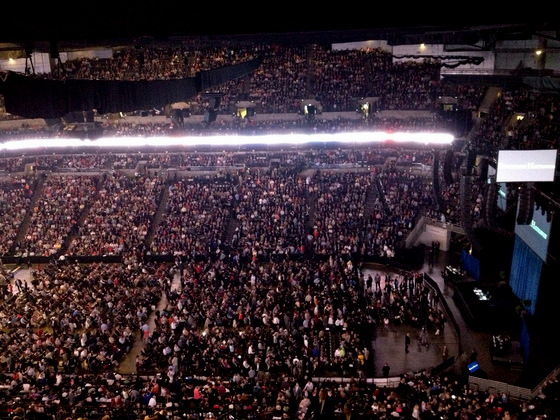

About 35,000 shareholders attended the Berkshire Hathaway AGM 2013. Warren Buffett and Charlie Munger were seated on the stage on the right of the picture. Photo: www.fool.com

About 35,000 shareholders attended the Berkshire Hathaway AGM 2013. Warren Buffett and Charlie Munger were seated on the stage on the right of the picture. Photo: www.fool.com  Warren Buffett. Photo: IMDAROUND THE WORLD, there have been many successful investors. None, however, has achieved the results and chronicled their lives and methods as clearly as Warren Buffett, the man dubbed by his fans as the “Oracle of Omaha”.

Warren Buffett. Photo: IMDAROUND THE WORLD, there have been many successful investors. None, however, has achieved the results and chronicled their lives and methods as clearly as Warren Buffett, the man dubbed by his fans as the “Oracle of Omaha”.

Libraries are filled with books on this remarkable man and there are countless articles and videos promising to explain how to “invest like Warren Buffett”.

Despite this, Warren Buffet and the secrets behind his track record are enigmatic.

Folksy, avuncular and disarmingly modest, he has hand built an empire in Berkshire that makes over US$1 million every ten minutes of the workday while having enough spare time to indulge in regular bridge and ukulele playing sessions. For investors who bought back in 1968, just $11 invested back then would be enough to make them a millionaire today.

Is investing really so easy? Or perhaps, as a wag once quipped: “Warren’s record is better because he’s smarter. He’s just too polite to say so.”

Planning the Family Holiday, Investor Style

For me, even after devouring all the major biographies on Buffett, figuring out the real secrets to his investment success is difficult. Attending the Berkshire Annual General Meeting (AGM) for shareholders is perhaps the easiest way to see him up close and learn more about his methods. However, flying 20 hours to Nebraska is a lot of backache to suffer to attend a one-day meeting.

Late one night in March, I hatched a plot to turn the AGM visit into an excuse for a family holiday.

“What do you think about two weeks in the US?” I suggested to my wife over breakfast. “I’m thinking of May, to attend Berkshire’s AGM. We can fly through California….it's late spring and San Francisco and Napa are beautiful that time of year.”

“Hmm....” she replied “Sounds good!”

And with that we were soon on our way!

Our 9.25am flight on SQ from Singapore to San Francisco went through Seoul and was extremely civilised - long haul passengers on morning flights have no reason to rush. In contrast, our Friday flight on Southwest (Herb Kelleher’s “Love airline”) from San Francisco to Omaha was burbling with excitement and every passenger seemed headed for the Berkshire AGM.

The shareholders who go to the AGM are generally well-off (one “A” share last traded for US$171,000), even tempered (buy and hold - it's a really long time! ) and older (think the movie “Cocoon”, or if you are too young to know what that is, think of your grandparents), and cardigans outnumber business jackets by an eye-popping number.

David Leow with wife Beverley and son Taylor outside of Warren Buffett's home in Omaha. Part of the Buffett legend, the house is where Warren has lived for over 50 years. Think of it as visiting a national monument.

David Leow with wife Beverley and son Taylor outside of Warren Buffett's home in Omaha. Part of the Buffett legend, the house is where Warren has lived for over 50 years. Think of it as visiting a national monument.

Photo courtesy of David Leow.

Ostensible strangers chatted like old friends on the flight. Maximum bragging rights were scored by early investors returning to the AGM.

“I only own ten of the “A”, but I’ve been to the AGM since 1995,” a man a few seats ahead says to his neighbour. Translation – I’m very relaxed because my Berkshire shares are up $1.5 million, thanks for asking.

