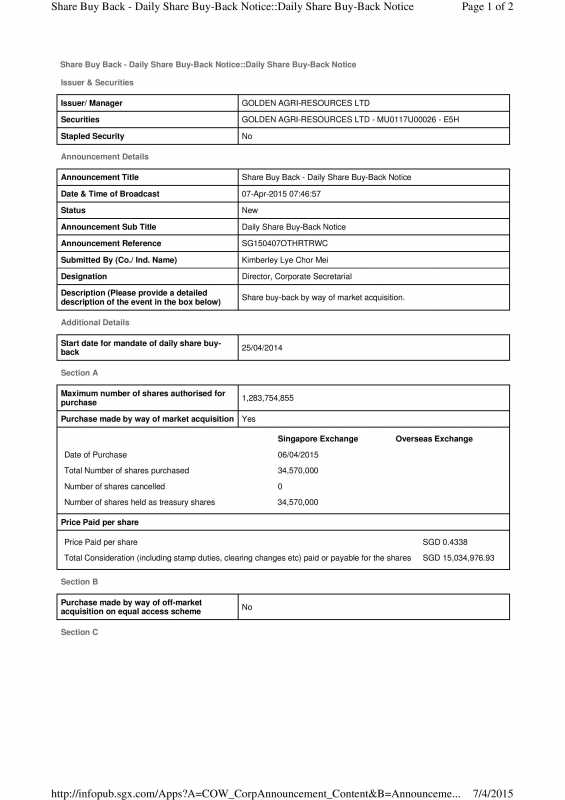

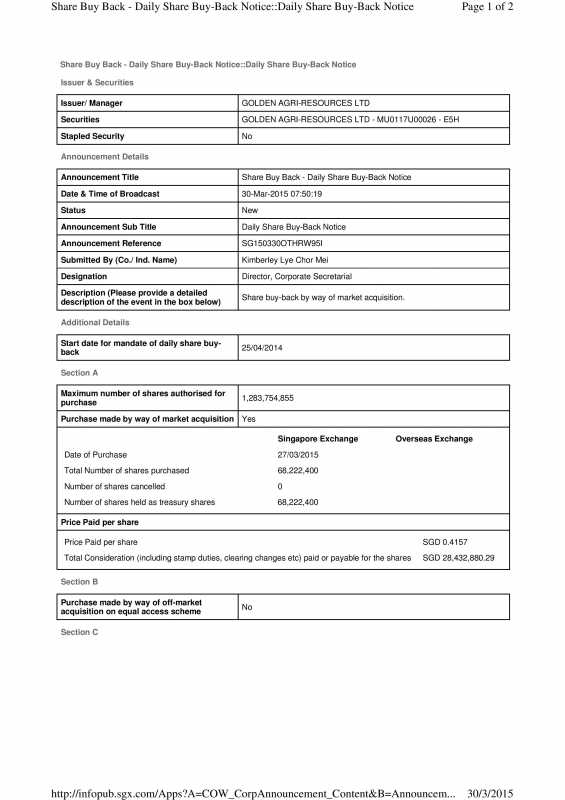

Golden Agri-Resources (GAR) has been accumulating their own shares start from March 2015, average purchase price is SGD 0.4157 & 0.4338. Number of treasury shares held after purchase 102,792,400. Number of issued shares excluding treasury shares12,734,756,156 (12.7348B).

Total Consideration (including stamp duties, clearing changes etc) paid or payable for the shares from March to April 2015 SGD 43,467,857.22. BUYING BACK OWN SHARES shows GAR has strong confident with their future progress and they know that the current stock price is DEEPLY UNDERVALUED!!! Please refer to the following share buy-back notice from GAR.

