AFTER GETTING OFF to a sluggish start, 2012 definitely took Hong Kong investors by surprise, managing to add 23% for the year.

Meanwhile, the warm winter in Hong Kong shows no sign of cooling down, with the benchmark index adding another 4.7% in January.

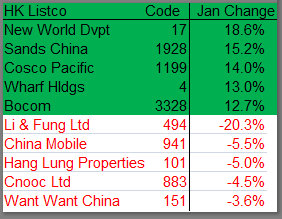

Leading the pack in the first month of the year was New World Development (HK: 17), a leading player in residential, office and retail properties, whose shares surged 18.6% in January.

The firm’s Hong Kong-listed shares were buoyed in part by a January 23 announcement that the consortium of New World Group and Vanke Property (HK) Co Ltd won the tender for the West Rail Tsuen Wan West Station TW6 Residential Property Development project in Hong Kong at a consideration of 3.4 billion hkd.

The development is the last waterfront site with prime location near the West Rail in Tsuen Wan.

NWD unit New World Department Store China Ltd, one of the largest owners and operators of department stores in the PRC, ended the year on a high note in being named by Forbes among "Asia's 200 Best Under a Billion" for the fifth consecutive year.

The distinction honors 200 high-performing Asia-Pacific listed companies screened out of a universe of 15,000 regional companies with annual sales between five million usd and one billion.

At latest count, NWD had a landbank of approximately 9.4 million square feet in Hong Kong; operated and managed a total of 39 stores in 18 cities across Mainland China; and had a total of 16 hotels providing 7,235 hotel rooms in Hong Kong, Mainland China, and Southeast Asia.

Founded in 1970, NWD is based in Central, Hong Kong.

Sands China (HK: 1928) was Hong Kong’s second best performer last month, surging ahead 15.2% from end-December levels.

Investors were cheered all month long on expectations of strong robust activity by Chinese visitors to its Macau-based casinos and resorts.

And the gaming play, owned by American billionaire Sheldon Adelson, did not disappoint, having just announced a 52% jump in its fourth quarter bottom line to 467 million usd.

Cosco Pacific (HK: 1199) saw its shares rise 14.0% in January.

Investors were cheered by a 9.8% throughput increase in 2012 to 55.7 million TEU.

Hong Kong’s benchmark Hang Seng Index has now finished higher for five consecutive months, matching a winning streak seen between March-July 2009.

The current upward run is the lengthiest since an eight-month stretch enjoyed from March-October 2007.

Top losers

Li & Fung took the dubious honor of the sharpest falling stock in January, shedding a whopping 20.3% in share value over the 31-day period.

The Hong Kong-based global trading group is heavily reliant on garments, comprising around two-thirds of revenue.

Therefore, raw material price fluctuations and still struggling export markets – especially in the EU – have hit Li & Fung hard.

China Mobile was the second worst performing stock in January, though its share price decline of 5.5% was far more manageable than Li & Fung’s recent selloffs.

The telecom giant’s shares suffered from shareholder anxiety last month amid an ongoing negotiation process with Apple over 3G carrier terms, even as China Mobile’s two domestic rivals already have inked agreements with Apple.

See also:

HK Stocks Still Smarter Choice Than Property

CHINA's REAL ESTATE & RETAIL: Latest Happenings...

Sumer: "Many Of My Property Stocks Have Performed Smartly In 2012"