China Print Power listed in Hong Kong in July 2011. From left: Kwan Wing Hang (who just retired), CPP Executive Director; Chan Wai Ming, CPP Executive Director; Sze Chun Lee, CPP CEO & Executive Director, and Lam Shek Kin, CPP Executive Director. Photo: CPPCHINA PRINT POWER eyeing gas sector

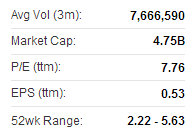

China Print Power listed in Hong Kong in July 2011. From left: Kwan Wing Hang (who just retired), CPP Executive Director; Chan Wai Ming, CPP Executive Director; Sze Chun Lee, CPP CEO & Executive Director, and Lam Shek Kin, CPP Executive Director. Photo: CPPCHINA PRINT POWER eyeing gas sectorChina Print Power Group Ltd (HK: 6828), a printer and manufacturer of a wide variety of products including board books, children’s books, photo albums, journals, planners and calendars, said it is considering the acquisition of natural gas assets in the east and northeast China.

China Print Power and New Topic Corp entered into a memorandum of understanding relating to a possible acquisition of approximately 79% indirect equity interest in Benxi Liaoyou Xinshidai Ranqi Co Ltd in Northeast China’s Liaoning Province.

The proposal has yet to be determined by both parties through negotiations and may be payable by a combination of cash, newly issued ordinary shares of the company, and/or newly issued convertible notes or bonds of the company.

CPP recently 2.39 hkdChina Print Power added it is also mulling the acquisition of natural gas assets in Eastern China’s Shandong Province.

CPP recently 2.39 hkdChina Print Power added it is also mulling the acquisition of natural gas assets in Eastern China’s Shandong Province.The printing firm entered into an MOU with independent third party Xiao Gangming regarding a possible acquisition of certain natural gas assets including a compressed natural gas (CNG) main gas station, a CNG satellite gas station and a liquefied natural gas facility situated in Shandong Province.

Meanwhile, China Print Power has announced that Executive Director Kwan Wing Hang has resigned from his position due to a desire to devote more time to personal goals.

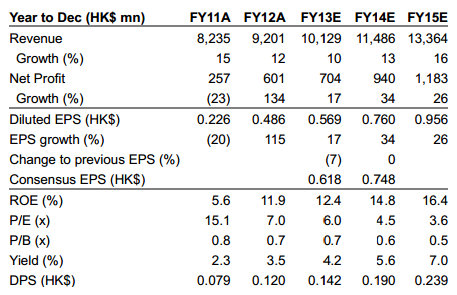

Oriental Patron: ‘Buy’ call kept on JU TENG

Oriental Patron said it is reiterating its “Buy” recommendation on Ju Teng International (HK: 3336), a maker of notebook computer casings with a 30% global market share.

The target price on Ju Teng is 6.10 hkd (recent share price 4.13).

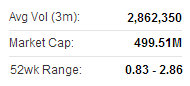

Source: Oriental Patron

Source: Oriental Patron

“Although IDC forecasts a 7.8% y-o-y decline in global notebook shipments in 2013 after a 13.3% drop in 1Q13 and 11.7% drop in 2Q13, we expect Ju Teng’s 1H13 revenue and net profit will likely be flat y-o-y after taking into account the 51 million hkd one-off tax expenses, thanks to increased sales contribution from hybrid casings/metal casings which offset the decline in overall notebook shipments,” Oriental Patron said.

The research house said it believes Ju Teng will be able to carry forward its 2H12 GPM to 1H13 or around 16% given the industry trend of increasing adoption of hybrid casings.

Ju Teng recently 4.13 hkdJu Teng’s share price was corrected by around 32% in a recent 30-day stretch mainly due to market rumors on the decline in revenue and profit due to loss of a key customer and weakness in notebook shipments.

Ju Teng recently 4.13 hkdJu Teng’s share price was corrected by around 32% in a recent 30-day stretch mainly due to market rumors on the decline in revenue and profit due to loss of a key customer and weakness in notebook shipments.

“We think the rumor is unlikely to be true given (1) JT is the market leader in notebook casings with an over 30% global market share, (2) most casing makers are loss-making due to lack of scale and low production yield.”

Oriental Patron added that it believes Ju Teng’s successful penetration into the tablet casing market and robust global tablet demand is able to partially offset the 7.8% decline in global notebook shipments in 2013.

“Margin improvement from increased sales contribution from hybrid casing remains intact and hence we are confident that Ju Teng is likely to deliver mid-teen earnings growth in FY13E.”

On Wednesday, Ju Teng's shares shot up over 4% on unconfirmed rumors that it was in a deal to provide smartphone casings to Motorola.

Guoco maintains ‘Buy’ call on JU TENG

Guoco Research said it is keeping its “Buy” recommendation on Ju Teng (HK: 3336) with a short-term target price of 5.0 hkd (recent share price 4.13).

Ju Teng produces casings for notebook computers and enjoys an over 30% global market share.

“The counter’s relative strength against the Hang Seng Index made a positive breakout recently, signaling a good chance to break out critical resistance at 4.50 hkd,” Guoco said.

The research house’s cut loss on Ju Teng is 3.80 hkd with a consensus 2013 PE of 6.68x and a consensus target price of 6.05 hkd.

See also:

CHINA PRINT POWER Boosts Sales