HL Tiong says he is an average Singaporean in his early 30s, has a full-time job, is happily married and caught within the sandwich class. He lives in an executive condominium with a "mountain-like mortgage". "My goal is to achieve financial freedom as early as I can. My target is 45 years old. I don't mind working but I hope to provide my wife an option not to work." The following article was recently published on his blog (http://reaching4financialfreedom.blogspot.sg/) and is republished with permission.

THANKS TO A reader for bringing to my attention Global Invacom two days ago. According to the reader, this company was recently relaunched via a Reverse Takeover (RTO) and thus there is a lack of relevant financials.

THANKS TO A reader for bringing to my attention Global Invacom two days ago. According to the reader, this company was recently relaunched via a Reverse Takeover (RTO) and thus there is a lack of relevant financials.

I would further sharpen what the reader meant by "relevant financials" by saying we lack financials that reveal how the business post-ante RTO had performed over a considerable amount of time.

This presents a blind spot for investors like myself who might not know the business well and are bad at forecasting attempts.

Firstly, let's have a brief understanding of what Global Invacom does.

Business

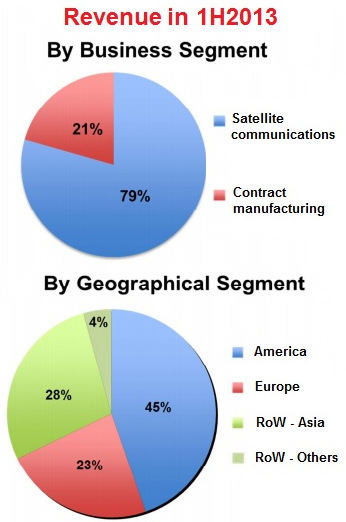

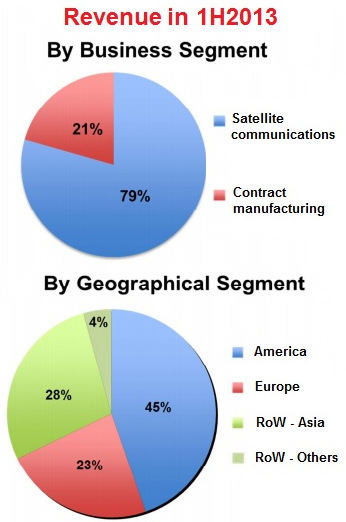

To put it simply, Global Invacom is in the global satellite communications equipment business.

Satellite broadcasters are its customers. They are usually large scale and examples include BSkyB, and Astro.

There is a lot of useful information in Global Invacom's presentation materials.

Elements that make me smile in my sleep if I were vested

(1) Discount to NAV

As at 30 Jun'13, Global Invacom's net asset value per share was US$0.25 or S$0.31.

Given that its last traded price was S$0.20, this represented a discount of 35% from its book value. Interesting.

(2) Negligble Gearing

As at 30 Jun'13, Global Invacom had US$199k of debt. This translates to a debt-to-equity ratio of 0.3%, which is very good.

This also means that Global Invacom has the capacity to gear up in future.

(3) High Cash Levels

As at 30 Jun'13, Global Invacom has US$25 million in cash and cash equivalents. This represents US$0.105 per share which is more than 50% of current market price.

THANKS TO A reader for bringing to my attention Global Invacom two days ago. According to the reader, this company was recently relaunched via a Reverse Takeover (RTO) and thus there is a lack of relevant financials.

THANKS TO A reader for bringing to my attention Global Invacom two days ago. According to the reader, this company was recently relaunched via a Reverse Takeover (RTO) and thus there is a lack of relevant financials.I would further sharpen what the reader meant by "relevant financials" by saying we lack financials that reveal how the business post-ante RTO had performed over a considerable amount of time.

This presents a blind spot for investors like myself who might not know the business well and are bad at forecasting attempts.

Firstly, let's have a brief understanding of what Global Invacom does.

Business

To put it simply, Global Invacom is in the global satellite communications equipment business.

Satellite broadcasters are its customers. They are usually large scale and examples include BSkyB, and Astro.