The AGM itself was a little surreal, with Buffet acolytes braving a blisteringly cold morning to shuffle into a snaking queue outside Qwest Center, a convention centre sized with this mammoth AGM in mind. The tide of people was overwhelming, and a count later put the number at 35,000 in attendance - equal to three packed houses of Singapore’s Indoor Stadium.

It was free seating and having had the temerity to stop for breakfast meant that though it was 7am when got seated, the front row seats were long gone.

Fortunately, the seats we did find were next to an extremely affable Chinese man who turned out to be a corporate law partner at one of Omaha’s leading law firms. This was the type of gentleman Ang Lee would cast in the Tom Cruise role if he ever did a remake of “A Few Good Men”, and I had a great chat with the former Shanghai and Chicago native about many things, including the swell of PRC money looking to invest in America’s Midwest.

Events kicked off at 8.30am with a movie skit featuring Arnold Schwarzenegger spurning a voracious Buffet for 89-year-old Berkshire billionaire Charlie Munger as the next Terminator.

More skits with celebrities like Jon Bon Jovi and Kevin James, and a clever parody with Buffet plotting to corner the peanut brittle market with help from “Breaking Bad” duo Bryan Cranston and Aaron Paul. Finally the movie session finished with a “Dancing with the Stars” skit showing an animated Buffett and Munger winning the finals by bopping "Gangnam Style".

With George Lucas in the audience, one imagines the force was strong within them that day.

At 930am, the stadium’s massive floodlights dimmed a moment, kicking off a Village People number which substituted “B-R-K-A!” (Berkshire’s stock code on NYSE) for the original “YMCA” refrain. Amidst a floor awash with dancers dressed as Heinz sauce bottles, financial industry glitterati such as Becky Quick of CNBC, Andrew Ross Sorkin of NYT and Carol Loomis of Fortune file in along with Berkshire directors which include Warren, Charlie and Bill Gates.

The real highlight of the AGM is the famous question-and-answer session, an eclectic five-and-a-half hour marathon split by a lunch break. In a display of staggering virtuosity, the Warren and Charlie double act (combined age 171 years) talked crisply about almost any topic lobbed at them – US housing market, succession planning, corporate governance, monetary policy and the mechanics of insurance, machining and railway companies.

It’s the business equivalent of being a two-man orchestra - woodwind, brass, percussion, string, with a little piano thrown in.

Even more astonishing was the self-awareness to keep answers within the limits of their knowledge. In Buffetspeak, this is “operating well within a circle of competence and knowing where the perimeter is”. Too often, experts fall into the trap of answering questions they have little knowledge of for fear of appearing less than expert.

There were too many topics to fully cover here, so below is just a sampling of some of their more memorable responses. Interestingly, Charlie is possibly smarter than Warren Buffett and certainly pithier.

So, was the trip worthwhile?

Absolutely. For me, a few things about Buffet’s investing style and what is replicable became clearer (see “What I Learned” below). For my wife, she came back two carats heftier (souvenirs from a trip to Berkshire-owned fine jeweller Borsheim’s which offers shareholder discounts of around 25% during the AGM week).

And as for my 6-year-old son, let’s just say that he enjoyed the extra time with mom and dad, and the Omaha french fries were pretty good too.

SELECTED AGM QUOTES

(These are reproduced from memory and limited notes, and are not a verbatim record. WB = Warren Buffett and CM= Charlie Munger)

ON MAKING GOOD DECISIONS AND WHY MOM GOT IT WRONG ABOUT CANDY

Charlie Munger, Warren Buffett’s investment partner. Photo: InternetCM: When we started, modern psychology hadn’t yet discovered how tiring it is to make decisions. Warren and I live on autopilot, we are totally habitual, and waste no energy on little decisions. Caffeine and sugar are great for decision-making and we ingest coke and chocolate all day long.

Charlie Munger, Warren Buffett’s investment partner. Photo: InternetCM: When we started, modern psychology hadn’t yet discovered how tiring it is to make decisions. Warren and I live on autopilot, we are totally habitual, and waste no energy on little decisions. Caffeine and sugar are great for decision-making and we ingest coke and chocolate all day long.

ON AGE

CM: I’m worried about my old age, it could come on at any time. (Laughter)

ON BUFFET’S GURU STATUS

CM: Just because Warren thought something twenty years ago doesn't make it a law of nature. (Laughter)

WB: We'll talk about that at lunch.

