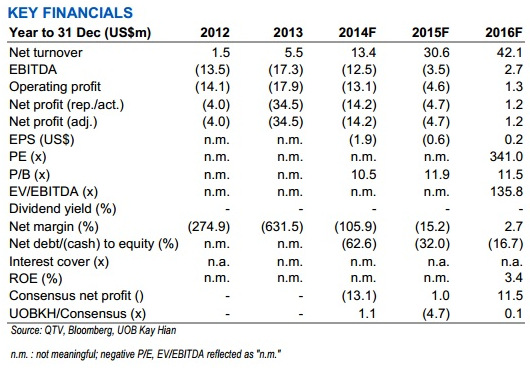

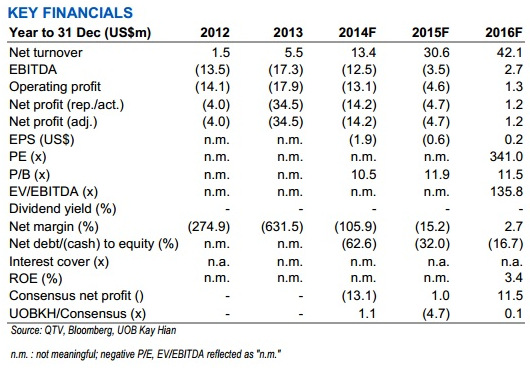

Excerpts from analysts' reportsUOB Kay Hian raises target price of QT Vascular from 51 cents to 60 cents Analyst:

Analyst: Andrea Isabel Co, CFA

(right)WHAT’S NEW

• QT Vascular (QTV) received FDA 510(k) clearance to market its Chocolate PTCA balloon catheter in the US on 4 Jun 14, ahead of our expectation of Oct 14. We re-looked at our estimates and valuation methodology after the positive surprise.

STOCK IMPACT

• Early approval of coronary Chocolate demonstrates management’s ability to execute. We note that the FDA clearance was secured ahead of our 4Q14 expectation and this makes the group well-poised to launch a marketing campaign in the US for its coronary portfolio towards the end of this year. This is the second coronary device for the group, the first one being its FDA-approved Glider PTCA balloon catheter.

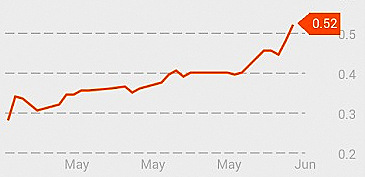

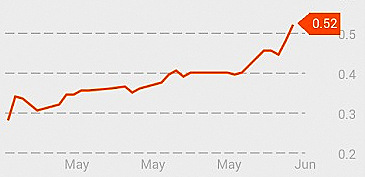

Since its listing on Catalist at 28 cents in April 2014, QT Vascular stock has proven to be a market darling:

Since its listing on Catalist at 28 cents in April 2014, QT Vascular stock has proven to be a market darling:

Chart: Bloomberg• Chocolate PTCA to provide access to the bigger heart-disease market. The Chocolate PTCA serves to treat coronary artery disease (CAD), the most common type of heart disease and is one of the three most costly diseases according to the American Heart Association. It is the leading cause of death in the US in both men and women.

We estimate the market size for devices that treat CAD to be more than double the market for peripheral vascular devices (US$4.8b), providing another source of upside for QTV.

• QTV to handle direct sales of Chocolate PTCA in the US to ensure proper marketing of its new device. While this could limit the potential revenue contribution in the short term, we note that this is in line with management’s strategy of initially targeting key opinion leaders and major medical centres to establish credible support from the medical industry for its device.

In the medium to longer term, we do not rule out the possibility of Cordis (J&J) eventually taking over distribution and expanding the device’s market reach both within and outside the US.

Recent story: QT VASCULAR -- target 64 c; YANGZIJIANG -- $1.55

|

CIMB lowers target for HanKore on higher-than-expected cost of acquisition of CEI

Analysts: Roy Chen & Gary Ng

What Happened

China Everbright's water assets have been injected into HanKore for RMB5.8 billion. Photo: CompanyThe HanKore-CEI deal went through, at a price of Rmb5.8bn (S$1.2bn), a premium over two valuers’ valuations of Rmb5.4bn and Rmb5.6bn, respectively. This translates to 2.24x trailing P/BV or 27.3x CY13 P/E. China Everbright's water assets have been injected into HanKore for RMB5.8 billion. Photo: CompanyThe HanKore-CEI deal went through, at a price of Rmb5.8bn (S$1.2bn), a premium over two valuers’ valuations of Rmb5.4bn and Rmb5.6bn, respectively. This translates to 2.24x trailing P/BV or 27.3x CY13 P/E.

Some 1.94bn new shares will be issued to CEI. After the deal, CEI will hold c.79.2% of HanKore's enlarged issued capital.

What We Think

The purchase price not in favour of HanKore. While we acknowledge a number of positive factors from the deal, including the expected much lower interest cost and strong SOE backing, we think the economic surplus from the deal has been more or less fully captured by CEI.

Current share price very demanding. Investors should recognise the limitations of a concession business model and its profitability potential. The IRR of a typical municipal water treatment concession is 8-10%.

Hence, a company must gear up to have higher returns. Even if already optimally geared, HanKore could be worth S$1.15, not far from its current price.

What You Should Do

Reduce, with target price of S$0.91. We do not think we are conservative as our target price has factored in an EPS expansion by 5x in the next 5 years. A decision simply based on industry price multiples is not immune to a possible industry-wise overvaluation. Switch to China Merchants Pacific Holdings (toll road business, similar business model, higher project return).

Recent story: HANKORE -- $1.50 target; CHINA MERCHANTS -- $1.06

|

Analyst: Andrea Isabel Co, CFA (right)

Analyst: Andrea Isabel Co, CFA (right) Since its listing on Catalist at 28 cents in April 2014, QT Vascular stock has proven to be a market darling:

Since its listing on Catalist at 28 cents in April 2014, QT Vascular stock has proven to be a market darling: