Screenshot of Shanghai Ocean Aquarium website www.sh-aquarium.com/en

Screenshot of Shanghai Ocean Aquarium website www.sh-aquarium.com/enWHILE STRACO CORPORATION has a track record of strong business performance, investors are now asking: When will it make another good acquisition? What is the next project that will take the business to another level?

But first, a rundown on Straco as it is not exactly a high-profile company on the Singapore Exchange despite the high quality of its business.

Straco started life as a public company in 2004 with just one key asset -- the Shanghai Ocean Aquarium that it developed from scratch. It also has a cable car operation in Xi'an but that has not been a key revenue contributor.

While the Shanghai Ocean Aquarium grew to become a major revenue for Straco, in 2007, Straco struck gold with the acquisition of the Xiamen Underwater World.

It turned the aquarium around remarkably. To date, the Xiamen aquarium has generated cash of around 4X the effective acquisition cost of about S$9 million (S$12.5 million transacted price minus S$3 million cash in the business then).

Collectively, its 3 assets have gone on to lift the performance of Straco, the latest result being a 20% rise in revenue in 2012 to S$55.2 million.

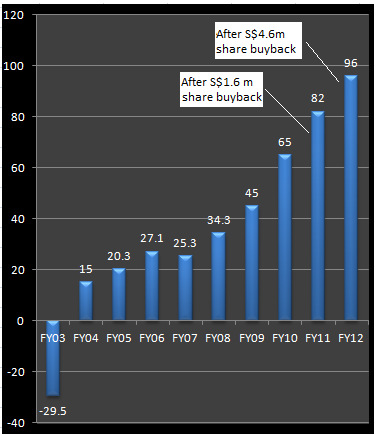

Straco's net cash (above) has soared to S$96 million as it generates strong free cashflow and requires relatively low maintenance capex. The cash level would have exceeded S$100 m last year if not for $4.6m spent on share buyback (but no one's complaining).Out of that, the company extracted a net profit of S$19.73 million, up 19% year on year.

Straco's net cash (above) has soared to S$96 million as it generates strong free cashflow and requires relatively low maintenance capex. The cash level would have exceeded S$100 m last year if not for $4.6m spent on share buyback (but no one's complaining).Out of that, the company extracted a net profit of S$19.73 million, up 19% year on year. The net margin was 35.7%, which firmly places Straco among a small bunch of Singapore-listed companies with such wonderful profit margins.

Straco's business also generates a powerful flow of cash.

As at end-2012, it had net cash of S$96 million or about 11.3 cents per share. That means a third of its current share price of 31 cents is cash.

Its cash builds up strongly in part because its capex requirements are not high.

Capex was just about S$1.1 million last year, covering repair and maintenance, and replacement of fish stock, etc.

The capex was more than covered by the S$2.7 million in interest income from its cash pile.

This year, Straco's cash pile will effortlessly shoot past the $100 million mark -- after taking into account a S$10.5 million dividend payout (1.25 cent a share for FY2012) and possibly some share buyback. Free cashflow from the business, on the other hand, is likely to be over S$20 million.

When will Straco deploy its cash into M&A action which could boost its earnings even more? That question was one of the more compelling ones from analysts during a meeting with CFO Amos Ng last week.

Amos Ng, CFO of Straco Corp for 13 years already. NextInsight file photoConstantly sizing up opportunities

Amos Ng, CFO of Straco Corp for 13 years already. NextInsight file photoConstantly sizing up opportunitiesStraco, Amos replied, has evaluated many proposals and opportunities. It, however, has not found one that it would seize.

Some time back, for example, an aquarium in China became available for a fraction of the owner's investment cost.

Straco decided against buying because it figured that the aquarium would continue to be loss-making for at least a few more years. And the asset would require significant management resources to turn it around, leading to opportunity costs.

Neither is starting a greenfield project a walk in the park in China, said Amos. The Chinese will approach many potential business partners to bid for projects.

Straco, in turn, has stringent criteria about the profitability potential of any venture it gets involved in.

But it does have a project that it will soon embark on. It has been deferred for some 10 years already owing to land acquisition issues.

This is the Chao Yuan Ge project in Xi'an for which Straco has earmarked an initial US$8 million for development. When ready, the project located on Mount Lishan will boost the number of users of Straco's cable car operation there.

It will showcase the culture and unique architectural features from the Tang Dynasty through reconstructed replicas of its major buildings.

The project, due to be completed in 2015/2016, will rank among the most important attractions in Xi'an along with the Terracotta Warriors Museum and the Qing Shihuang Mausoleum.

_____________________________________________________________________________

Recent stories:

STRACO: Delivers good set of 2012 results with dividend of 1.25 cents...above expectations

STRACO CORP: High free cashflow, net margin >35%