There is a lot of useful information in Global Invacom's presentation materials.

Elements that make me smile in my sleep if I were vested

(1) Discount to NAV

As at 30 Jun'13, Global Invacom's net asset value per share was US$0.25 or S$0.31.

Given that its last traded price was S$0.20, this represented a discount of 35% from its book value. Interesting.

(2) Negligble Gearing

As at 30 Jun'13, Global Invacom had US$199k of debt. This translates to a debt-to-equity ratio of 0.3%, which is very good.

This also means that Global Invacom has the capacity to gear up in future.

(3) High Cash Levels

As at 30 Jun'13, Global Invacom has US$25 million in cash and cash equivalents. This represents US$0.105 per share which is more than 50% of current market price.

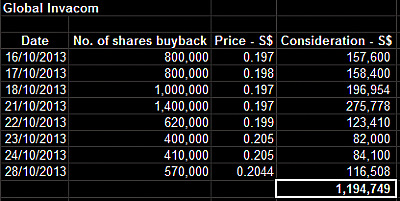

(4) Share buybacks

(4) Share buybacksExcluding transaction charges, Global Invacom has spent almost S$1.2 million on share buybacks.

This is a signal from management that they believe Mr Market is under-valuing the business.

Elements that may cause me to lose sleep if I were vested

(1) Company Strategy

Global Invacom's strategy is to grow aggressively through acquisitions.

To do that, you need financing which can come in a few forms:

(a) raise funds through rights issues

(b) increase share base by getting in other big-time investors

(c) debt financing (bank borrowings)

Acquisitions may be expensive and result in a cash drain, and potentially not shareholder value-accretive.

The margin of safety represented by huge cash levels, negligible gearing may also be eroded away.

(2) Expanding Asia Footprint

Global Invacom managed to secure the first order from Asia, and in its last announcement, Global Invacom said it intended to convert current Malaysian operations from sub-assembly to manufacturing.

The intention is to seek efficiency improvements and offer alternative manufacturing activities in China.

Two things do not work in its favour: (1) Malaysia will impose 6% tax by 2015, (2) Sat Comms manufacturing is high tech and involves high quality infrastructure. Currently electricity costs in Malaysia are artificially low due to subsidies but may increase with upcoming reforms in the electricity market.

All these will translate into increased costs and there is a time gestation in order to realise the intended efficiencies.

Therefore in the meantime, I expect operating costs to increase significantly without revenues rising in tandem.

Conclusion:

I think Global Invacom is an interesting company. It is clearly positioning itself to be a growth story and it might have a case. The market is pricing Global Invacom as if it would be liquidated tomorrow, and one will get only 65% back of its net assets.

Would the margin of safety represented by negligible gearing, high cash levels, discount to NAV be eroded due to relentless pursuit of growth? Your guess is as good as mine.

Acquisitions may be expensive and result in a cash drain, and potentially not shareholder value-accretive.

The margin of safety represented by huge cash levels, negligible gearing may also be eroded away.

(2) Expanding Asia Footprint

Global Invacom managed to secure the first order from Asia, and in its last announcement, Global Invacom said it intended to convert current Malaysian operations from sub-assembly to manufacturing.

The intention is to seek efficiency improvements and offer alternative manufacturing activities in China.

Two things do not work in its favour: (1) Malaysia will impose 6% tax by 2015, (2) Sat Comms manufacturing is high tech and involves high quality infrastructure. Currently electricity costs in Malaysia are artificially low due to subsidies but may increase with upcoming reforms in the electricity market.

All these will translate into increased costs and there is a time gestation in order to realise the intended efficiencies.

Therefore in the meantime, I expect operating costs to increase significantly without revenues rising in tandem.

Conclusion:

I think Global Invacom is an interesting company. It is clearly positioning itself to be a growth story and it might have a case. The market is pricing Global Invacom as if it would be liquidated tomorrow, and one will get only 65% back of its net assets.

Would the margin of safety represented by negligible gearing, high cash levels, discount to NAV be eroded due to relentless pursuit of growth? Your guess is as good as mine.