China Print Powers Up 2011 Revenue 28%

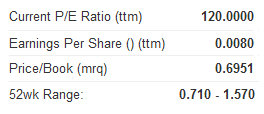

China Print Power Group Ltd (HK: 6828) boosted its 2011 revenue by nearly 28% to 257.86 million hkd.

The Hong Kong-listed firm is a printer and manufacturer of a wide variety of products including board books, photo albums, journals, planners, calendars, and non-book items, such as packing boxes, box sets, greeting cards, pop up cards and card sets.

In addition, it offers various integrated services comprising pre-press, printing, and finishing/binding services, as well as the sale of paper, leather, and related stationery products; and provision of custom-made and value-added printing products.

Profit before income tax in 2011 stood at 4.60 million hkd compared to 24.74 million in 2010.

Meanwhile, 2011 profit attributable to owners of the company was 1.14 million hkd or 0.8 HK cents per basic share compared to 22.01 million hkd or 18.0 HK cents per basic share, respectively, in 2010.

The increase in sales was mainly attributable to the increase in the sales orders received especially for the group's book products as a result of better competitive prices offered to customers.

Meanwhile, the decline in profit was mainly due to the increase in labour and raw material costs.

The board did not recommend the payment of any dividend for the year ended December 31, 2011.

China Print Power, founded in 2000 and headquartered in North Point, Hong Kong, also announced earlier this month that it is looking for acquisition opportunities.

The firm has placed 22 million shares at 0.95 hkd apiece with gross proceeds of 20.9 million hkd to be applied for potential acquisition activities as identified by China Print from time to time and as the general working capital of China Print.

See also:

CHINA PRINT POWER Prepares HK Listing

Photo: Andrew Vanburen

Focus Media Network raises 2011 revenue 24%

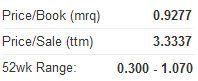

Focus Media Network -- Singapore and Hong Kong’s largest Out-of-Home media firm by the number of digital panels in elevator lobbies – raised its 2011 revenue by 24% to 60.03 mln hkd.

The increase in turnover was in line with the group's track record in delivering consistent double-digit growth over the years.

Operating profit last year stood at 2.59 mln hkd compared to 11.79 mln in 2010.

Profit for the year attributable to equity holders of the company was 2.04 mln hkd or 0.72 HK cents per basic and diluted share compared to 11.75 mln or 4.78 HK cents per basic and diluted share in 2010.

The decline in profit was due to the deployment of the IPO Use of Proceeds earmarked to be utilized by December 31, 2011 in accordance to the prospectus dated June 30, 2011, as well as the amortization of equity-based compensation.

Net cash generated from operating activities was 2.16 mln hkd against 1.98 mln a year earlier.

Purchase of property, plant and equipment in 2011 stood at 2.04 mln against 3.38 mln a year prior.

See also:

FOCUS MEDIA Gets 'Positive Outlook', Eyes ‘Substantial’ Pickup

FOCUS Helps Out Mercy Relief

Courage Marine Endures “Challenging” 2011

Courage Marine said the year 2011 remained a challenging one for global trade and hence for the shipping industry.

Global trading levels have still not recovered from the global financial crisis of 2008, and the events of 2011 such as the Japanese tsunami and the Eurozone sovereign debt crisis continue to suppress demand.

In addition, political instability in the Middle East has created concerns about global oil supply that has further weakened trade and driven up bunker prices.

For Courage Marine, these macro factors meant a tougher operating environment than in 2010.

“The oversupply of bulk shipping facilities due to low trading volumes has put immediate pressure on freight rates which led to lower fleet utilization due to lower demand for our chartering services in the Asian region. Bunker prices rose considerably too, making contracts with low freight rates unattractive while operating costs rose during the year also, adding further pressure,” said Courage Marine Chairman Hsu Chih-Chien.

On a positive note, the company said it sees the situation gradually improving in 2012, as the global economy stabilizes.

“Looking further ahead, the increase in the supply of vessels is expected to be slow by 2013 which should create a better match between vessel supply and shipping demand, and a more favorable environment for companies like Courage Marine,” Chairman Hsu added.

In 2011, the group’s turnover decreased by around 53% to approximately 21.7 mln usd.

The group recorded a net loss for the year of around 29.6 million usd, against a net profit of 9.0 million usd in 2010.

See also:

COURAGE MARINE Bolsters Fleet