Ernest Lim, CFA, CPADescription: Prior to July 2008, Kreuz was a division of the Swiber Group. Subsequently, it was listed on SGX on 29 Jul 2010 and transferred its listing to the Main Board of the SGX-ST on 8 Oct 12.

Ernest Lim, CFA, CPADescription: Prior to July 2008, Kreuz was a division of the Swiber Group. Subsequently, it was listed on SGX on 29 Jul 2010 and transferred its listing to the Main Board of the SGX-ST on 8 Oct 12.

Kreuz is a subsea provider whose services include subsea construction and installation services which support new offshore installation and construction projects as well as inspection, repair and maintenance (“IRM”) of existing offshore production and pipeline facilities. Refer to Kreuz’s website for more details.

Some interesting points

1. FY13F likely to beat FY12 record revenue and earnings since listing

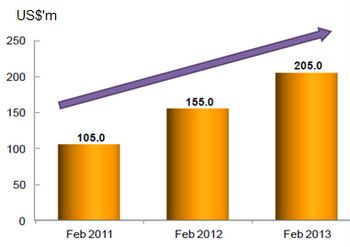

Order book as at end Feb 2013 was around US$205m (see table below) of which the bulk is likely to be recognised in FY13F. (FY12 revenue was around US$193m.)

Kreuz’s order book. Source: CompanyThus, coupled with the variation orders or unannounced contracts, Kreuz is likely to turn in a better FY13F than FY12, though FY12 was already a record year in terms of revenue and net profit since listing.

Kreuz’s order book. Source: CompanyThus, coupled with the variation orders or unannounced contracts, Kreuz is likely to turn in a better FY13F than FY12, though FY12 was already a record year in terms of revenue and net profit since listing.

2. Variation orders or unannounced contracts are quite material

According to DBS Research, variation orders or unannounced contracts which are not shown in their order books can be quite material. Thus, by looking at Kreuz’s order book alone you may underestimate the financial results of the firm.

3. Industry prospects remain bright

Capital expenditure is likely to increase in the various regions and for IRM from now to 2016. According to Infield Systems, an independent energy research and analysis firm, subsea expenditure for 2011 - 2015 will triple to US$7b, up from US$2.25b over 2006-2010.

This is corroborated by positive comments from various large subsea players such as Technip, Saipem, Aker Solutions etc.

In addition, in Asia, Malaysia, China, India and Indonesia are likely to lead subsea demand over the next five years. This should bode well for Kreuz with its presence in Malaysia, India and Indonesia.

4. Strong tenderbook of about US$500m

Kreuz’s tenderbook is currently around US$500m out of which (according to DBS Research), there may be new order wins in the near term.

5. FY15F is likely to be another growth year when its new build vessel arrives

Kreuz is building a US$113.65m deepwater subsea construction vessel via a Chinese shipbuilder. This vessel will be equipped with dynamic positioning and would enable Kreuz to compete in deepwater projects with leading subsea contractors such as Subsea 7 and Technip.

According to DBS Vickers, based on 60-70% utilisation, the vessel can rake in minimum incremental revenue of US$50m and net profit of up to US$15m per year. (Kreuz's FY12 revenue and earnings were US$193m and US$40m, respectively.)

6. Interesting sell queues

Although the 30-day average volume amounts to 2.8m shares a day, there seems to be heavy sell queues (most of the time) at 0.485-0.505 of around a million each. This begs the question that if the sellers do have that many shares, they are likely to be professionals and are unlikely to place so many shares on each level.

This would deter potential buyers. Furthermore, although the buy queue for Kreuz looks thin, it seems rather steady and price is roughly around the same level without dropping much intraday.

Personally (although I cannot quantify point 6 and it is most likely not 100% accurate), this pattern seems to show smart money accumulating the shares. I have seen it in Guocoleisure, Ezion, Nam Cheong, Sino Grandness, China Animal, and Eratat before. They seem to be a prelude to some upward movement (though it may take some time to materialise.)

Some noteworthy points

1. Long trade receivables

One drawback of Kreuz that most investors are wary of is its long trade receivables days. According to UOB Kay Hian Research, receivables spanning more than 6 months currently constituted about 50% of its receivables, which is quite a significant amount.

However, UOB Kay Hian cited that this was already an improvement from 6 months ago, when such receivables constituted about 60% of its receivables. According to the company, they are of the view that the receivables remained collectible.

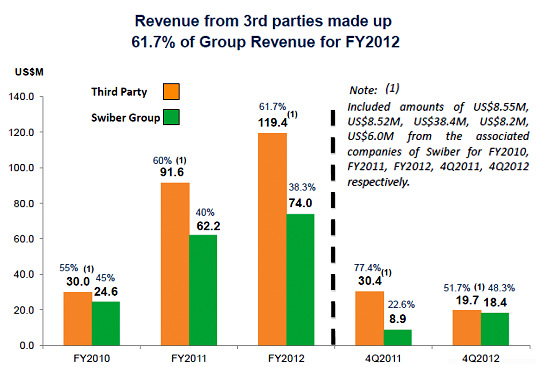

2. Customer concentration risk, i.e. Reliance on Swiber

Another concern that some investors cited is the customer concentration risk. With reference to the table below, Kreuz has come a long way in diversifying its customer base. In FY12, despite Swiber contributing more in revenue dollar terms, the revenue from 3rd parties continued to rise from 60% in FY11 to 61.7% in FY12.

Nice chart

Kreuz looks reassuring as it seems to be on an uptrend and is attempting to break out above its resistance of $0.490. Indicators such as RSI, MACD etc seem to be strengthening but are not overbought at current levels. OBV is at an all time high. ADX seems to be stopping its decline and turning upwards amid positively placed +DI. If it breaks $0.490 with volume, a measured technical target price would be around $0.550 with the first significant resistance (after $0.490) to be around $0.515 (all time high price).

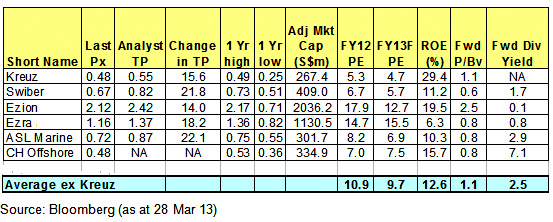

Valuations low against peers

If we compare Kreuz against its Singapore-listed peers (though not exactly direct comparables), it is trading at the lowest FY13F PE (Kreuz: 4.7x FY13F PE vs the average FY13F PE of 9.7x) with the highest ROE (Kreuz: 29.4% vs the average ROE of 12.6%).

In addition, Kreuz has given an interim dividend of 1.1 SG cents in 3QFY12 but for prudence, analysts who cover Kreuz are not projecting any dividends for this year.

This article was recently published on Ernest Lim's blog http://www.ernestlim15.blogspot.com/ and is reproduced with permission

Readers who are interested to know more about Kreuz can email Ernest at