FROM THE WALL STREET JOURNAL:

TOTAL SHARES OUSTANDING AS 22/7/2015 12.84B

FROM BLOOMBERG BUSINESS:

TOTAL SHARES OUSTANDING AS 22/7/2015 12.735B

TOTAL TANGIBLE ASSETS **: USD $ 8,967,276,000

NTA = USD $ 8,967,276,000 /12.84B= USD 0.698 = SGD 0.95 (WSJ)

OR

NTA = USD $ 8,967,276,000 /12.735B= USD 0.704 = SGD 0.96 (BLOOMBERG)

Current stock price as 22/7/2015: SGD 0.370 (61% huge discount compare to NTA)

**NTA (net tangible assets) is described as the total assets of a company, excluding intangible assets (such as goodwill, trademarks and patents) minus total liabilities. NTA/share is relevant because it helps you judge whether a share price is over or under valued.

Formula: NTA = total assets - total liabilities - intangible assets

Formula: NTA/share = net tangible assets ÷ number of shares on issue

Golden Agri-Resources (GAR) has been accumulating their own shares start from March 2015, average purchase price is SGD 0.4157 & 0.4338. Number of treasury shares held after purchase 102,792,400. Number of issued shares excluding treasury shares12,734,756,156 (12.7348B).

Total Consideration (including stamp duties, clearing changes etc) paid or payable for the shares from March to April 2015 SGD 43,467,857.22. BUYING BACK OWN SHARES shows GAR has strong confident with their future progress and they know that the current stock price is DEEPLY UNDERVALUED!!! Please refer to the following share buy-back notice from GAR.

Please Log in to join the conversation.

- financialanalyst18

- Topic Author

- Offline

- New Member

-

Less

More

- Posts: 6

- Thank you received: 0

10 years 7 months ago #22348

by financialanalyst18

Replied by financialanalyst18 on topic GOLDEN AGRI-RESOURCES LTD IS DEEP LY UNDERVALUED AT SGD 0.37 !!!!

Palm oil, which is the main business of Golden Agri-Resources (SGX: E5H), is something that is always in demand. That is unlikely to change any time soon. We use it in food stuffs, we use it in our personal-care products and we also use palm oil as a source of bio-fuels.

A healthy product demand could pique the interest of Warren Buffett. But how do the fundamentals of the company stack up?

Buffett likes companies with low earnings volatility. That is not one of GAR’s key attributes, though. Over the last ten years, operating income has been as high as S$1.1b and dipped as low as S$197m. Net Income has been all over the shop, too. At the moment, the trailing twelve month bottom-line profit is below the long-term average of S$950m.

Interestingly, GAR’s gross margins are reasonably stable. Even though palm-oil producers are price-takers rather than price-makers, GAR’s gross margins come in at between 20% and 30%. However, the Net Income Margin can be erratic.

Efficiency is one of the hallmarks of GAR. Its Asset Turnover 0.5 implies the company generates around S$0.50 for every dollar of asset employed in the business. Peers First Resources (SGX: EB5) and Indofood Agri-Resources (SGX: 5JS) generate S$0.34 and S$0.37 for every dollar of asset employed, respectively.

First Resources is not heavily leveraged. While the S$6.6b company does carry net debt of S$2.8b, borrowings are small in comparison to shareholder equity of S$10.9b. Its Leverage Ratio of 1.6 is slightly below the market average of 1. 7. The shares are not especially volatile, either. The volatility of 22% is only slightly above the market median.

Palm oil producers are not exactly the flavour-of-the-month right now. That could help explain Golden Agri-Resources’ low price-to-book ratio. At S$0.51, the company is valued at a 40% discount to its Net Assets. That might just interest Buffett, especially when there is a thrice-covered historic dividend yield of 2% on offer.

A healthy product demand could pique the interest of Warren Buffett. But how do the fundamentals of the company stack up?

Buffett likes companies with low earnings volatility. That is not one of GAR’s key attributes, though. Over the last ten years, operating income has been as high as S$1.1b and dipped as low as S$197m. Net Income has been all over the shop, too. At the moment, the trailing twelve month bottom-line profit is below the long-term average of S$950m.

Interestingly, GAR’s gross margins are reasonably stable. Even though palm-oil producers are price-takers rather than price-makers, GAR’s gross margins come in at between 20% and 30%. However, the Net Income Margin can be erratic.

Efficiency is one of the hallmarks of GAR. Its Asset Turnover 0.5 implies the company generates around S$0.50 for every dollar of asset employed in the business. Peers First Resources (SGX: EB5) and Indofood Agri-Resources (SGX: 5JS) generate S$0.34 and S$0.37 for every dollar of asset employed, respectively.

