Credit Suisse analyst: Gerald Wong, CFA

|

|

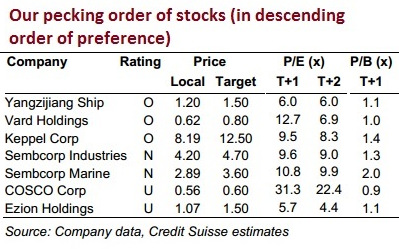

Yangzijiang our preferred pick; Ezion and Cosco least preferred

Yangzijiang our preferred pick; Ezion and Cosco least preferredWith few positive sector drivers, we maintain our UNDERWEIGHT stance on the sector. We are cautious on stocks trading significantly above book value, including Sembcorp Marine (NEUTRAL) and Ezion (UNDERPERFORM).

Our preference is for Yangzijiang due to limited oil and gas exposure. We expect Yangzijiang to benefit from ongoing consolidation in the Chinese shipbuilding sector and win a disproportionate share of new orders.

At the same time, the key overhang for the stock in the past few years has been its investments in financial assets in China, but we expect that to be gradually reduced with the company’s plans to exit from non-core businesses. Valuation is attractive with a P/B of about 1.1x, close to its historical trough.

At the same time, the key overhang for the stock in the past few years has been its investments in financial assets in China, but we expect that to be gradually reduced with the company’s plans to exit from non-core businesses. Valuation is attractive with a P/B of about 1.1x, close to its historical trough.

Recent story: YANGZIJIANG's outlook 2015: Buy, target $1.44, says UBS