Photo: Courage MarineCOURAGE MARINE H1 loss narrows to 1.56 mln usd

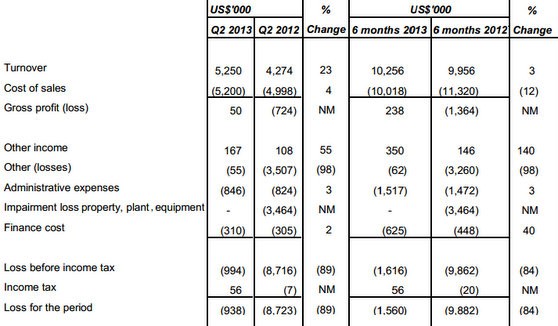

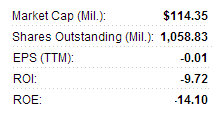

Photo: Courage MarineCOURAGE MARINE H1 loss narrows to 1.56 mln usdCourage Marine Group Ltd (HK: 1145) said its first half revenue rose 3% year-on-year to 10.26 million usd, which helped the bottom line loss narrow to 1.56 million from 9.88 million a year earlier.

Loss per share in the January-June period stood at 0.15 US cents.

No interim dividend was declared.

First half cost of sales decreased by 12% due to the reduction of high fixed overhead costs (i.e. depreciation) as a result of the disposal of certain aging vessels by the Group during the preceding period.

As such, Courage Marine recorded a first half gross profit of approximately 238,000 usd.

“The dry bulk market remains under intense pressure although the BDI has gradually increased from the 700 level in January 2013 to 1,000 currently,” said Courage Marine Chairman Mr. Hsu Chih-Chien.

He added that the dry bulk market remains weak and the BDI, which has a close correlation to freight rates, is still relatively low.

“Low demand of commodities in the Greater China Region and the over-supply of vessels have led to pressure on freight rates in the dry bulk market. The Group remains cautious on the outlook for 2013.”

Courage Marine acquired and took delivery of another vessel in February and the updated tonnage of the Group’s fleet is approximately 410,000 dwt.

Courage recently 1.16 hkd with a 52-week range of 0.25-4.10.Following the replacement of its older vessels, the Group is well placed to operate more efficiently in the event the dry bulk market recovers in full.

Courage recently 1.16 hkd with a 52-week range of 0.25-4.10.Following the replacement of its older vessels, the Group is well placed to operate more efficiently in the event the dry bulk market recovers in full.Last month the Group’s 10% equity interest investment in Singapore-based Santarli Realty Pte Ltd and the Group’s diversification into the property investment business were approved by shareholders at the special general meeting held on July 6.

“In light of the weak dry bulk market, the Group needs and shall continue to adopt a diversification approach in its long-term growth strategy, in order to diversify its income base and reduce its dependence on freight income, with a view to sustaining and enhancing shareholders’ value and returns,” Mr. Hsu added.

Courage Marine said it will maintain its cost-effective structure and focus on keeping its fleet well-deployed and running efficiently and in the meantime continue to identify any other investment opportunities under its diversification approach.

China Print Power listed in Hong Kong in July 2011. From left: Kwan Wing Hang (who just retired), CPP Executive Director; Chan Wai Ming, CPP Executive Director; Sze Chun Lee, CPP CEO & Executive Director, and Lam Shek Kin, CPP Executive Director. Photo: CPPCHINA PRINT POWER H1 loss narrows to 6.82 mln hkd

China Print Power listed in Hong Kong in July 2011. From left: Kwan Wing Hang (who just retired), CPP Executive Director; Chan Wai Ming, CPP Executive Director; Sze Chun Lee, CPP CEO & Executive Director, and Lam Shek Kin, CPP Executive Director. Photo: CPPCHINA PRINT POWER H1 loss narrows to 6.82 mln hkd

