OSK-DMG says knee-jerk selling provides entry point into AusGroup

Analyst: Lee Yue Jer

AusGroup made an announcement today regarding i) withholding of AUD21.7m of progress payments from Karara Mining Ltd (KML), ii) KML’s notice of intent to call on AusGroup’s AUD8.8m performance security, and iii) KML’s claim against AusGroup of unfinalised value. We cut FY13F earnings by 21% to reflect possible provisions, and reduce our TP to SGD0.66 (from SGD0.73) based on 9x blended FY13F/14F EPS.

An AusGroup fabrication complex in Australia. NextInsight file photoNo complaint from KML on past 13 months of work. AusGroup stated that “in the past 13 months AGC has performed this contract, KML have not issued any formal show cause notice” and that “KML has not provided a substantiated basis for refusing payment”. Operations began at KML on 9 Apr 2013, and according to Gindalbie Metals, production “continued to ramp up…currently running at 70% of its capacity”.

An AusGroup fabrication complex in Australia. NextInsight file photoNo complaint from KML on past 13 months of work. AusGroup stated that “in the past 13 months AGC has performed this contract, KML have not issued any formal show cause notice” and that “KML has not provided a substantiated basis for refusing payment”. Operations began at KML on 9 Apr 2013, and according to Gindalbie Metals, production “continued to ramp up…currently running at 70% of its capacity”. KML is a JV between ASX-listed Gindalbie Metals and China’s AnSteel. KML appears financially-troubled. MiningWeekly states that during the March quarter, each JV partner advanced a AUD50m interest-free loan to KML “to assist with short-term capital requirements”, which was subsequently followed by AUD30m advances from both parties. Three days ago, AnSteel offered another AUD30m loan to KML. Gindalbie’s MD expects it to turn “cash flow positive within months”.

Appears to be a squeeze on suppliers/contractors. From this angle, KML’s action against AusGroup appears to be an effort to pass losses on to its suppliers and contractors. AusGroup’s legal team is of the opinion that the Progress Payments are validly due. There is of course a possibility that AusGroup did not perform satisfactory works and KML is due damages, but the fact that the mine is now operational and ramping up production gives more credence to AusGroup’s point of view.

Market knee-jerk reaction offers attractive entry point. While we have made an AUD6m adjustment to reflect possible provisions, the dispute resolution process now currently underway may produce a better result. AusGroup remains in a net cash position, and valuation is attractive at 6.4x FY14F EPS. We maintain our BUY call with a lower TP of SGD0.66.

Recent story: AUSGROUP: 1HFY2013 revenue up 12% at A$307m on increased oil & gas activities

SIAS Research pegs Eratat Lifestyle's intrinsic value at 27 cents

Analyst: Liu Jinshu

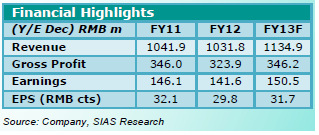

Eratat Lifestyle Limited (Eratat) reported 1Q FY13 revenue of RMB 221.2m (vs. RMB 187.7m in 1Q FY12, +17.9%).

Eratat Lifestyle Limited (Eratat) reported 1Q FY13 revenue of RMB 221.2m (vs. RMB 187.7m in 1Q FY12, +17.9%). 1Q net profit rose by RMB 22.7m to RMB 36.2m compared to the same period last year, due to the absence of renovation subsidy of RMB 20.9m.

The results were largely within our expectations, thus we leave our forecasts, valuation and

rating unchanged. Maintain Increase Exposure.

OCBC Investment Research sets OKP's fair value at 48 c

Analyst: Sarah Ong

Revenue from Eratat brand products was almost flat year-on-year, up a marginal RMB 0.5m.

What has changed is the product mix, with apparel making up for 90% of own brand sales in 1Q FY13 compared to 71% in 1Q FY12. Apparel made up for 82% of Eratat brand sales in 4Q.

A model showing off designs by Eratat Lifestyle at a trade fair. NextInsight file photo

A model showing off designs by Eratat Lifestyle at a trade fair. NextInsight file photo

Recent article: @ ERATAT LIFESTYLE's AGM: Keen Investor Interest In Share Buyback Mandate

A model showing off designs by Eratat Lifestyle at a trade fair. NextInsight file photo

A model showing off designs by Eratat Lifestyle at a trade fair. NextInsight file photoRecent article: @ ERATAT LIFESTYLE's AGM: Keen Investor Interest In Share Buyback Mandate

OCBC Investment Research sets OKP's fair value at 48 c

Analyst: Sarah Ong

OKP expanded the Central Expressway. Photo: CompanyOKP's 1Q13 revenue grew 28.4% YoY to S$32.0m but gross margin fell to 15.1% from 21.0% in 1Q12.

OKP expanded the Central Expressway. Photo: CompanyOKP's 1Q13 revenue grew 28.4% YoY to S$32.0m but gross margin fell to 15.1% from 21.0% in 1Q12. Speaking with management, we understand that the contraction in gross margin was chiefly due to increased subcontracting costs and labour costs. The latter includes higher costs for skilled labour, due to increased competition to attract and retain engineers.

Management is targeting to maintain gross margins at 15-20%. PATMI dropped 22.2% YoY to S$2.4m.

As of 30 Apr, OKP's gross order book remains healthy at S$393.5m, which is 12.3x 1Q13 revenue.

Adjusted our forecasts for OKP’s FY13 and FY14 performance and applying the same P/E multiple of 11x to FY13F EPS, we derive a FV of S$0.46, slightly lower than our previous FV of S$0.48. We maintain our HOLD rating on OKP.