CFO Yap Soon Yong at Yongmao's crane manufacturing facility in Fushun, Liaoning in China. NextInsight file photoIT'S RARE that CFOs make the top 20 shareholders' list of the companies they work for.

CFO Yap Soon Yong at Yongmao's crane manufacturing facility in Fushun, Liaoning in China. NextInsight file photoIT'S RARE that CFOs make the top 20 shareholders' list of the companies they work for.

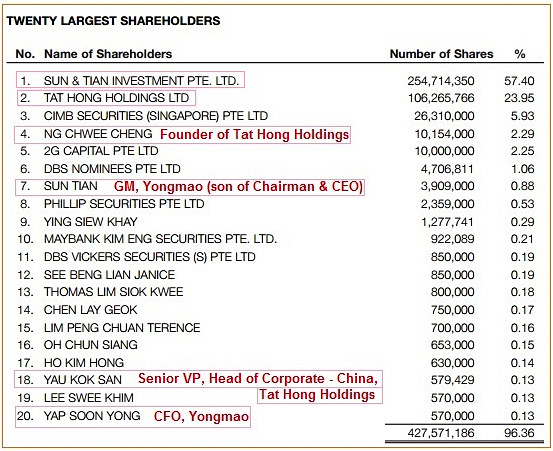

Yap Soon Yong has done so in the just-released annual report FY2014 (ended March 2014) of Yongmao Holdings, which manufactures cranes in China and sells to the world.

Adding to that distinction is the fact that he's a Singaporean, who joined Yongmao in 2007, and his investment is in an S-chip.

Mr Yap is listed at No.20 with 570,000 shares.

It's not known if he bought some shares in between the publication of annual reports for FY2013 and for FY2014.

He may have appeared on the Top 20 list because the cut-off in absolute shareholding has dropped this time.

The cut-off for No.20 in the annual report 2013 was 579,429 shares.

Though the current market value of Mr Yap's holding is about $119,700 (stock price: 21 cents), his investment can be seen as a strong vote of confidence in Yongmao.

The company's two biggest shareholders are Singapore-listed crane rental company Tat Hong Holdings, which is No. 2 after Sun & Tian Investment, the vehicle of the Chairman and CEO.

The top two shareholders' combined stake is 81.35% -- which is unusually high for a listco. There is even a business tie-up between the two: Yongmao and Tat Hong are joint owners of a tower crane leasing business in China.

This business is set to grow as more contractors find that leasing a crane is more advantageous than owning one. Revenue of this business grew to RMB 482m in FY 14 from RMB 418 m in the previous year.

Then there is Singapore investment firm 2G Capital in No.5 spot.

At No.18 is Mr Yau Kok San, Tat Hong's Senior Vice President, Head of Corporate - China.

His shareholding of 579,429 didn't change between annual report (AR) 2013 & AR 2014.

Mr Yau was No.20 in AR2013.

These shareholders would have been pleased with the 130.4% year-on-year increase in Yongmao's net profit attributable to shareholders of RMB51.3 million for FY 2014. A final dividend of 0.5 cent a share has been proposed. (Details here)

Yongmao's AGM will be held on July 21 at its Singapore office in Ubi Ave 4.  Notes in red by NextInsight. Source: Annual report FY2014.

Notes in red by NextInsight. Source: Annual report FY2014.

Recent story: YONGMAO: Why it dominates tower crane industry