Main source: Story in Securities Times

CITIC SECURITIES says the best returns in China’s long-suffering A-share markets will come from blue chip stocks.

Which sectors in particular are expected to thrive?

Furthermore, why have the mega-caps been ignored for so long?

And why have upstarts on the three-year old board often termed “China’s Nasdaq” been performing so much better than blue chips, in terms of P/E ratios, at least until recent times?

Market watchers generally expect mid- to long-term prospects in China’s A-share markets to trend upwards, given the “lost year” that was 2012, in which the Year of the Dragon was more huffing and puffing than anything resembling a bullish mien.

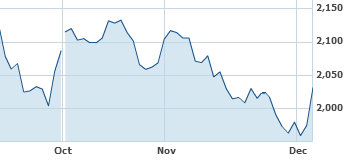

During the 12-month period that began on January 1 of this year, the benchmark index for A-shares listed in Shanghai and Shenzhen – the Shanghai Composite Index – ranged between 1,900 points and 2,500.

The Index is now at 2,151, helped in large part by the Friday jump of over 4% in share prices.

Citic Securities recently said it expects four seminal events to occur in China’s capital markets next year.

The first is that a “sizeable” rebound in the first quarter of 2013 will almost certainly occur.

In the second quarter, i.e. April-June 2013, Citic expects the Chinese equity markets to settle into a happy medium zone.

In the July-September period, Citic expects a broad upward trend lifting all boats moored on the Shanghai and Shenzhen bourses.

And why should we pay so much credence to one particular PRC-based brokerage’s take on the bourses?

Here’s why...

In 2011, CITIC Securities ranked No.1 in China in investment banking business as measured by the total amount of equity and debt underwritten, and tops in sales, trading and brokerage business as measured by equity and fixed income trading turnover as well as enjoying the number one position in asset management business as measured by AUM.

CITIC Securities is also the largest among China's investment banks as measured by total assets, total equity, total revenue and profit in 2011.

Now that you are convinced, what does China’s most influential brokerage have to say about the state of things a year from now in the world’s second largest economy’s equity markets?

The Beijing-based brokerage expects A-shares to possibly move northwards, but it isn’t ready to commit at this point.

And with the increasingly fluid credit availability – thanks to successive reductions in both the prime lending rate in the People’s Republic as well as a gradual ratcheting down in the reserve requirement ratio, more and more money will be available to the investing community.

And this can only be good news for financial sector listco giants like banks, brokerages and insurers.

And capital-hungry industries like property developers – who are always looking to bolster their land banks if the price is right and the money is there – are also clear beneficiaries of a consistently liquid credit regime.

And given the fact that banks, insurers and developers make up the lion’s share of blue chips among A-share listed firms in both Shanghai and Shenzhen, it only stands to reason that these firms – with their depressed share prices – are some of the most likely candidates to bread out big time in the upcoming Year of the Snake.

See also:

CHINA/HK Property: What Do Big Research Houses Say?

What Slowdown? CHINA NEW TOWN Lands 533 Mln Yuan Deal

CHINA NEW TOWN Inks Landmark Beijing Fund Deal