This was first posted in the NextInsight forum by 'Sumer' who may be regarded as the resident guru on property investments.

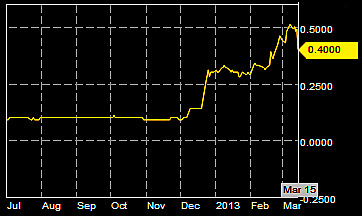

Rowsley has a market cap of S$385 m. Its NAV is 4.19 cents a share. In the 9m ending Dec 2012, net loss was $1.2 m, compared to net loss of $3.3 m in the previous corresponding period. Chart: BloombergROWSLEY LTD's sharp and sudden fall on Friday afternoon (from 49 cents the day before to 40 cents) was supposedly due to talk of someone giving an "overvalued" assessment on the counter.

Rowsley has a market cap of S$385 m. Its NAV is 4.19 cents a share. In the 9m ending Dec 2012, net loss was $1.2 m, compared to net loss of $3.3 m in the previous corresponding period. Chart: BloombergROWSLEY LTD's sharp and sudden fall on Friday afternoon (from 49 cents the day before to 40 cents) was supposedly due to talk of someone giving an "overvalued" assessment on the counter. For a stock that held on well to its price last week despite the rout on speculative counters, the sudden hammering on Friday seems rather strange and sudden, and SGX apparently thought so too, querying the company at 4.30pm.

After all, Rowlsey has always been more of a speculative "concept" stock that should have come down earlier together with its compatriots rather than only on late Friday afternoon.

With the little info that I have, I thought it's interesting to see how Rowsley's figures look like, assuming that the deal to (1) acquire RSP Architects and (2) purchase and develop Vantage Bay's site in Johor Bahru are successful.

Rowsley plans to develop 10 million sq ft of GFA (hotels, condos, hospitals, shops) on a piece of land in JB not far away from the Causeway, facing the straits and Singapore. It is near to the new MRT station in JB that will be linked to Singapore. The site looks rather good.

Assuming that this space is all used to build condo units for sale (being the most conservative assumption since medical and retail spaces would be much more valuable), this is the possible maths:

> Land cost psf of GFA = M$90 psf (arrived at from S$358m divided by 10m sq ft multiplied by 0.4 exchange rate)

> Other costs = M$510 psf (assumption based on 99-yr condos of a reasonable standard at Medini being launched at $600-700 psf; so cost of M$510 psf is reasonable)

> Sale price = M$1,200 psf (based on average sales price of Brunsfield's Danga Bay project of M$1,100 psf, and Setia 88's condo at JB of M$1,200-1,400 psf, etc. I think Rowsley's product should be priced higher as the Singapore name would command a premium, but M$1,200 psf is assumed for prudence)

> Gross profit = 10,000,000 X (M$1,200-$510-$90) = M$6 billion.

Divided by 6.841 billion shares post the warrants issue, the gross profit per share is thus 87.7 sen or 35 Sing cts.

This, of course, is a very crude way of calculating, but it does give us an idea that the project could be quite profitable. Of course, the Vantage Bay medical city development would span several years, and not all parts of it will be for sale.

Because of the warrants issue, the ex-rights (to the warrants) price of Rowsley would be 25.3 ct, assuming Friday's close of 40ct. This 25.3 ct is then compared to the gross profit of 35 ct from the Vantage Bay project and, on this alone, the maths does not look too bad. Many other speculative counters do not have similar positive projections.

In addition, Rowsley will not just be a developer stock but one that can be grouped under "medical" should it retain the hospital, thereby commanding a higher valuation. RSP Architects would also form another component of its NAV. There are also possibilities of further injection of businesses into Rowsley, since Peter Lim is also working on Motorsports City in Gerbang Nusajaya.

Personally, I like the Iskandar theme as I see many catalysts going forward. So far, only a few SGX stocks come under this theme, and Rowsley is the most "exposed" in terms of its Iskandar business relative to its market cap. The caveat, of course, is that the deal is successfully completed.

The catalysts for Iskandar are many, and one only has to follow the articles in Malaysian online news sites to see that many things are going on just up north. Some of these include the imminent IPO of IWH, the HSR developments, and the confirmation of the Woodlands-JB MRT link.

As an interesting example, if one were to go through CATs ads last Saturday, one would come across ads for a condo called Astaka. Not many people know it yet, but it will have the tallest residential building in Malaysia/Singapore.

And it will be built in JB City, which is Zone A of Iskandar. It will be 300m high and tower over the tallest buildings in Singapore (ie, Republic Plaza, at 280m) and rise higher than Marina Bay Sands (207m). Already, whole floors of the towers are snapped up by buyers.

That an iconic tower like this is planned for Iskandar is perhaps a sign that the music is getting a bit louder just outside our backyard. Could Rowsley be one of the tunes?

For more on the all-crucial Rowsley deals yet to be completed, read AsiaOne article.

Recent article: SUMER: My (conservative) estimate of RNAVs of some property stocks

Believe it is a bet on future earnings and projects......