HSBC: Lower Trading Cost to Sustain A-share Rebound

HSBC Global Research said China’s market regulator, the CSRC, revealed several policy initiatives over the past week including lower trading fees, IPO reform and new delisting rules.

“Transaction handling charges and scrip fees will be lowered by 25% from June 1, or around three billion yuan saving (2-3% of all trading costs). This is positive for sentiment and lower stamp duty tax so we reiterate our year-end target of 2,800 for the benchmark Shanghai Composite (currently 2,438).”

The research arm of the London-based bank, which is also the largest lender in Hong Kong, added it was upbeat on market reforms initiated by Beijing.

“We view 2012 as the year of reform for China’s financial and capital markets. For equity investors, progress on reforms could serve as the anticipated long-term re-rating catalyst for the A-share market.”

The Hong Kong-listed financial institution said that since Chairman Guo Shuqing took the helm of the CSRC, he has shifted the regulatory focus from IPO approvals to market supervision and investor protection.

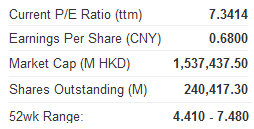

“From a valuation perspective, China A-share markets are still at their trough valuation on both P/E and P/B terms.

“Over the past week, the CSRC has revealed a series of policy initiatives to boost investors’ confidence on the domestic A-share market: i) lower trading fees for futures and stocks; ii) guidelines on further IPO reforms to improve disclosure and rationalize valuations; and iii) new delisting rules to improve market disciplines. These are the latest reform efforts under the new CSRC Chairman Guo for the past six months.”

See also:

BAD TIMING: Quality Scandal Halts China’s Laiyifen IPO

KISSING COUSINS: PRC Market Rise To Carry Hong Kong

SHOW ME THE MONEY: What Happens To SOE Profits In PRC?

China IPOs Putting Pressure On Large Caps

HSBC: China Banks Results Largely ‘In-line’

HSBC Global Research said that its coverage of Chinese-listed lenders found their first-quarter results “broadly in line.”

The research house said first quarter profits rose between 9% and 60% y-o-y, around 25% of its FY12 forecasts.

“Pressure on NIM q-o-q and our expectation of rising credit costs in 2012 imply FY profits will be driven by loan volume. We prefer banks with more liquid balance sheets and better capitalized to drive loan growth, like ICBC and CCB, with CITIC a preferred high beta play.”

NIM is Net Interest Margin.

See also:

NEW KID ON BLOCK: 21 A-Shares In Red; 4 In Hot Water

KINGS OF THE HILL: 12 Banks Produce Over Half Of All Listcos’ Profit

What’s Really Behind China Share Rally?

Funds To Fuel Further A-Share Frenzy