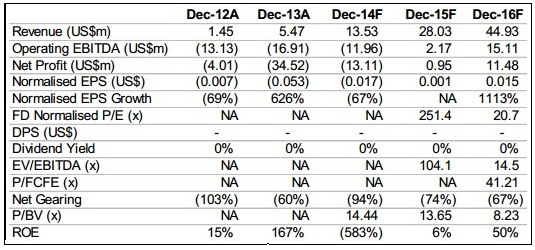

| Excerpts from analysts' reports CIMB starts coverage of QT Vascular as its products gain traction globally  Analyst: Gary Ng (left) Analyst: Gary Ng (left)The story of QT Vascular (QTV) has never been about its turnaround. It is about how a tried-and-tested technology is finding its way back to the physician’s table, after a breakthrough. It is about how one can participate in the growth of an early-stage medical company with a star-studded cast of expert investors. This is the story of QTV! We initiate coverage with an Add rating and target price of S$0.64, based on blended P/Sales, EV/EVITDA, P/E, EV/Sales and DCF valuations. QTV’s outreach may seem aggressive but is certainly not outlandish, in our view, given product adoption globally and exclusive partnerships with reputable distributors. Pipeline creations and staggered approvals are key to transforming this early-stage incubator into a serious contender in the global vascular market, leading to maiden profits and potential M&As with medical giants.  |

|

Vascular market reshaped The exit of the-then drug-eluting stent market leader, Johnson & Johnson in 2011, and China’s Shandong Weigao in 2012 offers insights into how physicians and patients are re-thinking the use of invasive treatments for vascular disease. The successful penetration of its flagship Chocolate balloon in the US and GliderXtreme in Japan speaks volumes about QTV’s innovation and success in re-shaping a plain-vanilla minimally-invasive vascular device. Billion-dollar question Already equipped with FDA-approved peripheral artery products, the company’s next game changer lies in a penetration of the US$8bn worldwide coronary disease treatment market. In our opinion, various geographical approvals for coronary balloon catheters will bring QTV’s growth trajectory to the next level. Playing the money game Globally, QTV has forged distribution agreements with renowned distributors (Century Medical, Weigao and Cordis) to distribute its products. This is important, as a previous lack of scale and networks has been addressed, paving the way for an eventual lowering of distribution costs and a widening catchment of global hospitals/physicians. Schemes of distribution agreements are instrumental in helping QTV lower its opex, in our view, possibly turning around its bottom line. Recent story: ST ENGINEERING -- Target $4.30; QT VASCULAR -- 51 Cents DBS Vickers says Yangzijiang's valuation has fallen to attractive 6X FY14 PE  Analyst: Ho Pei Hwa (left) Analyst: Ho Pei Hwa (left)Mr. Ren dismisses Guoheng’s accusations. Yangzijiang’s share price took a toll following headlines that Mr. Ren is under investigation for misconduct relating to his personal investment in China-listed Tianjin Guoheng Railway Holding (Guoheng). Yangzijiang has released announcement to clarify that the allegations are against Mr Ren and not Yangzijiang. In addition, Mr. Ren has also reassured shareholders that the accusations are unfounded and he is taking necessary actions to set matters straight.  Ren Yuanlin, chairman of Yangzijiang Shipbuilding. Ren Yuanlin, chairman of Yangzijiang Shipbuilding. NextInsight file photoOur take. The selldown on Yangzijiang seems overdone: 1) The allegations were against Mr Ren and have no impact on Yangzijiang’s operations and financials; 2) While sentiment may be hit, it is premature to jump to any conclusions especially with Mr Ren dismissing these allegations; 3) It appears that the motive behind the accusations seem ambiguous as Guoheng’s Board of Directors have resisted Mr Ren’s attempts to reconstitute the Board and restructure Guoheng; and 4) Lastly, based on interactions with Mr Ren over the past 7 years, he has been forthcoming in his guidance and outlook on the company and industry during both good times and the downcycles. In fact, he cautioned investors when the market was overheated during the 2007/08 superboom. Reiterate BUY; TP unchanged at S$1.55. Valuation has fallen to an attractive 6x FY14F PE and 1.0x P/BV following the knee-jerk reaction to the news last Friday, presenting buying opportunities for investors who remain positive on Yangzijiang’s fundamentals. |

Recent story: DBS Vickers: Bullish on YANGZIJIANG, sceptical about COSCO's profitability

Comments

You may have miss out their annoucement on the reply to sgx query on 31 may .

CFS

C.C. Low