Excerpts from analysts' reports

John Lim, CEO of ARA Asset Management. Photo: CompanyDBS Vickers says ARA ($1.65) is "attractive at current level"

John Lim, CEO of ARA Asset Management. Photo: CompanyDBS Vickers says ARA ($1.65) is "attractive at current level"

We are upgrading ARA Asset Management to BUY, TP S$1.89 (Prev S$1.78).

Backed by a strong cashflow generating and scalable business that is growing steadily, we believe that ARA offers an attractive investment proposition at current levels.

ARA is an attractive proxy for REITs, without the interest rate risk. Fees derived from its REITs are resilient, transparent and growing.

The group derives close to 66-67% of its revenues from its six managed REITs across major Asian markets.

John Lim, CEO of ARA Asset Management. Photo: CompanyDBS Vickers says ARA ($1.65) is "attractive at current level"

John Lim, CEO of ARA Asset Management. Photo: CompanyDBS Vickers says ARA ($1.65) is "attractive at current level"We are upgrading ARA Asset Management to BUY, TP S$1.89 (Prev S$1.78).

Backed by a strong cashflow generating and scalable business that is growing steadily, we believe that ARA offers an attractive investment proposition at current levels.

ARA is an attractive proxy for REITs, without the interest rate risk. Fees derived from its REITs are resilient, transparent and growing.

The group derives close to 66-67% of its revenues from its six managed REITs across major Asian markets.

Recent story: ARA ASSET MANAGEMENT: Stock price flirting with all-time high, market cap touches $1.7 billion

Credit Suisse says Amtek Engineering "seeing signs of demand recovery"

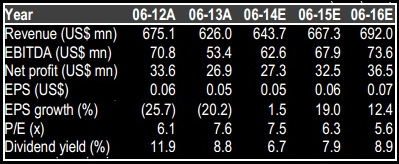

Analysts: Anand Swaminathan & Louis Chua

We hosted Ms. Sheila Ng (CFO and Deputy CEO) and Ms. Jocelin Soon (Deputy CFO) for lunch with investors.

We hosted Ms. Sheila Ng (CFO and Deputy CEO) and Ms. Jocelin Soon (Deputy CFO) for lunch with investors.● Management is keen to achieve a reversal in the revenue decline seen over the past two financial years which was driven by sustained weakness in end-demand in both the consumer and enterprise segments. The automation and cost saving initiatives implemented over the past couple of years should provide the additional boost to the bottom line when revenue growth returns.

● Signs of a demand recovery are imminent in many segments, given the record tooling sales seen through FY13. Amtek is also seeing many new customer wins in segments like consumer electronics, automotive and casings. Mass storage is the only segment expected to see continued weakness. There is also potential for M&A to consolidate positioning in certain segments.

● At 7x 12-month forward consensus P/E and 1.1x P/B, valuations do not appear to be pricing in any growth or ROE improvements. A dividend yield of 6-7% also looks very defensive.

Maintain Neutral. Target price: 56 cents.