Main reference: Story in Sinafinance

HONG KONG and Shenzhen-listed hybrid and fully-electric automaker BYD Co Ltd (HK: 1211; SZA: 002594) has surprised on the upside in terms of sedan sales of late.

Is the Shenzhen-based firm poised for an extended run?

Sitting Pretty? Recent sales by BYD Auto may suggest a turnaround Photo: CompanyGiven the dual-listed firm’s flurry of year-end sales activity in showrooms across Mainland China, auto sector watchers are asking if this latest spurt might represent the end of the revenue rut BYD has been stuck in for nearly three years.

Sitting Pretty? Recent sales by BYD Auto may suggest a turnaround Photo: CompanyGiven the dual-listed firm’s flurry of year-end sales activity in showrooms across Mainland China, auto sector watchers are asking if this latest spurt might represent the end of the revenue rut BYD has been stuck in for nearly three years.

BYD’s vehicle sales in October, November and December of last year all registered year-on-year and sequential increases, and represented the third, fourth and fifth straight months of uptrend.

Monthly auto sales were 40,000, 50,000 and 61,000 units, respectively.

Average sequential monthly increases over the quarter saw rises of nearly 10,000 units per month, a feat not achieved in recent memory and not since the company was owner of the country’s top selling sedan at the time – the F3.

And when calendars were thrown away as the new year arrived, the “green automaker” that is 10% owned by Warren Buffett’s investment firm Berkshire Hathaway continued to rev up sales surprises.

For the first two months of the new year, month sales volumes have risen by over 30% year-on-year.

This suggests that the hybrid sedan play is ready to make a sustained turnaround.

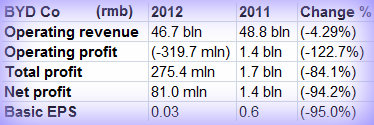

Despite the surprisingly supercharged salesroom performance of late, the year-end flurry could not prevent BYD from finishing with poor FY2012 results.

Net profit plummeted 94.2% to 81.0 million yuan.

Net profit plummeted 94.2% to 81.0 million yuan.

The top line shrank 4.3% to 46.7 billion yuan.

“The pace of growth in demand in the automobile market in the PRC continued to slow down in 2012 being hampered by uncertainties in macroeconomic conditions.

“Despite the substantial quarter-on-quarter growth in the fourth quarter income of the company’s automobile business, driven by the rapid increase in the sales volume of new models, the growth for the year was relatively steady as compared with last year,” said BYD Chairman Wang Chuan-fu.

Year-on-year operating results of BYD’s handset components and assembly services business – the other major undertaking of the firm -- slightly deteriorated in 2012 attributable to the decrease in market share of “a major customer,” Mr. Wang added without elaborating.

As for BYD’s struggling solar cell business, operating results “worsened substantially” due to the persistently slow market of solar cells worldwide, the company said.

Despite the poor overall results, investors will no doubt take some consolation from BYD’s recent auto selling blitz, especially as the new leadership in Beijing has stated its commitment to both boosting domestic demand and improving and expanding the nation’s transportation infrastructure.

See also:

Stock Picks Post-Political Powwow In China