OSK-DMG raises target price of Nam Cheong to 48 cents

Analysts: Lee Yue Jer & Jason Saw

NCL reported record core PATMI of MYR193m, up 41% y-o-y, in line with our top-of-street estimate and 7% above consensus. |

Strong results. Nam Cheong (NCL)’s FY13 PATMI was MYR205.6m, including a one-off MYR12.6m tax writeback on deferred tax liabilities provisioned in FY07-12, now no longer necessary.

Nam Cheong Ltd declared a 0.5 cent of ordinary dividend and a 0.5 cent special dividend, thus doubling the dividend from FY12.

File photo

Core PATMI thus surged 41% y-o-y to MYR193m, beating consensus forecast. Shipbuilding margins were 21% in 4Q13, ahead of consensus, which had predicted the margins to fall.

Delivering on “happy dividend” promise. NCL declared 0.5 cent of ordinary dividend and a 0.5 cent special dividend, thus doubling the dividend from FY12 and fulfilling the promise of a “happy dividend” made in 3Q13. Given the strong earnings growth profile, we expect dividend increases over the next few years, bringing the yield to 3.5-4.2%.

FY15 shipbuilding programme above trigger-point, expect a wave of upgrades. The company revealed that its FY15 shipbuilding programme will comprise 35 vessels worth USD700m, up from FY14’s 30 vessels worth USD600m, which is also the consensus forecast.

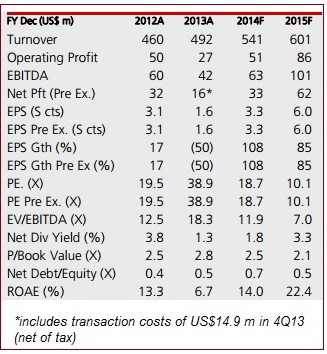

We raise FY14/15F estimates by 7%/16% accordingly, and expect a wave of street upgrades on the new information. Based on this new forecast, we see NCL delivering 34%/22% earnings growth over the next two years and continuing its track record of delivering 25% ROE per year.

Raising TP to SGD0.48; Top Pick with BUY. We continue to like NCL for its: i) strong growth, ii) low valuations, iii) high ROEs, iv) strong order win momentum and orderbook, and v) asset-light strategy and business model. The growing income component of the dividend yield adds another attraction to this stock.

Maintain BUY on the stock, which is one of our Top Picks in the offshore & marine space, with a higher SGD0.48 TP (from SGD0.45) based on a 10x FY14F P/E.

For full report, click here.

Recent story: Chan Kit Whye on ....OXLEY, VALUETRONICS, NAM CHEONG

DBS Vickers keeps Del Monte target at 82 cents

Analyst: Andy Sim, CFA

Integration, cost synergies and focus on growing business. The US$1.675bn acquisition of DMFI was completed on 18 Feb 2014. Going forward, with the consolidation of DMFI, DMPL’s financial year end will be adjusted to April, instead of December. Our current forecast have not factored that in for now.

Management expects higher recurring earnings in 1Q14, but lower non-recurring income due to one-off costs. However, it remains optimistic that earnings will improve in its new FY15 (May’14 to Apr’15) on the potential of the acquisition and intends to focus on cost synergies coupled with growing the business.

Uncertainty of acquisition financing largely over. With the >30% share price correction since late last Oct, we believe this presents a buying opportunity, especially with financing of the acquisition largely firmed up through issuance of bonds and bank financing.

The company still intends to refinance US$530m of bank and shareholder’s loans with preference shares (c.US$350m) and rights issue (>c.US$165m) over the next 4-6 months. The potential fundraising has been indicated previously, and we believe this should have been factored into its current share price.

Recommendation

Maintain BUY, TP: S$0.82. Maintain BUY, TP remains at S$0.82. Key risks to our recommendation are higher interest rates, hiccups in integration and performance of the combined entity, and overhang from potential equity financing.