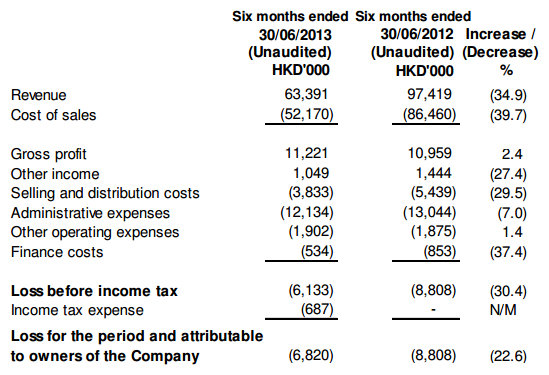

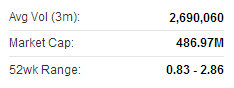

China Print Power Group Ltd (HK: 6828) said its first half revenue fell 34.9% year-on-year to 63.4 million hkd.

But thanks to higher selling prices, the January-June net loss shrank to 6.82 million hkd from 8.81 million a year earlier.

First half gross profit rose 2.39% year-on-year to 11.22 million hkd.

No interim dividend was declared.

“The weaker performance was due to deteriorating sales as a result of gloomy market sentiment. Furthermore, market demand was adversely affected by the Group’s strategic move of selectively increasing average selling prices for certain customers,” said China Print Power Executive Director Mr. Sze Chun Lee.

However, the move did have an upside, contributing to an improved gross profit margin, up to approximately 17.7% in HY2013 from approximately 11.2% in HY2012.

However, narrower income streams along with escalating operating costs led to a net loss for the period.

“The printing industry is undergoing a reshuffle as digital printing becomes a stronger player and e-books are gaining increasing popularity,” Mr. Sze added.

Impacted by fierce competition together with the strategic move of selectively increasing average selling prices, the Group’s core business – the book products segment – posted a drop of 40.1% in revenue to approximately 35.2 million hkd in HY2013 (HY2012: approximately 58.8 million).

Being the major revenue contributor, the book products segment accounted for 55.6% of the Group’s turnover.

“Striving to maintain a leading market position, the Group has devoted continuous efforts to developing business channels to create a more diversified revenue base,” Mr. Sze said.

During the period under review, 44.4% of the Group’s total turnover was contributed by the specialized products segment, totaling approximately 28.2 million hkd (HY2012: approximately 38.7 million), a 27.1% decrease resulting from weaker order intake.

“The first half of 2013 saw chill winds in the printing industry, resulting from the challenging operating environment with Europe experiencing a deeper than expected recession and China lacking momentum to sustain its high growth rate.

“There are also concerns that uncertainties in the US economy might be caused if the government withdraws the accommodative monetary policy. Serving a customer base across Europe, North America and Asia, the Group suffered from such persistent uncertainty in global conditions,” Mr. Sze said.

CPP recently 2.34 hkdProduction costs escalated along with higher labor cost as a result of the structural tightening in the Chinese labor market.

CPP recently 2.34 hkdProduction costs escalated along with higher labor cost as a result of the structural tightening in the Chinese labor market.

Furthermore, the central parity of RMB against US dollar has appreciated 1.73% in the first half of 2013, which not only led to increasing raw material expenses, but also had a considerable impact on export demand.

“To reduce the risk of bad-debt as well as partly offset the operating cost pressure, the Group selectively increased the average selling prices for certain customers, as a strategy targeting a healthy financial position.”

China Print Power is confident in its ability to build loyalty among existing customers by consistently delivering premium products with value-added features, and at the same time attract new ones by conducting active promotion campaigns.

“Keeping in mind the interests of our shareholders, the Group will spare no efforts to continuously explore investment opportunities and take prudent steps to maximize their returns,” Mr. Sze said.

On February 7, 2013, a wholly-owned subsidiary of the Company entered into a non-binding MOU in relation to the proposed acquisition of a wholly-owned subsidiary of New Times Corp Ltd (HK: 166).

Then on July 19, 2013, a wholly-owned subsidiary of the Company entered into a non-binding MOU in relation to the proposed acquisition of certain natural gas assets from Mr. Xiao Gangming, as well as another MOU last month in relation to the proposed acquisition of a wholly-owned subsidiary of New Topic Ltd.

See also:

COURAGE MARINE: Hong Kong Shares Surge Eightfold In Two Days

CHINA PRINT POWER Eyeing Gas Business