'There has been a pick up in August orders,' said CFO Samuel Ng (right). NextInsight file photoAT WORLD PRECISION MACHINERY’S results briefing on Tue, CFO Samuel Ng provided fund managers with insights to the finances of the leading PRC manufacturer of precision metal stamping machines.

'There has been a pick up in August orders,' said CFO Samuel Ng (right). NextInsight file photoAT WORLD PRECISION MACHINERY’S results briefing on Tue, CFO Samuel Ng provided fund managers with insights to the finances of the leading PRC manufacturer of precision metal stamping machines.

During 1H2013, even though there was an increase in sales volume, average selling prices of high tonnage performance machines declined by 5.8% to Rmb 136,044 per unit. As a result, Group revenue slipped 2.0% to Rmb 440.5 million.

Higher overheads also resulted in gross profit margin decreasing by 2.4 percentage points to 29.4%.

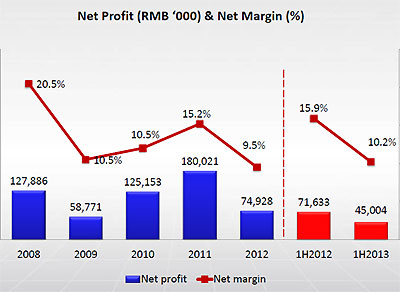

Net profit attributable to shareholders declined by 37.0% to Rmb 45.1 million.

Net margin was 10.2%, down 5.7 percentage points.

Other income, however, increased by 136.5% to Rmb 8.2 million due to an increase in income from bank deposits, a subsidy from the PRC government for new products developed, rental income from a related party and a Rmb 3.0 million deposit forfeited from a customer on order cancellation. Company dataFinancial expenses increased by 83.2% to Rmb 6.2 million.

Company dataFinancial expenses increased by 83.2% to Rmb 6.2 million.

The CFO expects the company’s net margin will improve in the second half of the year.

Firstly, finance expenses will be lower. It reduced its bank loans from Rmb 266.6 million as at 30 June 2012 to Rmb 95 million in 30 June 2013.

Secondly, the company’s tax structure will improve in the second half.

For more information on its 1H financial performance, refer to its SGX announcement here.

Below is a summary of questions raised at the results briefing and the replies provided by the CFO.

Q: As a major supplier to automobile and home appliances manufacturers in the PRC, how does China’s promotion of green electric vehicles and appliances impact you?

New models of alternative energy automobiles will be rolled out into the market. There will be greater demand for new stamping machines to produce auto components for these new car models.

Likewise, a boom in consumer demand for green appliances will create demand for more stamping machines. Sales volume of high-tonnage-machines have gone up, but average selling prices are down. NextInsight file photoQ: Why has your average selling price declined? How will the credit tightening in China affect you?

Sales volume of high-tonnage-machines have gone up, but average selling prices are down. NextInsight file photoQ: Why has your average selling price declined? How will the credit tightening in China affect you?

Fluctuation of our selling prices is a seasonal trend. The credit tightening has not created problems for our customers, judging from the orders they have placed with us.

Q: Who guarantees your loans?

Our loans are guaranteed by various entities. We have a Rmb 90 million loan guaranteed by World Precision Machinery and Jiangsu World Agricultural Machinery, in which our major shareholder, Mr Wang Weiyao, has substantial interest. Rmb 10 million is guaranteed by World Precision Machinery. Another Rmb 10 million are personally guaranteed by Mr Wang and his wife.

We only have one secured loan: Rmb 245 million guaranteed by a subsidiary, World Precise Machinery (China), and secured by the land and building of World Precise Machinery (Shenyang).

Q: Please provide an update on your capacity expansion.

We have completed constructing the façade for phase 1 of the Shenyang plant and are installing equipment and electrical wiring now. The machine trial run will take place in 4Q2013. We already have some orders, but significant revenue contribution will only commence next year.

Q: On top of your trade payables of Rmb 221 million, a significant chunk (Rmb 151 million) of payables is classified as 'other payables and accruals'. What is in your ‘other payables’?

These are advances received from customers.

Recent story: WORLD PRECISION MACHINERY: Changes In Top Management, UOB KH Says 'Buy'