SOLARGIGA ENERGY HOLDINGS LTD (HK: 757; TDR: 9157TT) realized a net profit in the second half of 2013, with executives telling investors in Hong Kong that there are signs of recovery in the air for the green energy solar play.

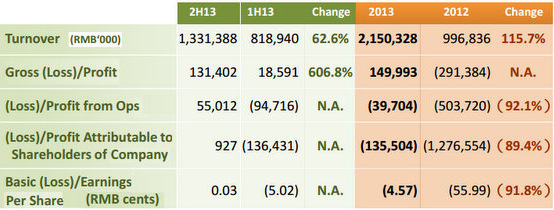

During the July-December 2013 period, turnover rose 62.6% sequentially to 1.33 billion yuan, allowing Solargiga to realize a net profit of 927,000 yuan versus a loss of 136.4 million in 1H2013.

FY2013 bottom line loss shrank 89.4% year-on-year to 135.5 million while revenue surged 115.7% to 2.15 billion yuan.

Gross profit in 2013 swung to the black, standing at 150 million yuan compared to a gross loss of 291 million in 2012.

Solargiga management is upbeat on the solar sector following its stronger H2 performance last year. From left: CFO Mr. Roger Wang, Chairman Mr. Tan Wen Hua and CEO Mr. Hsu You Yuan.

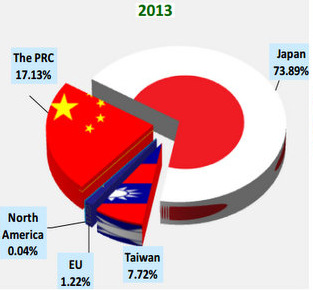

Solargiga management is upbeat on the solar sector following its stronger H2 performance last year. From left: CFO Mr. Roger Wang, Chairman Mr. Tan Wen Hua and CEO Mr. Hsu You Yuan. Photo: Aries ConsultingThe bulk of Solargiga’s products are sold in Asia, with Japan replacing the PRC as the top market in 2013 – thanks in large part to a growing supply relationship with Japan’s Sharp Corporation.

In 2012, 54.5% of Solargiga’s revenue came from China with 28.3% from Japan but in 2013, 73.9% was from Japan and 17.1% from China.

“Overreliance on a single country market or client is not advisable, but Sharp has high demand for our products, and has very high standards so we enjoy a premium on selling prices.

Geographical contribution to Solargiga's 2013 revenue.“However, in the future we believe China will continue to be our largest market, and we will not over rely on a single market but will work to diversify our client base,” said Solargiga Chairman Mr. Tan Wen Hua.

Geographical contribution to Solargiga's 2013 revenue.“However, in the future we believe China will continue to be our largest market, and we will not over rely on a single market but will work to diversify our client base,” said Solargiga Chairman Mr. Tan Wen Hua.“We’re benefitting from stable orders, especially from Japan.

“Given our ‘one stop’ multi-product capability, we are able to meet a broad range of customer standards and requests,” Mr. Tan added.

And Solargiga was confident that orders from Japan would remain robust, especially given the growing concerns over nuclear power safety following the Fukushima disaster in 2011.

Solargiga focuses mainly on wafers, with 266 MW of wafers shipped in 2013 representing 36.5% of its total products shipped.

To help produce the highest-quality solar wafers possible, Solargiga has 121 wire saws in operation at its Jinzhou, Liaoning Province factory with an annual wafer production capacity of 900 MW.

Strong Support from Beijing

“Thanks to the benefit of supportive national policies, there are various recent advantages for the photovoltaic industry in China such as in July 2013 a new policy suggested that the total installation capacity target for photovoltaic power generation in the PRC in 2015 should reach 35 GW, which was above market expectations.

“We believe that this helps the PRC photovoltaic industry overcome hardships of oversupply of production capacity and the insufficient development in the domestic market,” said, Executive Director and CEO Mr. Hsu You Yuan.

On the supply side, raw material prices should show further recovery this year after polysilicon price drops over the past few years led Solargiga and many of its peers to engage in costly writedowns.

“Polysilicon prices should continue to increase in 2014,” he told the roomful of investors.

He also pointed to favorable fiscal policy last year, including a new tax measure meant to encourage solar energy as a pollution-free alternative to coal-fired power plant.

“From 1 October 2013 to 31 December 2015, a policy of a 50% immediate refund of VAT was implemented for sales of self-generated solar energy-produced electricity products for taxpayers.”

Solargiga, with a market cap of 1.20 billion hkd, has seen its Hong Kong shares move between a 52-week range of 0.33 – 0.47 hkd. Chart: Yahoo Finance

Solargiga, with a market cap of 1.20 billion hkd, has seen its Hong Kong shares move between a 52-week range of 0.33 – 0.47 hkd. Chart: Yahoo FinanceThe Hong Kong and Taiwan listco is more sanguine on business prospects going forward.

“Based on the aforesaid policies, the recovery of the industry and sector visibility is crystal clear, while at the same time there is significantly increased demand in the photovoltaic market, during which capacity in the market will be enlarged.

“As a leading supplier within both the upstream and downstream vertically-integrated sectors of solar energy services in the PRC, Solargiga will expand its production chains to consolidate advantages in the upstream business and expand the downstream business,” Mr. Hsu said.

And the company was focusing on non-organic strategies to realize its expansion goals.

“We will actively seek suitable target companies for acquisition, including power generation system project development firms and EPC (engineering, procurement and construction) companies.

“These can reinforce synergies between our businesses, strengthen advantages of our vertical integration and fully utilize our existing advantages of German design processes, high product qualities widely accepted in the Japan market and competitive Chinese manufacturing costs to enhance market shares of each business within Solargiga.”

Despite the more encouraging performance in the latter half of 2013, recent years haven’t been kind to Chinese solar firms.

“Since the last quarter of 2011, Solargiga’s solar cell business had been severely affected by weak market demand and the significant drop in prices of solar products.

“As such, Solargiga recognized an impairment of 208.2 million yuan for the goodwill allocated to the segment in the first half of 2012 and an impairment of 201.5 million for the intangible assets of the segment in the second half of 2012,” Mr. Hsu added.

For more information, check out Solargiga's FY13 results announcement on the HKEx website.

See also:

Sunny News For SOLARGIGA