5 consecutive years of record profit. Source: FT.ComCHINA AVIATION OIL, which holds the monopoly for importing jet fuel into China, not only flew to record profit levels last year but made it its fifth consecutive year of achieving record profits.

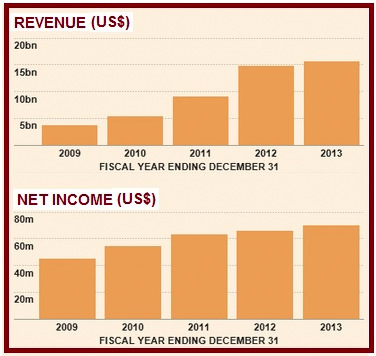

5 consecutive years of record profit. Source: FT.ComCHINA AVIATION OIL, which holds the monopoly for importing jet fuel into China, not only flew to record profit levels last year but made it its fifth consecutive year of achieving record profits.Net profit attributable to shareholders increased 6.1% year-on-year to US$70.2 million while group revenue also hit another record high of US$15.6 billion.

Oddly, the market has not rewarded the company with a record-breaking stock price (see chart below).

In fact, the stock is currently trading at 87.5 cents, a level which is far below its peak in 2010.

The PE is 8.4X on last year's earnings, which does not appear to be expensive at all for a company that not only has achieved rising profitability but has a S$750-million market cap -- sizeable enough to attract fund-buying.

CAO is the largest supplier of jet fuel to the three largest Chinese airlines whose aircraft call at 30 international airports outside China, including locations in Europe, North America, Asia Pacific and Middle East.

CAO proposed a first and final dividend for FY2013 of 2 SG cents a share, or a 2.3% yield on the current stock price. The dividend is unchanged from the year before but it's payable also on the bonus shares (1 bonus share for 5 CAO shares) issued recently.

A recent dampener on investor sentiment could be its 4Q2013 result: Net profit fell 25.7% to US$13.5 million, largely due to a 39% fall in contribution from associates.

For more on the results, see CAO's Powerpoint materials which have been uploaded to the SGX website.

The largest shareholder of CAO is state-owned enterprise China National Aviation Fuel Group Corp, which holds a 51% stake. BP is No.2 with 20%. Chart: FT.com

The largest shareholder of CAO is state-owned enterprise China National Aviation Fuel Group Corp, which holds a 51% stake. BP is No.2 with 20%. Chart: FT.com