First Resources is not heavily leveraged. While the S$6.6b company does carry net debt of S$2.8b, borrowings are small in comparison to shareholder equity of S$10.9b. Its Leverage Ratio of 1.6 is slightly below the market average of 1. 7. The shares are not especially volatile, either. The volatility of 22% is only slightly above the market median.

Palm oil producers are not exactly the flavour-of-the-month right now. That could help explain Golden Agri-Resources’ low price-to-book ratio. At S$0.51, the company is valued at a 40% discount to its Net Assets. That might just interest Buffett, especially when there is a thrice-covered historic dividend yield of 2% on offer.

Please Log in to join the conversation.

- financialanalyst18

- Topic Author

- Offline

- New Member

-

Less

More

- Posts: 6

- Thank you received: 0

10 years 7 months ago #22350

by financialanalyst18

Replied by financialanalyst18 on topic GOLDEN AGRI-RESOURCES LTD IS DEEP LY UNDERVALUED AT SGD 0.37 !!!!

Golden Agri-Resources raised to " buy" , target lifted to 60 cents by OSK DMG

Date: 03/07/2015

Price Target : 0.60

Price Call : BUY

SINGAPORE (July 3): OSK DMG has upgraded Golden Agri-Resources to " buy" from " neutral" , saying the palm oil producer is expected to turn in stronger earnings in the quarters ahead.

Its oilseeds business turned profitable in 4Q2014, marking the second straight quarter of improvement, while its biodiesel business could get a boost from Indonesia' s plans to shore up the biodiesel sector, OSK DMG said.

Golden Agri-Resources manages nearly half a million hectares of oil palm plantations in Indonesia. It has evolved to become one of the industry&rsquo s largest palm oil producing companies. The company owns 161 oil palm estates, with total planted area amounting to 472,800 hectares and the average age profile notching at 14 years. Roughly 75% of the estates are at prime age, which offers a solid foundation for growth in the foreseeable future. As at the end of 2014, the firm generates more than 80% of its total revenue from the palm and laurics segment, with the rest primarily coming from the plantation and palm oil mills segment, and the oilseeds segment.

Chief executive officer Franky Widjaja stressed that the industry' s long term fundamentals remain firm.

" While there may be resistance from the current large soybean production and low crude oil prices, slower crude palm oil output growth and the biodiesel policy in Indonesia bode well for future prices.

" Moreover, we view that global demand of palm oil both for food and non-food continues to be strong, especially in developing countries," Mr Widjaja said.

Date: 03/07/2015

Price Target : 0.60

Price Call : BUY

SINGAPORE (July 3): OSK DMG has upgraded Golden Agri-Resources to " buy" from " neutral" , saying the palm oil producer is expected to turn in stronger earnings in the quarters ahead.

Its oilseeds business turned profitable in 4Q2014, marking the second straight quarter of improvement, while its biodiesel business could get a boost from Indonesia' s plans to shore up the biodiesel sector, OSK DMG said.

Golden Agri-Resources manages nearly half a million hectares of oil palm plantations in Indonesia. It has evolved to become one of the industry&rsquo s largest palm oil producing companies. The company owns 161 oil palm estates, with total planted area amounting to 472,800 hectares and the average age profile notching at 14 years. Roughly 75% of the estates are at prime age, which offers a solid foundation for growth in the foreseeable future. As at the end of 2014, the firm generates more than 80% of its total revenue from the palm and laurics segment, with the rest primarily coming from the plantation and palm oil mills segment, and the oilseeds segment.

Chief executive officer Franky Widjaja stressed that the industry' s long term fundamentals remain firm.

" While there may be resistance from the current large soybean production and low crude oil prices, slower crude palm oil output growth and the biodiesel policy in Indonesia bode well for future prices.

" Moreover, we view that global demand of palm oil both for food and non-food continues to be strong, especially in developing countries," Mr Widjaja said.

Please Log in to join the conversation.

Time to create page: 0.207 seconds