SBI E2: COMTEC SOLAR Gets ‘Hold’ Call

SBI E2-Capital said it is assigning a “Hold” recommendation on pure-play monocrystalline solar ingot and wafer manufacturer Comtec Solar (HK: 712).

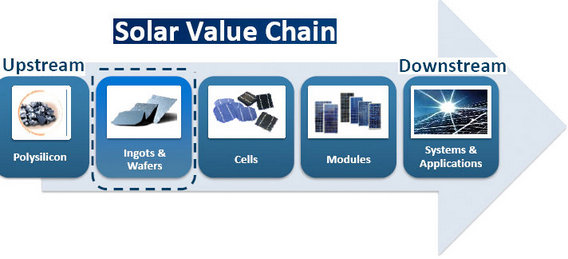

Comtec focuses on ingots and wafers within the solar chain and is thus less prone to downside amid the ongoing global trade spats which focus more on modules and panels. Image: Comtec

Comtec focuses on ingots and wafers within the solar chain and is thus less prone to downside amid the ongoing global trade spats which focus more on modules and panels. Image: Comtec

The target price is slightly adjusted to 1.40 hkd from 1.48, representing 14.6x and 10.0x P/E on net profit of 99.1 mln yuan and 144.4 mln yuan, respectively, for FY12/13F and FY12/14F.

Comtec was trading as high as 2.19 hkd in early January from 0.63 in late July last year.

“By end-2012, Comtec was in net cash position of 32.0 mln yuan with 56 mln raised in December and further added 203.8 mln yuan in equity in January this year to survive the consolidation and position for next up-cycle,” SBI E2 said.

Comtec's shares surged in January on news that Warren Buffett's firm was investing in a major client of Comtec's. Chart: Yahoo Finance

Comtec's shares surged in January on news that Warren Buffett's firm was investing in a major client of Comtec's. Chart: Yahoo Finance

Though on the right track, the research house said its view on Comtec’s short-term performance becomes less positive.

In 2012, 77.7% turnover was from n-type wafers sales to SunPower (SPWR US) fabrication facilities in Philippines.

The company expects to raise n-type sales to Sanyo (6764 JP) possibly in 2H 2013F.

Management attributed unexpected Q4 break-even in gross profit to sales of p-type wafers with good credit terms and sales of a certain amount of polysilicon and ingots that both off-set double digit margin of n-type wafers.

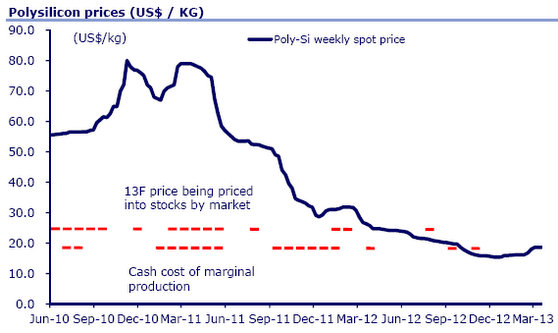

Source: CLSA

Source: CLSA

CLSA: Solar Trade War Brewing?

CLSA said that China is expected to fire the next shot in the global solar trade war as soon as this week amid continued weak polysilicon prices.

“If this time proves different than the false alarm in February, we would expect a short-term boost for China’s upstream, notably GCL Poly (HK: 3800).

Solargiga Executive Director Hsu You Yuan meeting with investors recently in Hong Kong. The solar firm is well-diversified up and down the production chain and is thus less likely to take a big hit from new possible tariffs on panels and modules. NextInsight file photo“However, if the tariffs are not full of loop-holes, the move would (1) assure reprisals from Europe; (2) squeeze struggling panel makers,” CLSA said.

Solargiga Executive Director Hsu You Yuan meeting with investors recently in Hong Kong. The solar firm is well-diversified up and down the production chain and is thus less likely to take a big hit from new possible tariffs on panels and modules. NextInsight file photo“However, if the tariffs are not full of loop-holes, the move would (1) assure reprisals from Europe; (2) squeeze struggling panel makers,” CLSA said.

That would also be potentially less damaging to Chinese solar plays like Solargiga Energy (HK: 757) and Comtec Solar (HK: 712) who focus more on wafers and ingots.

China is widely expected to fire the next salvo in the global solar trade war in April by imposing anti-dumping measures on foreign polysilicon imports.

“We are looking for 17% growth in global solar demand this year, with 128% demand growth from China to 8 GW more than offsetting Europe’s slide,” the French research house said.

However, some PRC solar plays like Longyuan (HK: 916) are worried about Chinese government subsidies only targeting more viable domestic plays.

“A proposed subsidy cut from Rmb1/kWh to as low as Rmb0.75/kWh has put a chill in the market as acceptable returns become impossible at current prices.

“Leading operator Longyuan confirmed that they have frozen new solar developments until the proposed subsidy cut is scrapped.”

See also:

SOLARGIGA: Q4 Order Surge