ON EXPLAINING BERKSHIRE’S COMPETITIVE ADVANTAGE TO A CHILD

CM: We try to be sane when others go crazy. We also use the golden rule to treat subsidiaries how we would want to be treated if we were their subsidiaries. We try to be a good partner and that is an advantage. We left behind a competitive place to go to a place more unusual. This was a great idea and I wish we had done it on purpose. (Laughter)

ON ENVY BEING A LOUSY VICE

CM: I always said there’s a reason why envy is in the Bible - can't covet your neighbour's ass. They were having trouble with envy a long time ago. It is the one sin there is no fun in.

WB: Lust on the other hand, can be fun sometimes. (Laughter)

ON ECONOMIC SAGES

CM: Our current problems are quite confusing. If you aren't confused, I think you don’t understand what’s happening very well. (Laughter)

|

WHAT I LEARNED Buffet is indeed smarter than the rest of us. In the course of my career, I’ve discussed business with several hundred CEOs and the breadth of knowledge and ability to synthesise a number of factors into a functional worldview is as good as I’ve ever seen (scarily, from the AGM it looks like Munger could be even better at this than Buffett). |

FUN FACTS ABOUT BUFFETT

At 82 years of age, Buffett seems to be in rude good health despite a diet consisting of 6 cokes a day, T-bone steaks, cheese burgers, candy and reputedly premium vanilla ice cream for breakfast. At the AGM, he and Charlie chomped through a two pound bowl of peanut brittle fast enough to make a dentist – let alone a dietician - wince.

Despite living in the same house for over 50 years, Buffett professes not to know the colour of his carpets. “My brain doesn’t work that way”.

Buffett drives a Lincoln Town Car (starting price US$35,000) and lives in a house with an estimated market value of US$750,000. This means many Singaporeans drive a more expensive car and live in a more expensive house than the man who took third spot in Forbes 2013 rich list with US$55 billion net worth.

Buffett believes in doing what you love so much that he has said “If you gave me the choice of being CEO of General Electric, IBM, General Motors, you name it, or delivering papers, I would deliver papers. I enjoyed doing that. I can think about what I want to think. I don't have to do anything I don't want to do.”

Buffett seems to only call himself an investor for convenience, more often referring to himself as an “asset allocator” and seeing his role as to “hire great people”. The distinction is in the control over incoming and outgoing cashflow he has as compared to most investors.

Despite being best known for his investment track record, Buffett believes after he is gone, he will be most remembered as a teacher.

Despite being the world’s richest investor, Buffett does not seek maximum monetary returns at all costs. His priorities seem to be doing what he enjoys (building businesses), working with people he likes and minimising risk. His returns are the maximum achievable after taking these factors into account.

Family holiday post-AGM  Taylor and mother in a moment of closeness while visiting Castello di Amorosa, a winery in California. Photos courtesy of David Leow

Taylor and mother in a moment of closeness while visiting Castello di Amorosa, a winery in California. Photos courtesy of David Leow

“Dad, never forget that while in the short term the market is a voting machine, in the long term it is a weighing machine”. Picture taken at the Club Lounge of the Sheraton Omaha.

“Dad, never forget that while in the short term the market is a voting machine, in the long term it is a weighing machine”. Picture taken at the Club Lounge of the Sheraton Omaha.

Taylor in a happy mood in Castello di Amorosa.

Taylor in a happy mood in Castello di Amorosa. Stagggeringly good steaks from room service at Sheraton Ohama where 30-day dry aged beef is de rigueur

Stagggeringly good steaks from room service at Sheraton Ohama where 30-day dry aged beef is de rigueur

About the Author: David Leow is an advisor to several publicly-listed and private companies on their corporate activities as well as a private investor. He currently serves as Managing Director of Thaler Group. His previous roles have included Founding Director of Business Development for Sir Richard Branson's Virgin Group in Asia, Vice President of the DBS Bank’s Private Equity Group, and Vice President of UOB Kay Hian’s Equity Capital Markets Group. He was also a part of the management team that established HSBC Securities in Singapore. David is a charter holder with the Chartered Financial Analysts Institute (USA) as well as the Institute of Chartered Accountants (Australia). He can be contacted at